Answered step by step

Verified Expert Solution

Question

1 Approved Answer

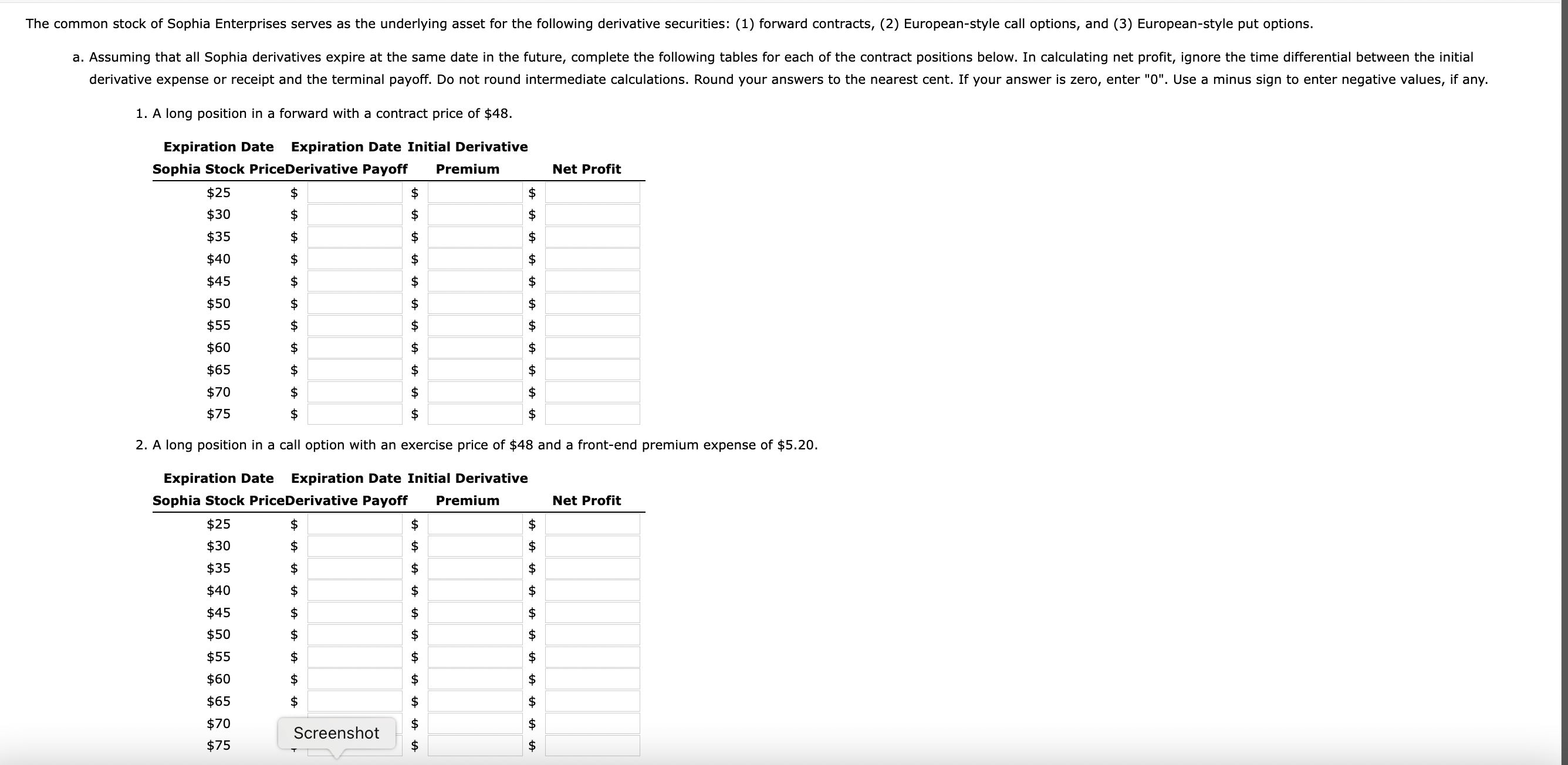

1. A long position in a forward with a contract price of $48. 2. A long position in a call option with an exercise price

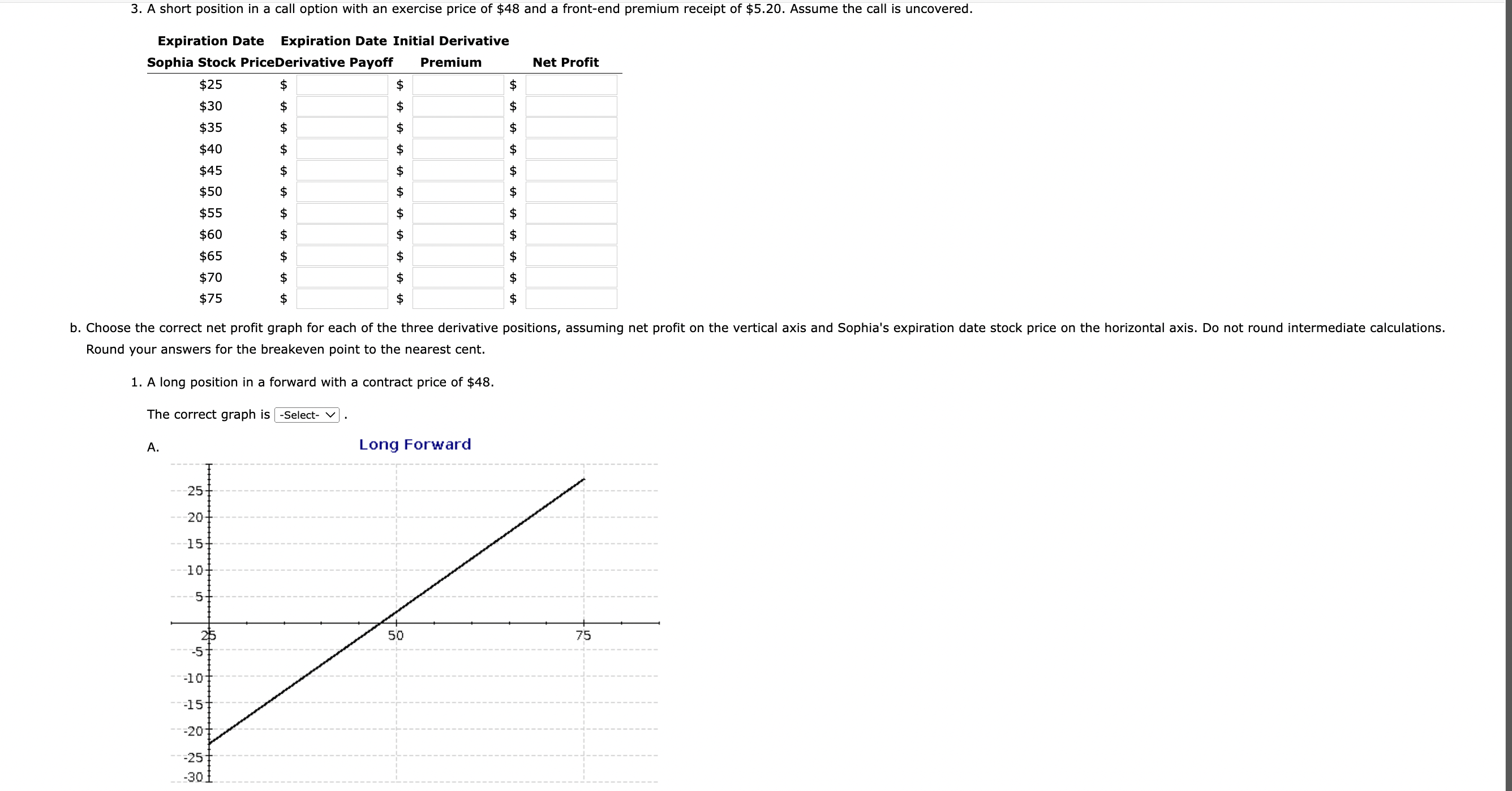

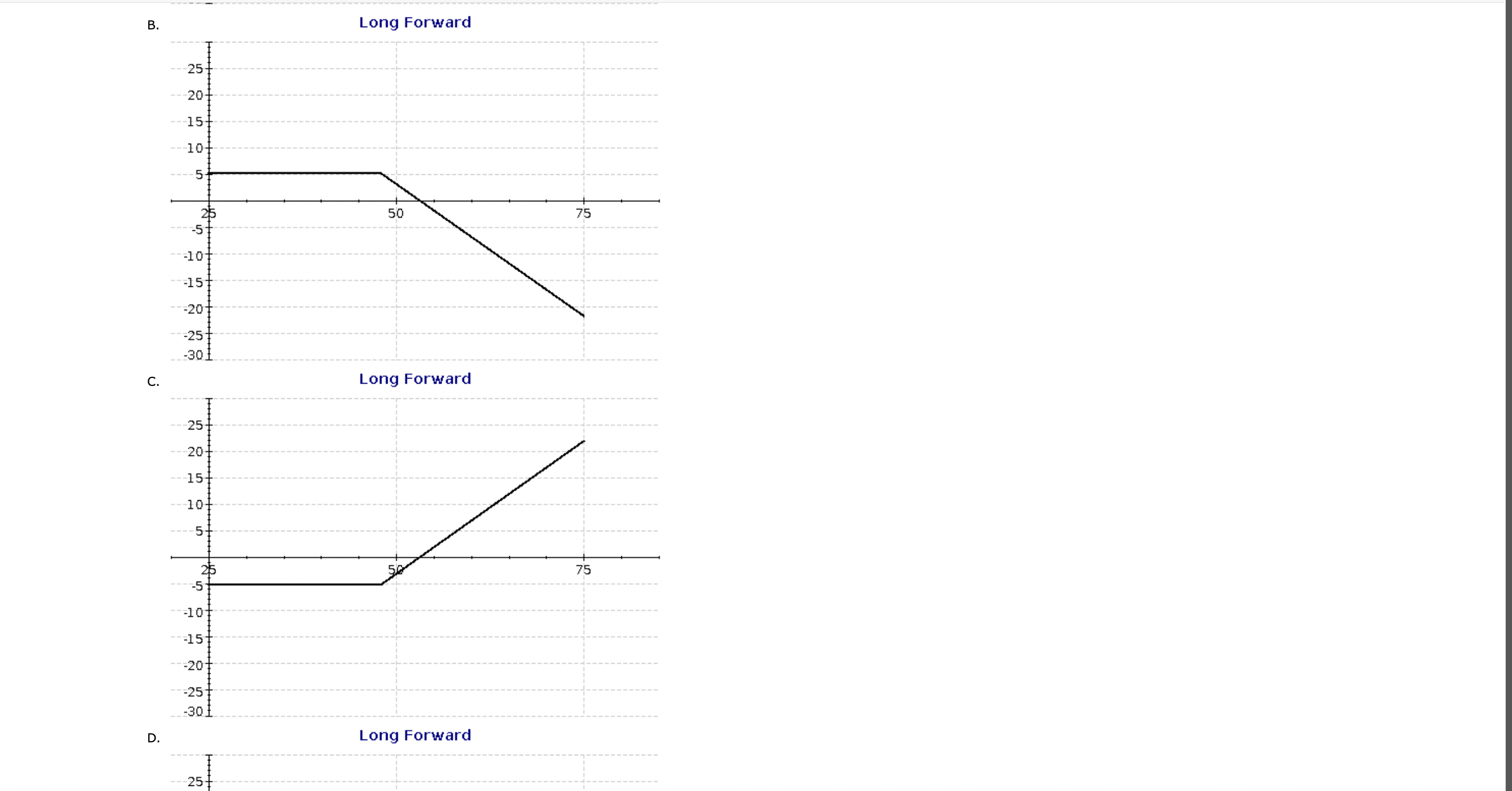

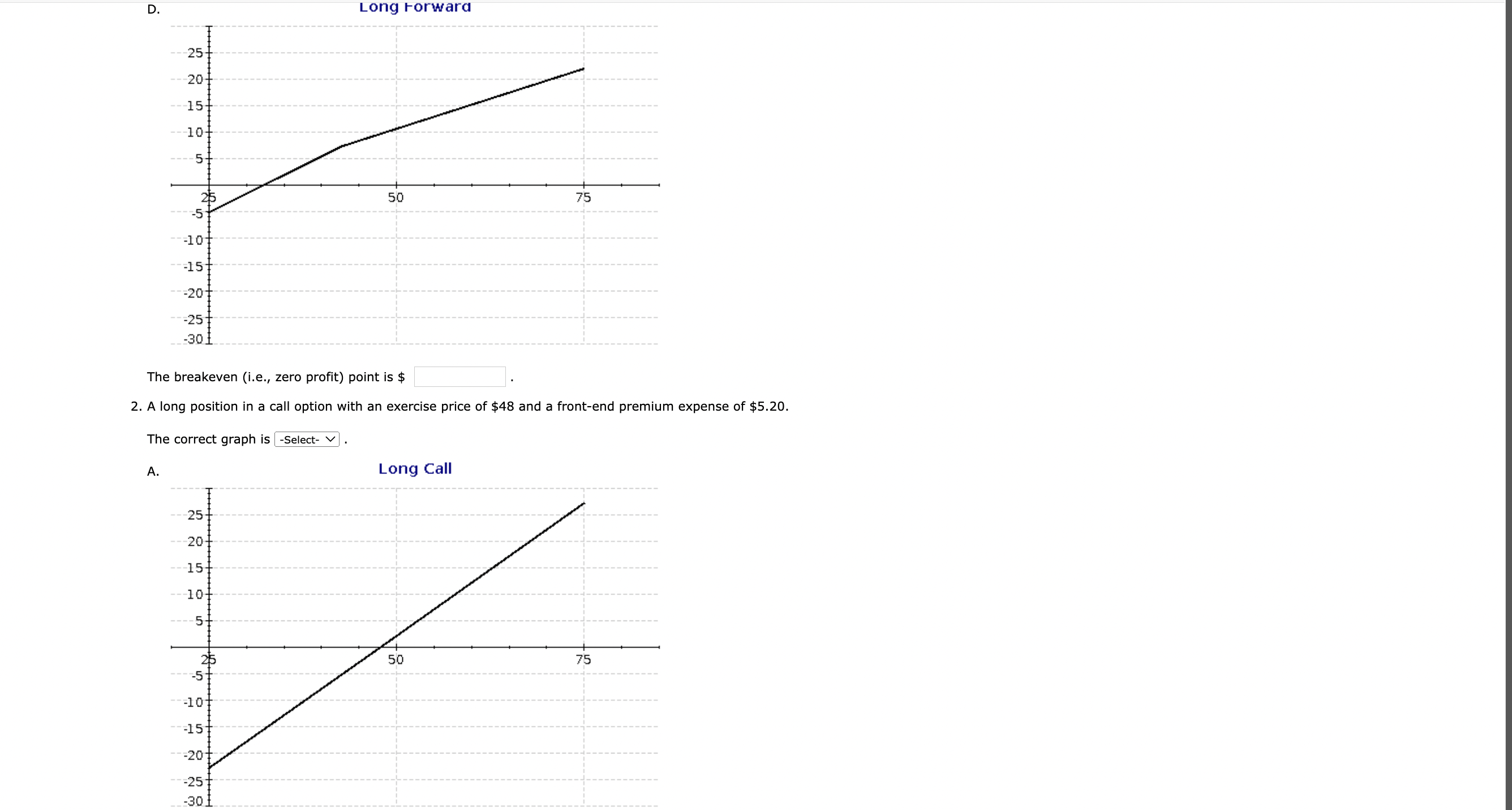

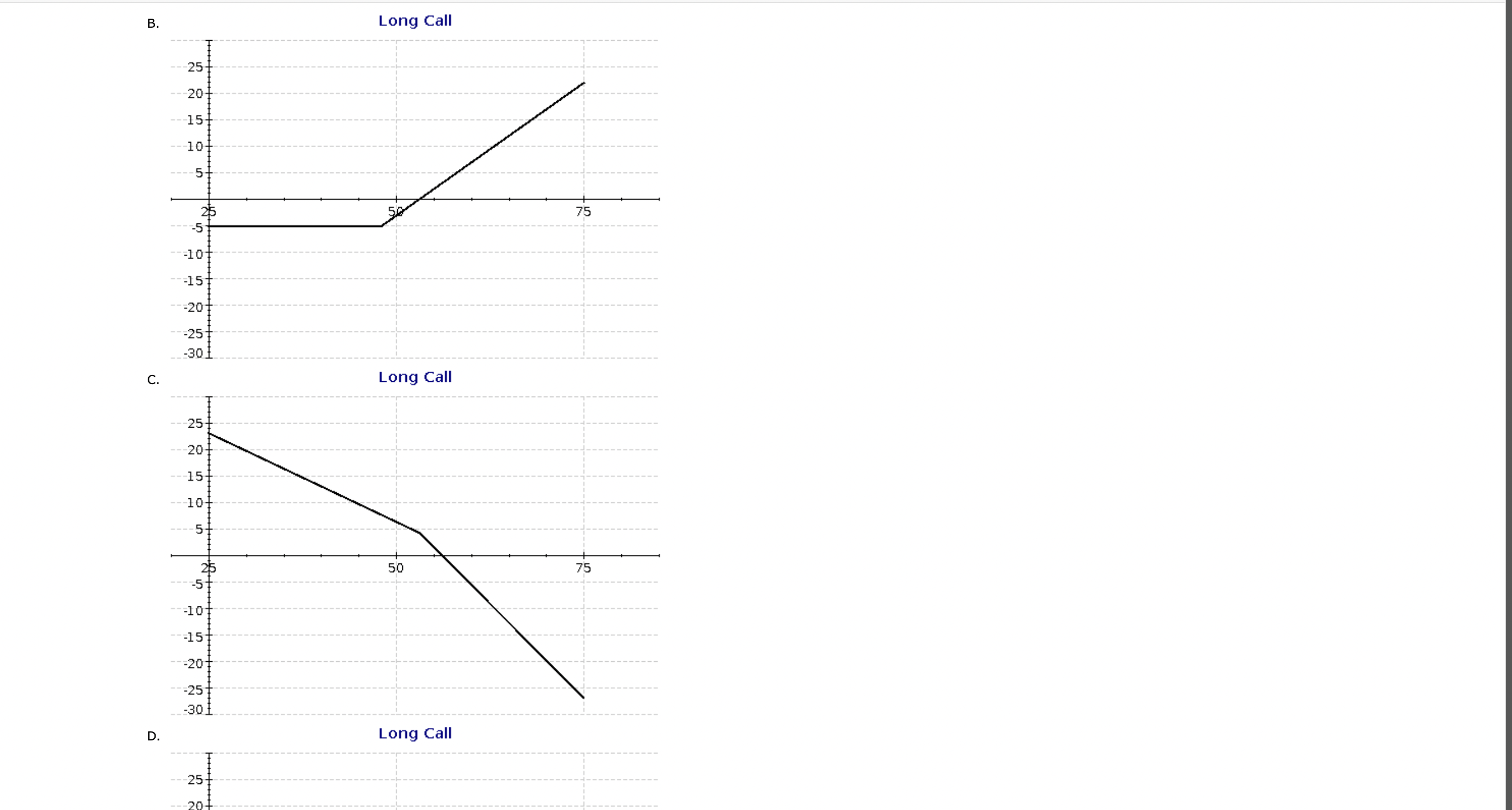

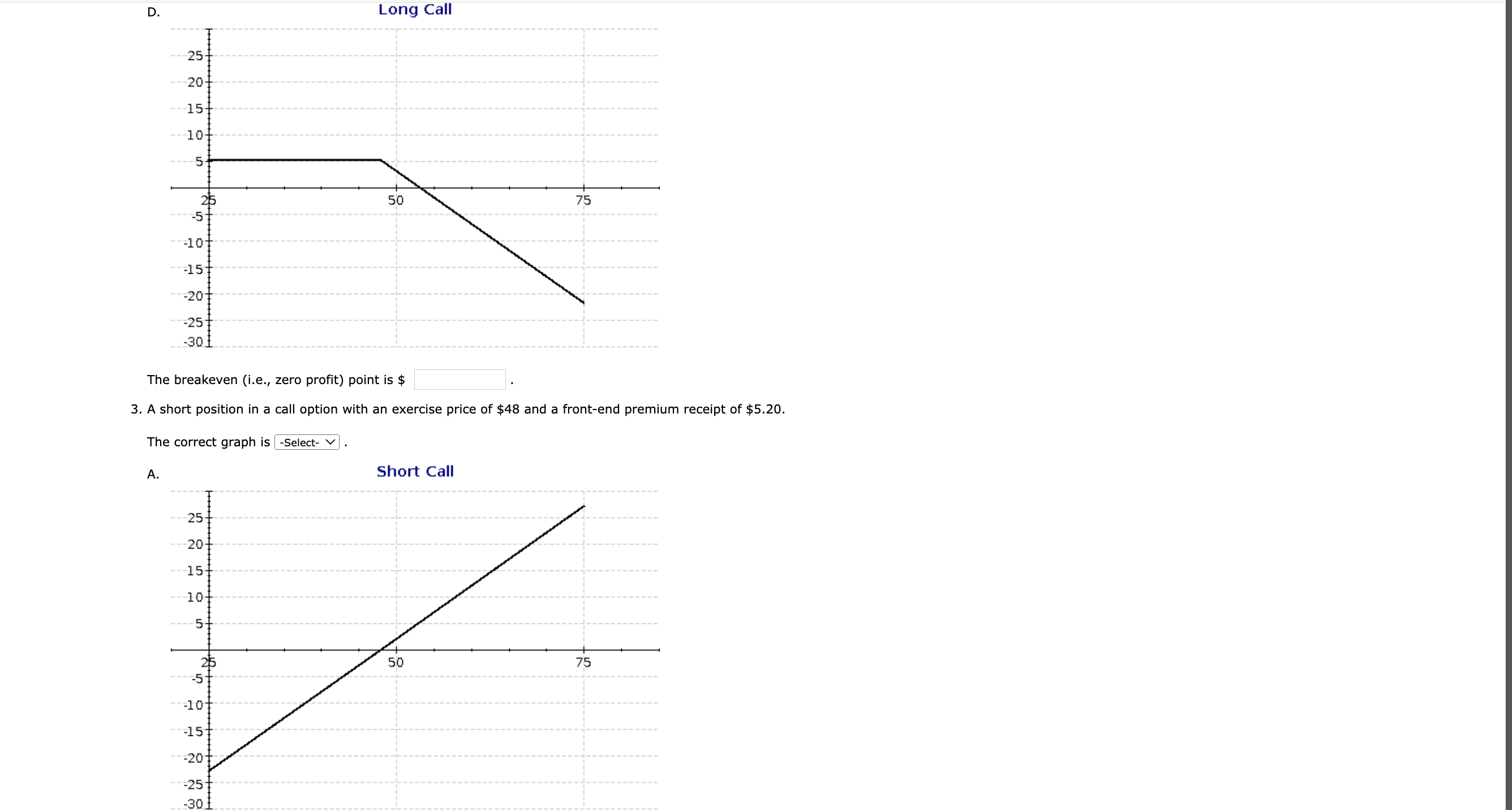

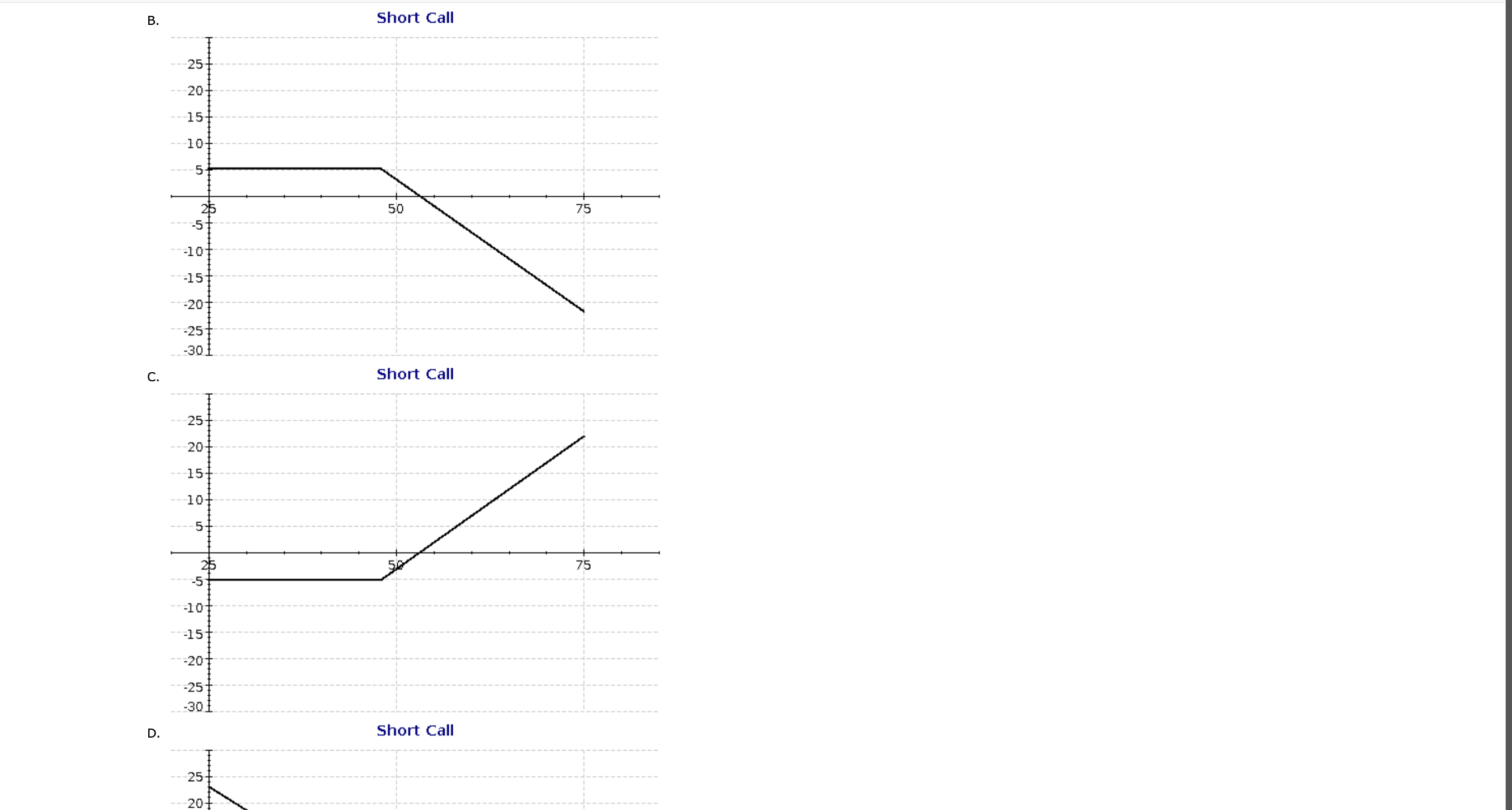

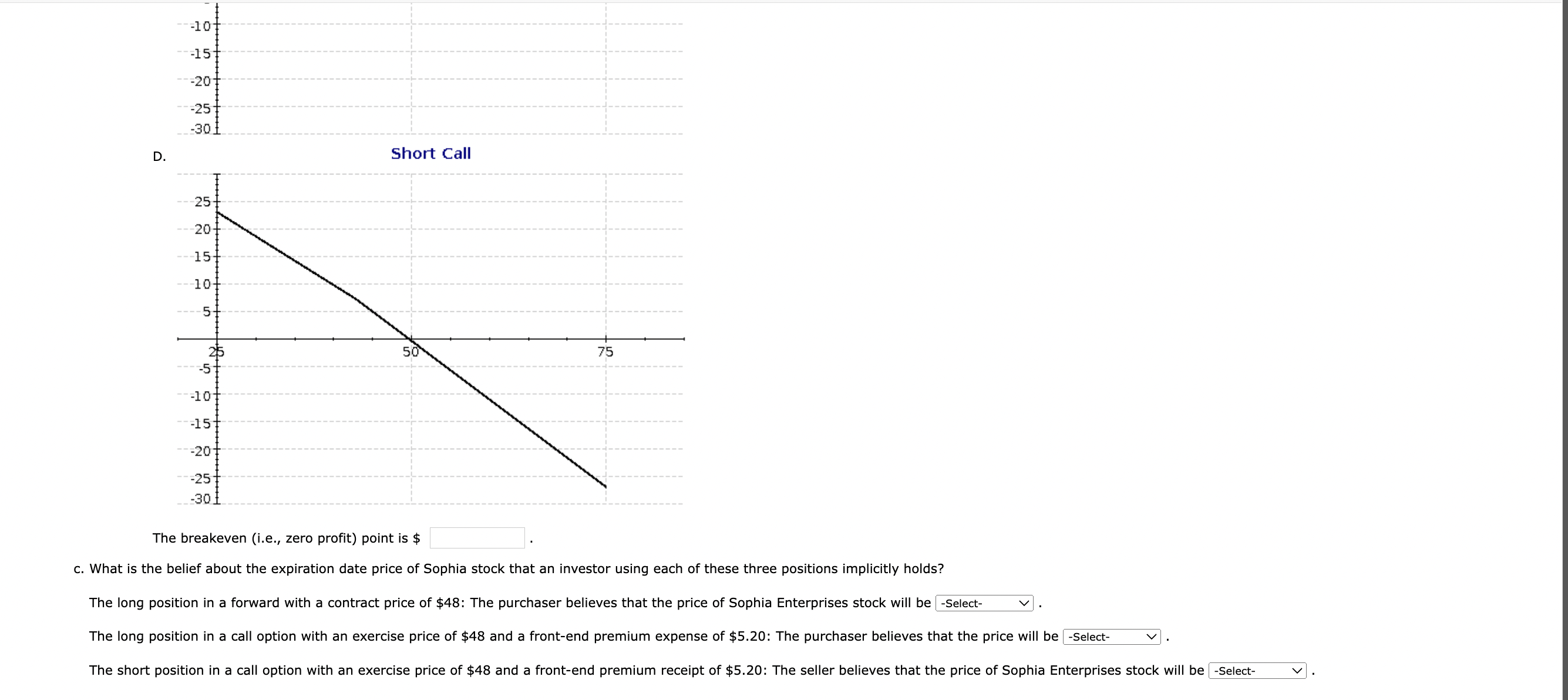

