Answered step by step

Verified Expert Solution

Question

1 Approved Answer

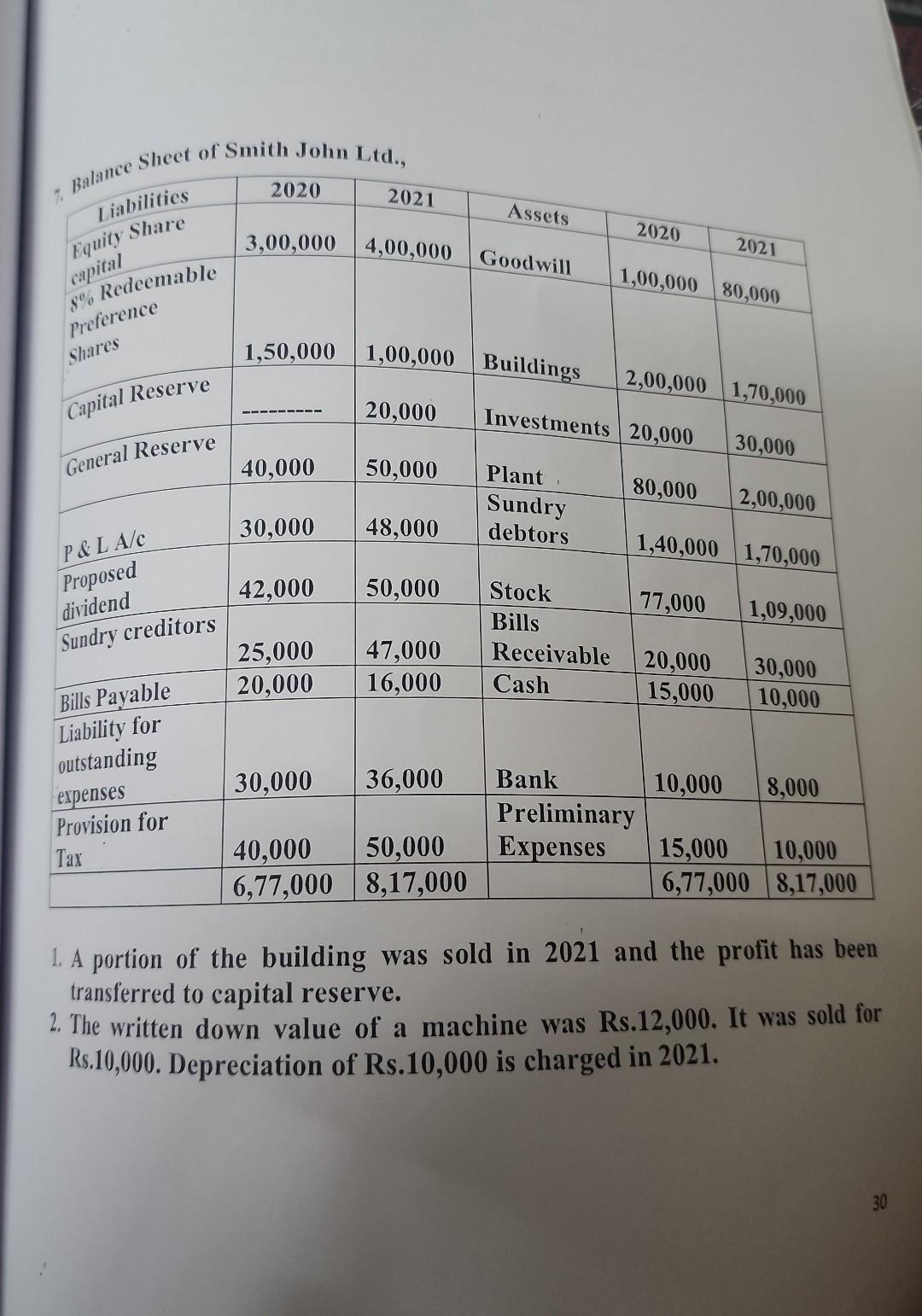

