Question

1. a. Lt. Dan Corporation invested $80,000 in a manufacturing equipment. The salvage value of the asset is expected to be $0. The company is

1.

a. Lt. Dan Corporation invested $80,000 in a manufacturing equipment. The salvage value of the asset is expected to be $0. The company is expected to add $9,000 per year to the net income. Using the original cost of the asset, the unadjusted rate of return on the investment will be? Hint: If the problem does not give you enough information to determine the net values, keep your calculations simple!

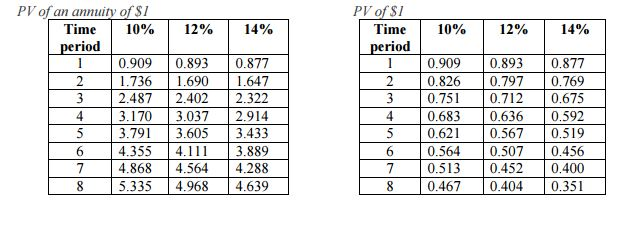

b. Triple Crossing Brewing is considering installing a new cooler (equipment) in order to increase the volume and variety of beverages they can offer. The new cooler will cost $24,000. It is expected to last 7 years but only if the cooler is overhauled (REPAIRED) at a cost of $4,000 at the end of year 4. The new cooler is expected to have a $2,000 salvage value at the end of 7 years. The new cooler is expected to generate additional revenues of $15,000 per year with an increase in expenses of $9,000 per year. Triple Crossings discount rate is 12%. What is the net present value of this investment opportunity? Should they invest in the cooler? Hint: determine the PV of each item. Be careful if the item is an annuity (annual) or one time only event.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started