1. A long position in a forward with a contract price of $48. 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. Round your answers for the breakeven point to the nearest cent. 1. A long position in a forward with a contract price of $48. The correct graph is B. Long Forward C. Long Forward D. Long Forward 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. The correct graph is - Select- V. B. Long Call C. D. Long Call 3. A short position in a call option with an exercise price of $48 and a front-end premium receipt of $5.20. The correct graph is - Select- V. B. Short Call c. Short Call D. Short Call c. What is the belief about the expiration date price of Sophia stock that an investor using each of these three positions implicitly holds? The long position in a forward with a contract price of $48 : The purchaser believes that the price of Sophia Enterprises stock will be The long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20 : The purchaser believes that the price will be 1. A long position in a forward with a contract price of $48. 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. Round your answers for the breakeven point to the nearest cent. 1. A long position in a forward with a contract price of $48. The correct graph is B. Long Forward C. Long Forward D. Long Forward 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. The correct graph is - Select- V. B. Long Call C. D. Long Call 3. A short position in a call option with an exercise price of $48 and a front-end premium receipt of $5.20. The correct graph is - Select- V. B. Short Call c. Short Call D. Short Call c. What is the belief about the expiration date price of Sophia stock that an investor using each of these three positions implicitly holds? The long position in a forward with