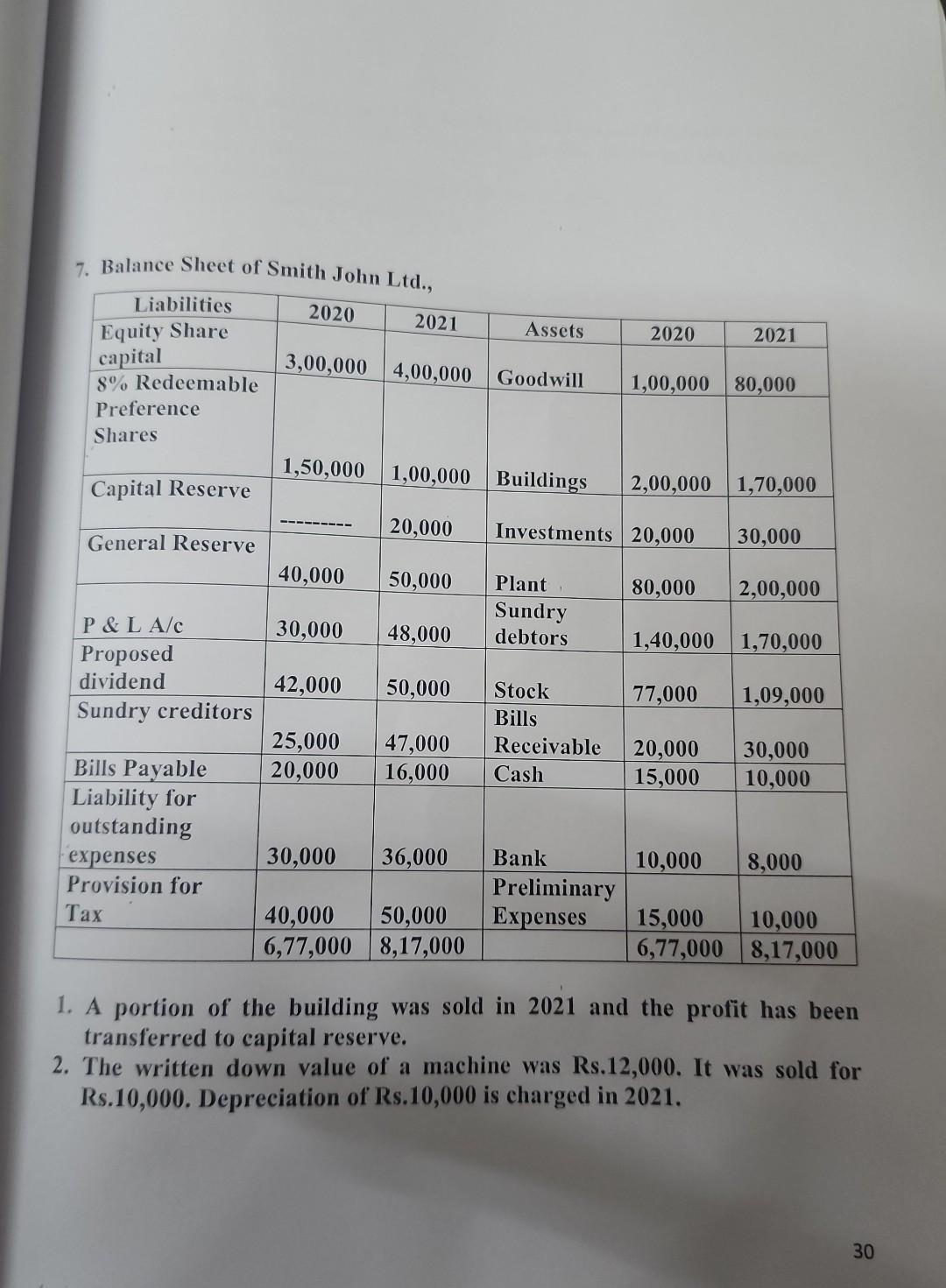

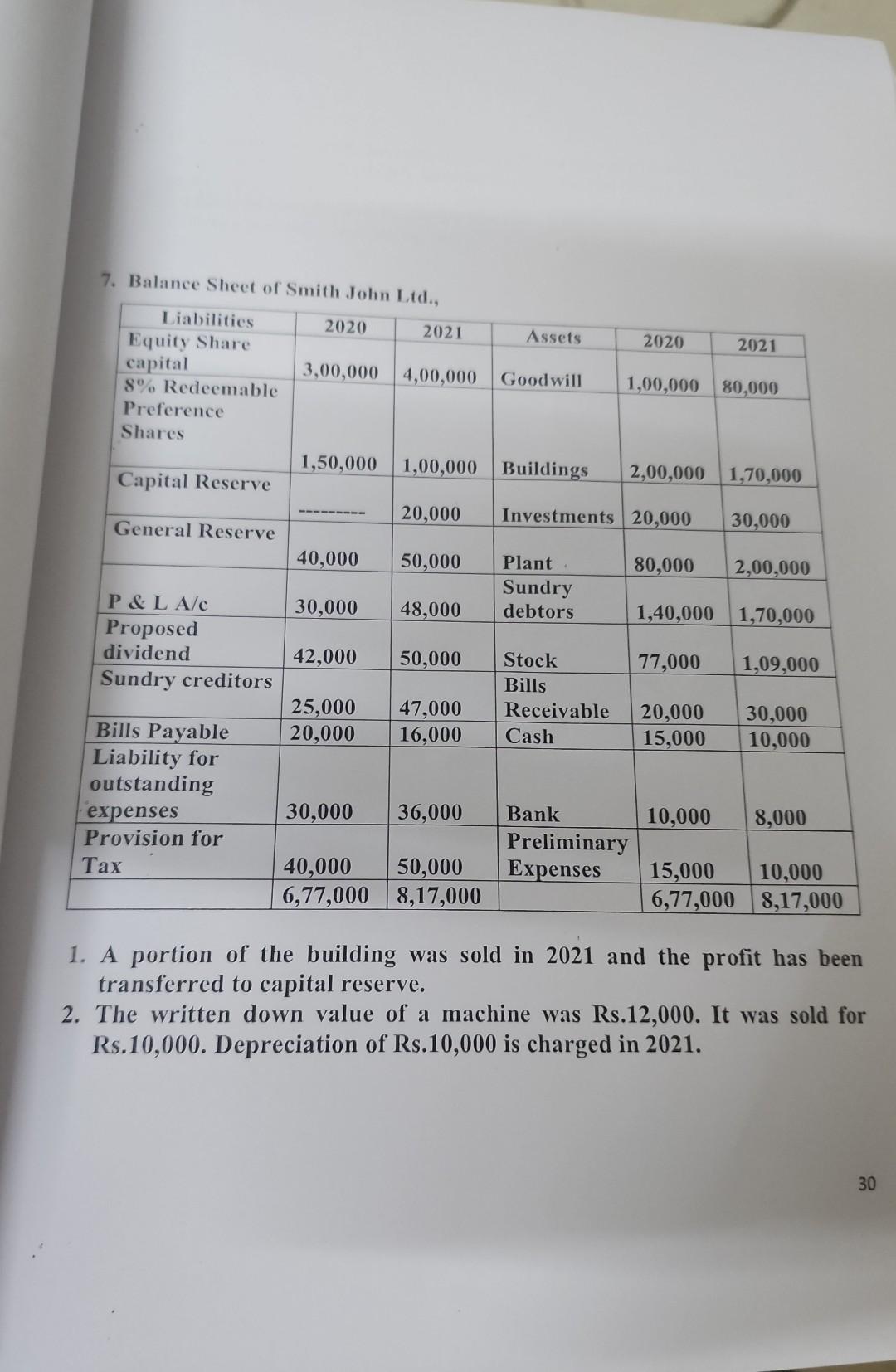

1. A portion of the building was sold in 2021 and the profit has been transferred to capital reserve. 2. The written down value of

