Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A stock had returns of 12 percent, 39 percent, and -12 percent over the past three years. What was the standard deviation of the

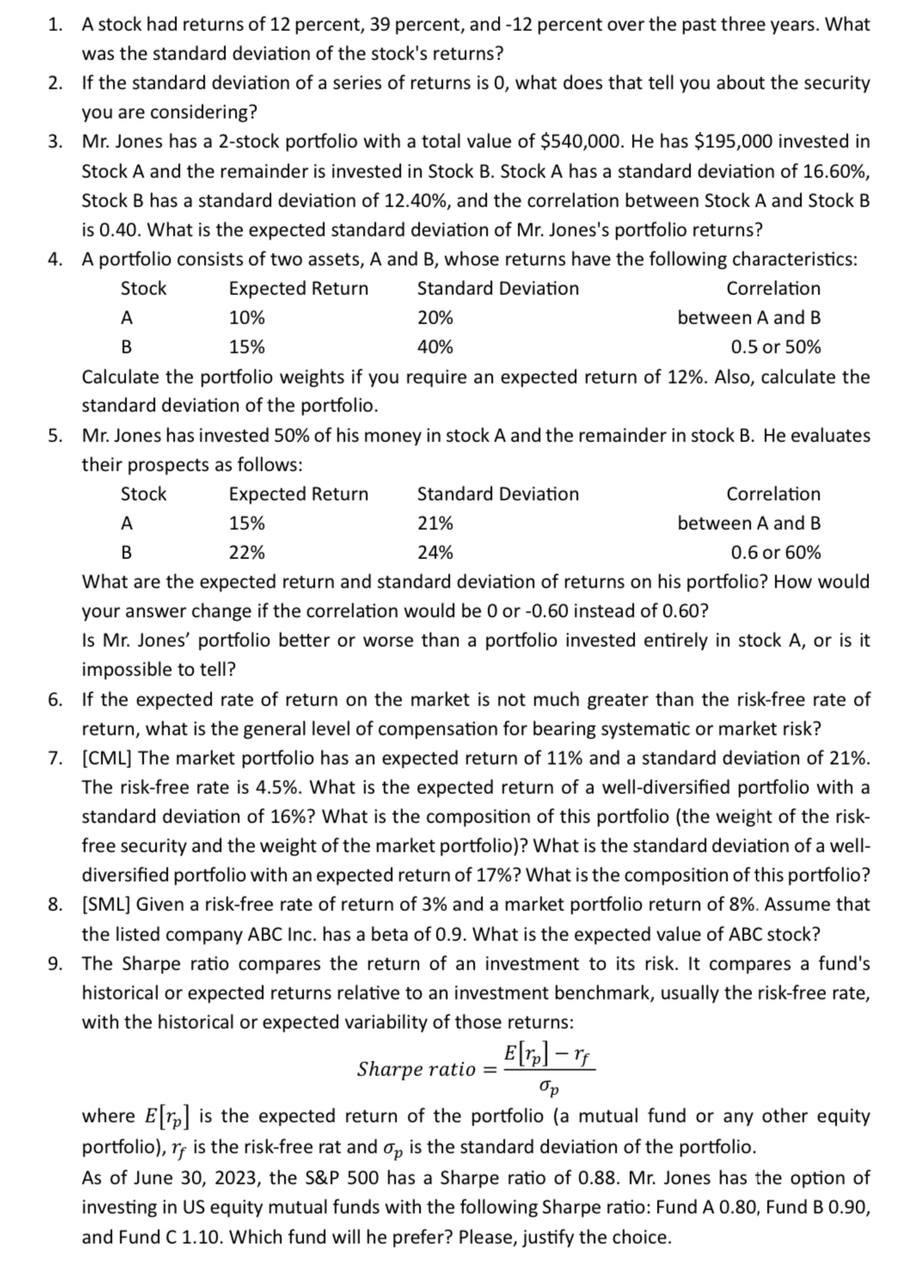

1. A stock had returns of 12 percent, 39 percent, and -12 percent over the past three years. What was the standard deviation of the stock's returns? 2. If the standard deviation of a series of returns is 0 , what does that tell you about the security you are considering? 3. Mr. Jones has a 2-stock portfolio with a total value of $540,000. He has $195,000 invested in Stock A and the remainder is invested in Stock B. Stock A has a standard deviation of 16.60%, Stock B has a standard deviation of 12.40%, and the correlation between Stock A and Stock B is 0.40 . What is the expected standard deviation of Mr. Jones's portfolio returns? 4. A portfolio consists of two assets. A and B. whose returns have the following characteristics: Calculate the portfolio weights if you require an expected return of 12%. Also, calculate the standard deviation of the portfolio. 5. Mr. Jones has invested 50% of his money in stock A and the remainder in stock B. He evaluates their prospects as follows: What are the expected return and standard deviation of returns on his portfolio? How would your answer change if the correlation would be 0 or -0.60 instead of 0.60 ? Is Mr. Jones' portfolio better or worse than a portfolio invested entirely in stock A, or is it impossible to tell? 6. If the expected rate of return on the market is not much greater than the risk-free rate of return, what is the general level of compensation for bearing systematic or market risk? 7. [CML] The market portfolio has an expected return of 11% and a standard deviation of 21%. The risk-free rate is 4.5%. What is the expected return of a well-diversified portfolio with a standard deviation of 16% ? What is the composition of this portfolio (the weight of the riskfree security and the weight of the market portfolio)? What is the standard deviation of a welldiversified portfolio with an expected return of 17% ? What is the composition of this portfolio? 8. [SML] Given a risk-free rate of return of 3% and a market portfolio return of 8%. Assume that the listed company ABC Inc. has a beta of 0.9. What is the expected value of ABC stock? 9. The Sharpe ratio compares the return of an investment to its risk. It compares a fund's historical or expected returns relative to an investment benchmark, usually the risk-free rate, with the historical or expected variability of those returns: Sharperatio=pE[rp]rf where E[rp] is the expected return of the portfolio (a mutual fund or any other equity portfolio), rf is the risk-free rat and p is the standard deviation of the portfolio. As of June 30,2023 , the S\&P 500 has a Sharpe ratio of 0.88 . Mr. Jones has the option of investing in US equity mutual funds with the following Sharpe ratio: Fund A 0.80, Fund B 0.90, and Fund C 1.10. Which fund will he prefer? Please, justify the choice