a contract price of $48 : The purchaser believes that the price of Sophia Enterprises stock will be The long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20 : The purchaser believes that the price will be

1. A long position in a forward with a contract price of $48. 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. Round your answers for the breakeven point to the nearest cent. 1. A long position in a forward with a contract price of $48. The correct graph is B. Long Forward C. Long Forward D. Long Forward 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. The correct graph is - Select- V. B. Long Call C. D. Long Call 3. A short position in a call option with an exercise price of $48 and a front-end premium receipt of $5.20. The correct graph is - Select- V. B. Short Call c. Short Call D. Short Call c. What is the belief about the expiration date price of Sophia stock that an investor using each of these three positions implicitly holds? The long position in a forward with a contract price of $48 : The purchaser believes that the price of Sophia Enterprises stock will be The long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20 : The purchaser believes that the price will be 1. A long position in a forward with a contract price of $48. 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. Round your answers for the breakeven point to the nearest cent. 1. A long position in a forward with a contract price of $48. The correct graph is B. Long Forward C. Long Forward D. Long Forward 2. A long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20. The correct graph is - Select- V. B. Long Call C. D. Long Call 3. A short position in a call option with an exercise price of $48 and a front-end premium receipt of $5.20. The correct graph is - Select- V. B. Short Call c. Short Call D. Short Call c. What is the belief about the expiration date price of Sophia stock that an investor using each of these three positions implicitly holds? The long position in a forward with a contract price of $48 : The purchaser believes that the price of Sophia Enterprises stock will be The long position in a call option with an exercise price of $48 and a front-end premium expense of $5.20 : The purchaser believes that the price will be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started