Answered step by step

Verified Expert Solution

Question

1 Approved Answer

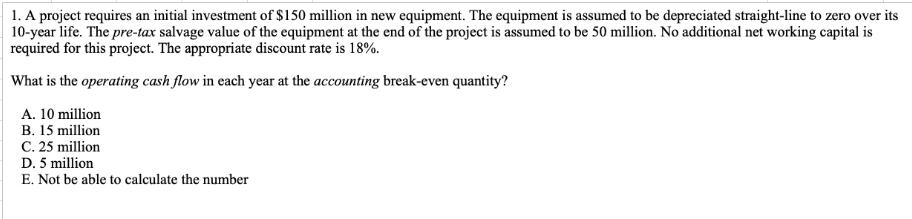

1. A project requires an initial investment of $150 million in new equipment. The equipment is assumed to be depreciated straight-line to zero over

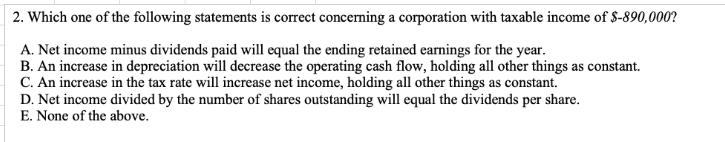

1. A project requires an initial investment of $150 million in new equipment. The equipment is assumed to be depreciated straight-line to zero over its 10-year life. The pre-tax salvage value of the equipment at the end of the project is assumed to be 50 million. No additional net working capital is required for this project. The appropriate discount rate is 18%. What is the operating cash flow in each year at the accounting break-even quantity? A. 10 million B. 15 million C. 25 million D. 5 million E. Not be able to calculate the number 2. Which one of the following statements is correct concerning a corporation with taxable income of $-890,000? A. Net income minus dividends paid will equal the ending retained earnings for the year. B. An increase in depreciation will decrease the operating cash flow, holding all other things as constant. C. An increase in the tax rate will increase net income, holding all other things as constant. D. Net income divided by the number of shares outstanding will equal the dividends per share. E. None of the above.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each question 1 Operating cash flow in each year at the accounting breakeven quantity To calculate the operating cash flow OCF at the acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started