1. A stock had returns of 12 percent, 39 percent, and -12 percent over the past three years. What was the standard deviation of the stock's returns? 2. If the standard deviation of a series of returns is 0 , what does that tell you about the security you are considering? 3. Mr. Jones has a 2-stock portfolio with a total value of $540,000. He has $195,000 invested in Stock A and the remainder is invested in Stock B. Stock A has a standard deviation of 16.60%, Stock B has a standard deviation of 12.40%, and the correlation between Stock A and Stock B is 0.40 . What is the expected standard deviation of Mr. Jones's portfolio returns? 4. A portfolio consists of two assets. A and B. whose returns have the following characteristics: Calculate the portfolio weights if you require an expected return of 12%. Also, calculate the standard deviation of the portfolio. 5. Mr. Jones has invested 50% of his money in stock A and the remainder in stock B. He evaluates their prospects as follows: What are the expected return and standard deviation of returns on his portfolio? How would your answer change if the correlation would be 0 or -0.60 instead of 0.60 ? Is Mr. Jones' portfolio better or worse than a portfolio invested entirely in stock A, or is it impossible to tell? 6. If the expected rate of return on the market is not much greater than the risk-free rate of return, what is the general level of compensation for bearing systematic or market risk? 7. [CML] The market portfolio has an expected return of 11% and a standard deviation of 21%. The risk-free rate is 4.5%. What is the expected return of a well-diversified portfolio with a standard deviation of 16% ? What is the composition of this portfolio (the weight of the riskfree security and the weight of the market portfolio)? What is the standard deviation of a welldiversified portfolio with an expected return of 17% ? What is the composition of this portfolio? 8. [SML] Given a risk-free rate of return of 3% and a market portfolio return of 8%. Assume that the listed company ABC Inc. has a beta of 0.9. What is the expected value of ABC stock? 9. The Sharpe ratio compares the return of an investment to its risk. It compares a fund's historical or expected returns relative to an investment benchmark, usually the risk-free rate, with the historical or expected variability of those returns: Sharperatio=pE[rp]rf where E[rp] is the expected return of the portfolio (a mutual fund or any other equity portfolio), rf is the risk-free rat and p is the standard deviation of the portfolio. As of June 30,2023 , the S\&P 500 has a Sharpe ratio of 0.88 . Mr. Jones has the option of investing in US equity mutual funds with the following Sharpe ratio: Fund A 0.80, Fund B 0.90, and Fund C 1.10. Which fund will he prefer? Please, justify the choice Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started