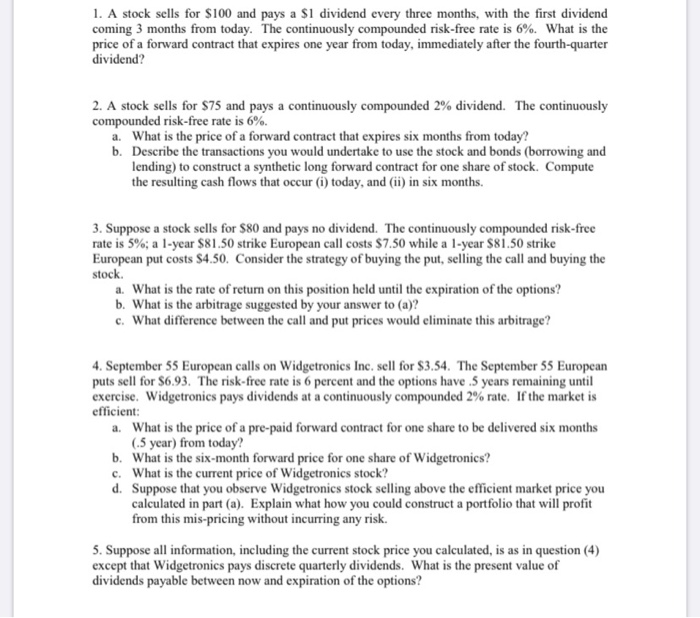

1. A stock sells for $100 and pays a $1 dividend every three months, with the first dividend coming 3 months from today. The continuously compounded risk-free rate is 6%. What is the price of a forward contract that expires one year from today, immediately after the fourth-quarter dividend? 2. A stock sells for $75 and pays a continuously compounded 2% dividend. The continuously compounded risk-free rate is 6%. a. What is the price of a forward contract that expires six months from today? b. Describe the transactions you would undertake to use the stock and bonds (borrowing and lending) to construct a synthetic long forward contract for one share of stock. Compute the resulting cash flows that occur (i) today, and (ii) in six months 3. Suppose a stock sells for $80 and pays no dividend. The continuously compounded risk-free rate is 5%, a l-year $81.50 strike European call costs $7.50 while a 1-year $81.50 strike European put costs $4.50. Consider the strategy of buying the put, selling the call and buying the stock a. What is the rate of return on this position held until the expiration of the options? b. What is the arbitrage suggested by your answer to (a)? c. What difference between the call and put prices would eliminate this arbitrage? 4. September 55 European calls on Widgetronics Inc. sell for $3.54. The September 55 European puts sell for $6.93. The risk-free rate is 6 percent and the options have 5 years remaining until exercise. Widgetronics pays dividends at a continuously compounded 2% rate. If the market is efficient: a. What is the price of a pre-paid forward contract for one share to be delivered six months (.5 year) from today? b. What is the six-month forward price for one share of Widgetronics? c. What is the current price of Widgetronics stock? d. Suppose that you observe Widgetronics stock selling above the efficient market price you calculated in part (a). Explain what how you could construct a portfolio that will profit from this mis-pricing without incurring any risk. 5. Suppose all information, including the current stock price you calculated, is as in question (4) except that Widgetronics pays discrete quarterly dividends. What is the present value of dividends payable between now and expiration of the options