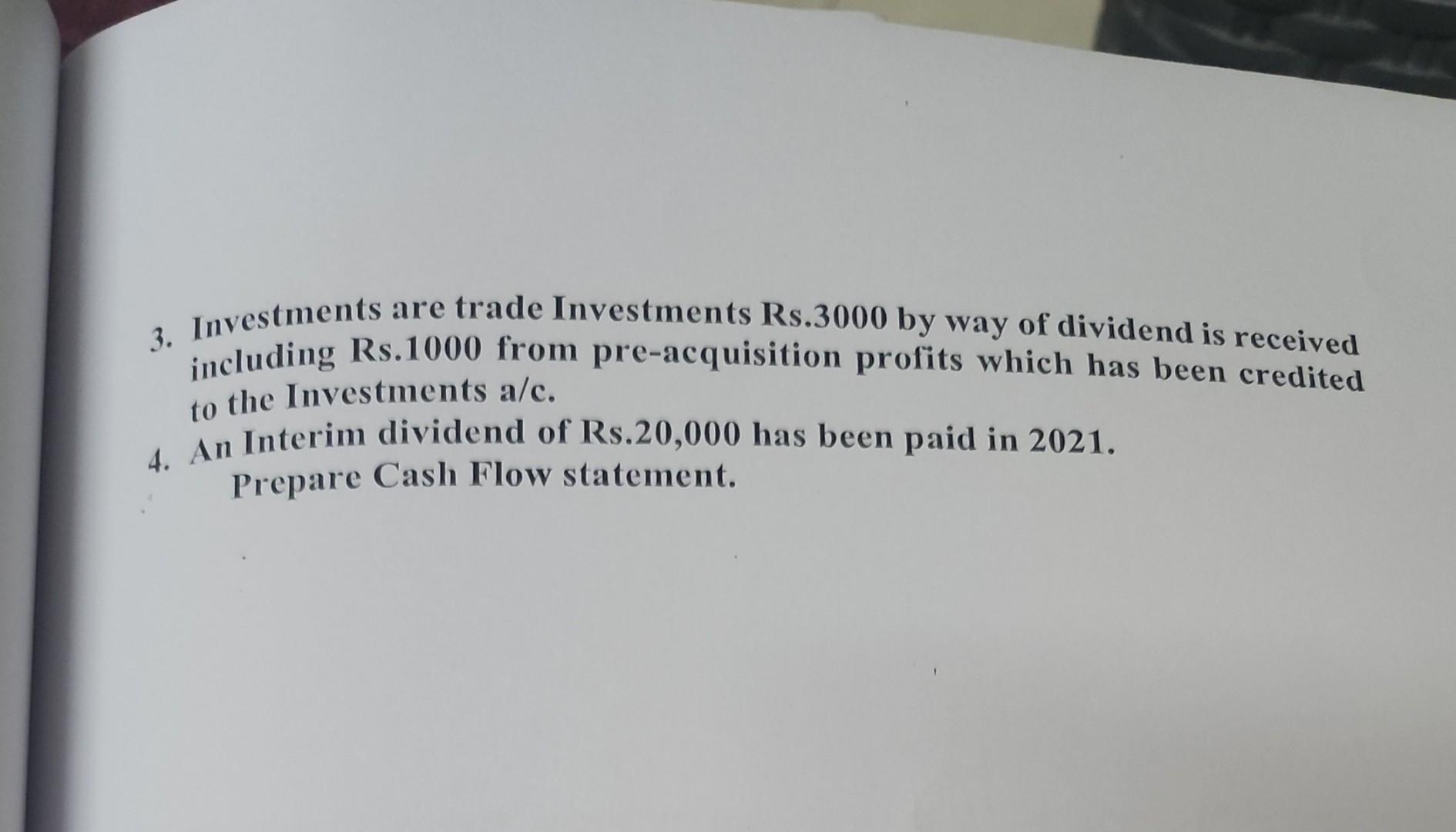

1. A portion of the building was sold in 2021 and the profit has been transferred to capital reserve. 2. The written down value of a machine was Rs.12,000. It was sold for Rs.10,000. Depreciation of Rs. 10,000 is charged in 2021. 7. Balance Sheet of Smith John Ltd., 1. A portion of the building was sold in 2021 and the profit has been transferred to capital reserve. 2. The written down value of a machine was Rs.12,000. It was sold for Rs.10,000. Depreciation of Rs. 10,000 is charged in 2021. 3. Investments are trade Investments Rs.3000 by way of dividend is received including Rs.1000 from pre-acquisition profits which has been credited to the Investments a/c. 4. An Interim dividend of Rs.20,000 has been paid in 2021. Prepare Cash Flow statement. 7. Balance Sheet of Smith John Ltd.. 1. A portion of the building was sold in 2021 and the profit has been transferred to capital reserve. 2. The written down value of a machine was Rs.12,000. It was sold for Rs.10,000. Depreciation of Rs. 10,000 is charged in 2021. 3. Investments are trade Investments Rs. 3000 by way of dividend is received including Rs. 1000 from pre-acquisition profits which has been eredited to the Investments a/c. 4. An Interim dividend of Rs.20,000 has been paid in 2021 . Prepare Cash Flow statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started