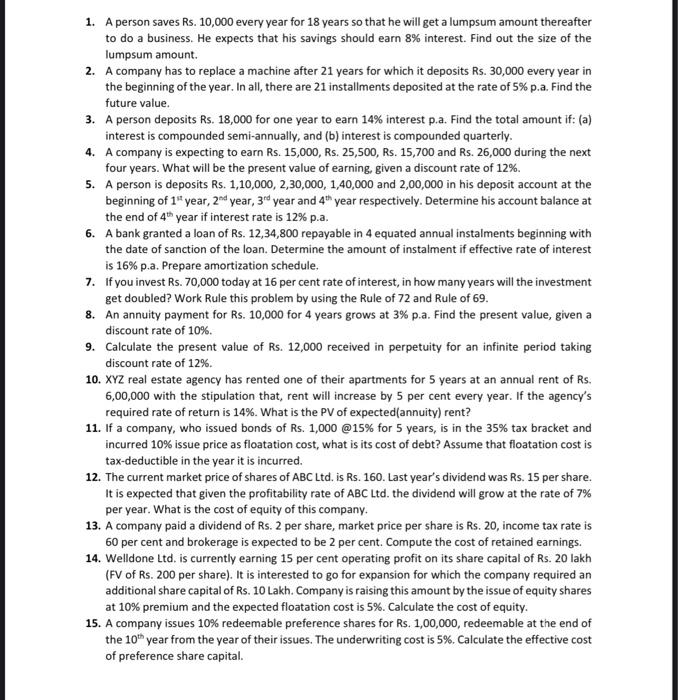

1. A person saves Rs. 10,000 every year for 18 years so that he will get a lumpsum amount thereafter to do a business. He expects that his savings should earn 8% interest. Find out the size of the lumpsum amount. 2. A company has to replace a machine after 21 years for which it deposits Rs. 30,000 every year in the beginning of the year. In all, there are 21 installments deposited at the rate of 5% p.a. Find the future value. 3. A person deposits Rs. 18,000 for one year to earn 14% interest p.a. Find the total amount if: (a) interest is compounded semi-annually, and (b) interest is compounded quarterly. 4. A company is expecting to earn Rs. 15,000 , Rs. 25,500 , Rs. 15,700 and Rs. 26,000 during the next four years. What will be the present value of earning, given a discount rate of 12%. 5. A person is deposits Rs. 1,10,000,2,30,000,1,40,000 and 2,00,000 in his deposit account at the beginning of 1th year, 2ad year, 3nd year and 4th year respectively. Determine his account balance at the end of 4th year if interest rate is 12% p.a. 6. A bank granted a loan of Rs. 12,34,800 repayable in 4 equated annual instalments beginning with the date of sanction of the loan. Determine the amount of instalment if effective rate of interest is 16% p.a. Prepare amortization schedule. 7. If you invest Rs. 70,000 today at 16 per cent rate of interest, in how many years will the investment get doubled? Work Rule this problem by using the Rule of 72 and Rule of 69 . 8. An annuity payment for Rs. 10,000 for 4 years grows at 3% p.a. Find the present value, given a discount rate of 10%. 9. Calculate the present value of Rs. 12,000 received in perpetuity for an infinite period taking discount rate of 12%. 10. XYZ real estate agency has rented one of their apartments for 5 years at an annual rent of Rs. 6,00,000 with the stipulation that, rent will increase by 5 per cent every year. If the agency's required rate of return is 14%. What is the PV of expected(annuity) rent? 11. If a company, who issued bonds of Rs. 1,000@15% for 5 years, is in the 35% tax bracket and incurred 10% issue price as floatation cost, what is its cost of debt? Assume that floatation cost is tax-deductible in the year it is incurred. 12. The current market price of shares of ABC Ltd. is Rs. 160 . Last year's dividend was Rs. 15 per share. It is expected that given the profitability rate of ABC Ltd. the dividend will grow at the rate of 7% per year. What is the cost of equity of this company. 13. A company paid a dividend of Rs. 2 per share, market price per share is Rs. 20, income tax rate is 60 per cent and brokerage is expected to be 2 per cent. Compute the cost of retained earnings. 14. Welldone Ltd, is currently earning 15 per cent operating profit on its share capital of Rs. 20 lakh (FV of Rs. 200 per share). It is interested to go for expansion for which the company required an additional share capital of Rs. 10 Lakh. Company is raising this amount by the issue of equity shares at 10% premium and the expected floatation cost is 5%. Calculate the cost of equity. 15. A company issues 10% redeemable preference shares for Rs. 1,00,000, redeemable at the end of the 10th year from the year of their issues. The underwriting cost is 5%. Calculate the effective cost of preference share capital