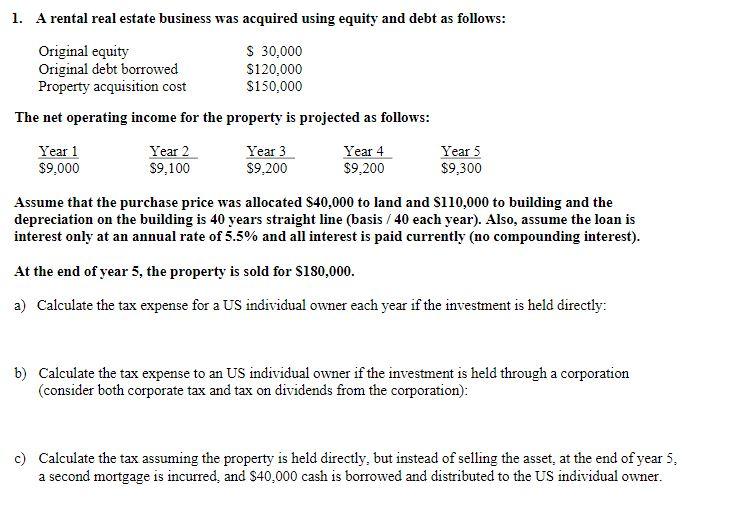

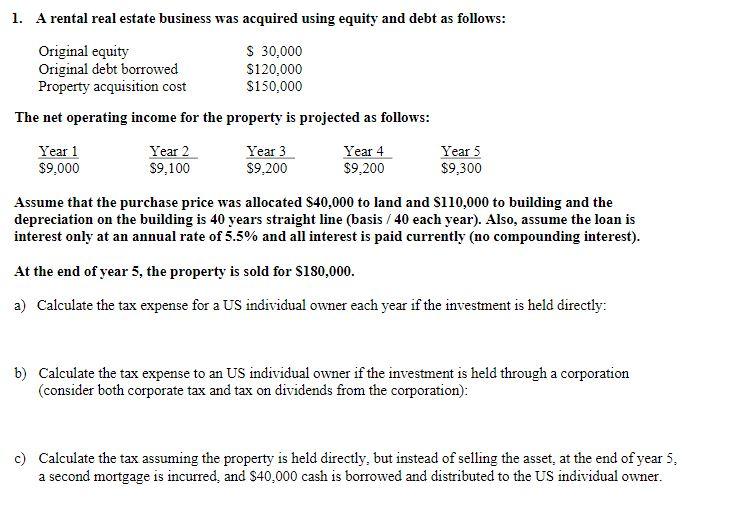

1. A rental real estate business was acquired using equity and debt as follows: Original equity $ 30,000 Original debt borrowed $120,000 Property acquisition cost $150,000 The net operating income for the property is projected as follows: Year 1 $9.000 Year 2 $9,100 Year 3 $9,200 Year 4 $9,200 Year 5 $9.300 Assume that the purchase price was allocated $40,000 to land and S110,000 to building and the depreciation on the building is 40 years straight line (basis / 40 each year). Also, assume the loan is interest only at an annual rate of 5.5% and all interest is paid currently (no compounding interest). At the end of year 5, the property is sold for $180,000. a) Calculate the tax expense for a US individual owner each year if the investment is held directly: b) Calculate the tax expense to an US individual owner if the investment is held through a corporation (consider both corporate tax and tax on dividends from the corporation): c) Calculate the tax assuming the property is held directly, but instead of selling the asset, at the end of year 5. a second mortgage is incurred, and $40,000 cash is borrowed and distributed to the US individual owner. 1. A rental real estate business was acquired using equity and debt as follows: Original equity $ 30,000 Original debt borrowed $120,000 Property acquisition cost $150,000 The net operating income for the property is projected as follows: Year 1 $9.000 Year 2 $9,100 Year 3 $9,200 Year 4 $9,200 Year 5 $9.300 Assume that the purchase price was allocated $40,000 to land and S110,000 to building and the depreciation on the building is 40 years straight line (basis / 40 each year). Also, assume the loan is interest only at an annual rate of 5.5% and all interest is paid currently (no compounding interest). At the end of year 5, the property is sold for $180,000. a) Calculate the tax expense for a US individual owner each year if the investment is held directly: b) Calculate the tax expense to an US individual owner if the investment is held through a corporation (consider both corporate tax and tax on dividends from the corporation): c) Calculate the tax assuming the property is held directly, but instead of selling the asset, at the end of year 5. a second mortgage is incurred, and $40,000 cash is borrowed and distributed to the US individual owner