Question

1/ A rail operating company incurs extra costs if its long-distance trains are late. Passengers are given a voucher to put towards the cost of

1/ A rail operating company incurs extra costs if its long-distance trains are late.

Passengers are given a voucher to put towards the cost of a future journey if the delay is

between thirty minutes and two hours. If the train is more than two hours late the company refunds the cost of the ticket for every passenger. The cost of issuing vouchers

costs the company 500. The cost of refunding all the fares costs the company 6000.

The probability that a train is between thirty minutes and two hours late is 10% and

the probability a train is more than two hours late is 2%.

What is the expected monetary value of the operating company's extra costs per journey?

2/ Ivana Loyer claims she has been unfairly dismissed by her employers. She consults the law firm of Zackon and Vorovat, who agree to take up her case. They advise her that if she wins her case she can expect compensation of 15,000, but if she loses she will receive nothing. They estimate that their fee will be 1500, which she will have to pay whether she wins or loses.

Under the rules of the relevant tribunal she cannot be asked to pay her employer's costs. As an alternative they offer her a 'no win no fee' deal under which she pays no fee but if she wins her case Zackon and Vorovat take one-third of the compensation she receives. She could decide against bringing the case, which would incur no cost and result in no compensation. Advise Ivana what to do:

(a) using the maximax decision rule

(b) using the maximin decision rule

(c) using the minimax regret decision rule

(d) using the equal likelihood decision rule

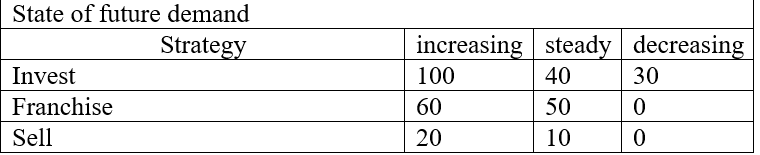

3/ Following the success of their Best Seafood fast food restaurant in Vietnam, the proprietors, Vinh and Tuan, are thinking of expanding the business. They could do ths

by investing in new sites or by franchising the operation to aspiring fast food entrepreneurs who would pay a fee to Vinh and Tuan. The estimated profits for each strategy depend on the future demand for healthy fast food, which could increase, remain stable, or decline. Another possibility for Vinh and Tuan is to accept the offer of 20m that a major international fast food company has made for their business. The expected

profits are shown in Table:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started