Question

1. a) Managers regularly face decisions that have dimensions of social responsibility. Could you provide two such examples? b) Please provide two measures of corporate

1. a) Managers regularly face decisions that have dimensions of social responsibility. Could you provide two such examples? b) Please provide two measures of corporate social responsibility (CSR).

c) Please provide two benefits of doing CSR.

2. One company has the following debt and equity: Common stock: 500,000 shares outstanding, selling for $30 per share; beta is 2.5. Debt: 10,000 bonds, selling for 105 percent of par. The bonds have a $1,000 par value each and the YTM is 8%. Preferred stock: 15,000 shares outstanding, selling for $250 per share. Annual dividend is $30 per share. The market risk premium is 4%, and the risk-free rate is 1.5%. tax rate is 21%.

a) What are cost of equity, cost of debt, and cost of preferred stock?

b) What is the capital structure weights of the company? (hint: the weight of each financing)

c) What is the cost of capital of the company?

3.

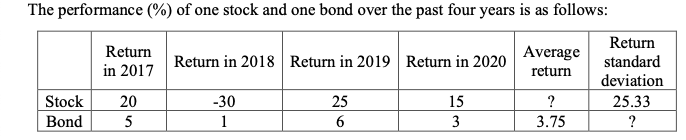

a) What is the average return of the stock?

b) What is the standard deviation of the bond?

c) What are the two lessons from the capital market history?

The performance (%) of one stock and one bond over the past four years is as follows: Return Return Average Return in 2018 Return in 2019 Return in 2020 standard in 2017 return deviation Stock 20 -30 25 15 ? 25.33 Bond 5 1 6 3 3.75Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started