Answered step by step

Verified Expert Solution

Question

1 Approved Answer

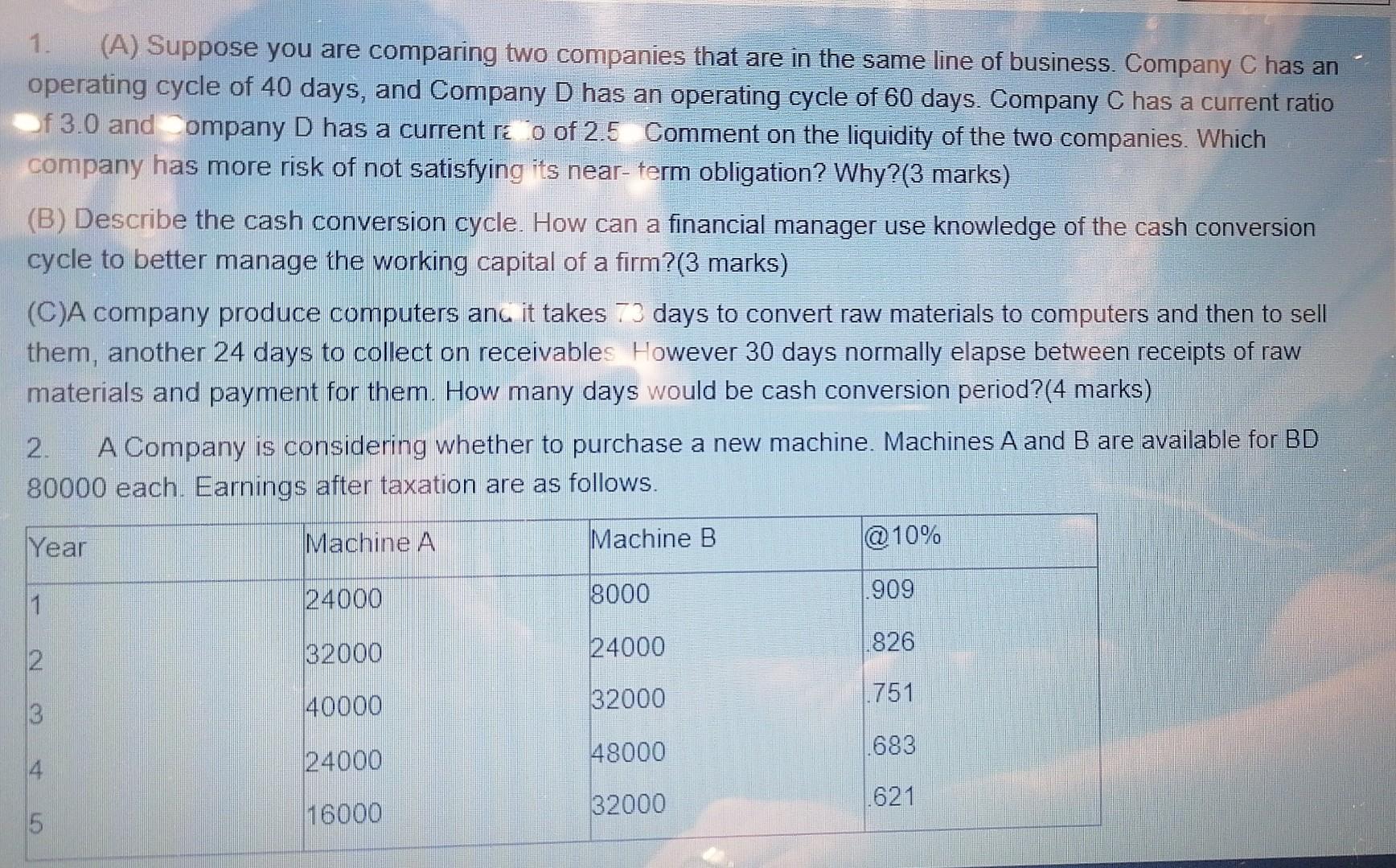

1. (A) Suppose you are comparing two companies that are in the same line of business. Company C has an operating cycle of 40 days,

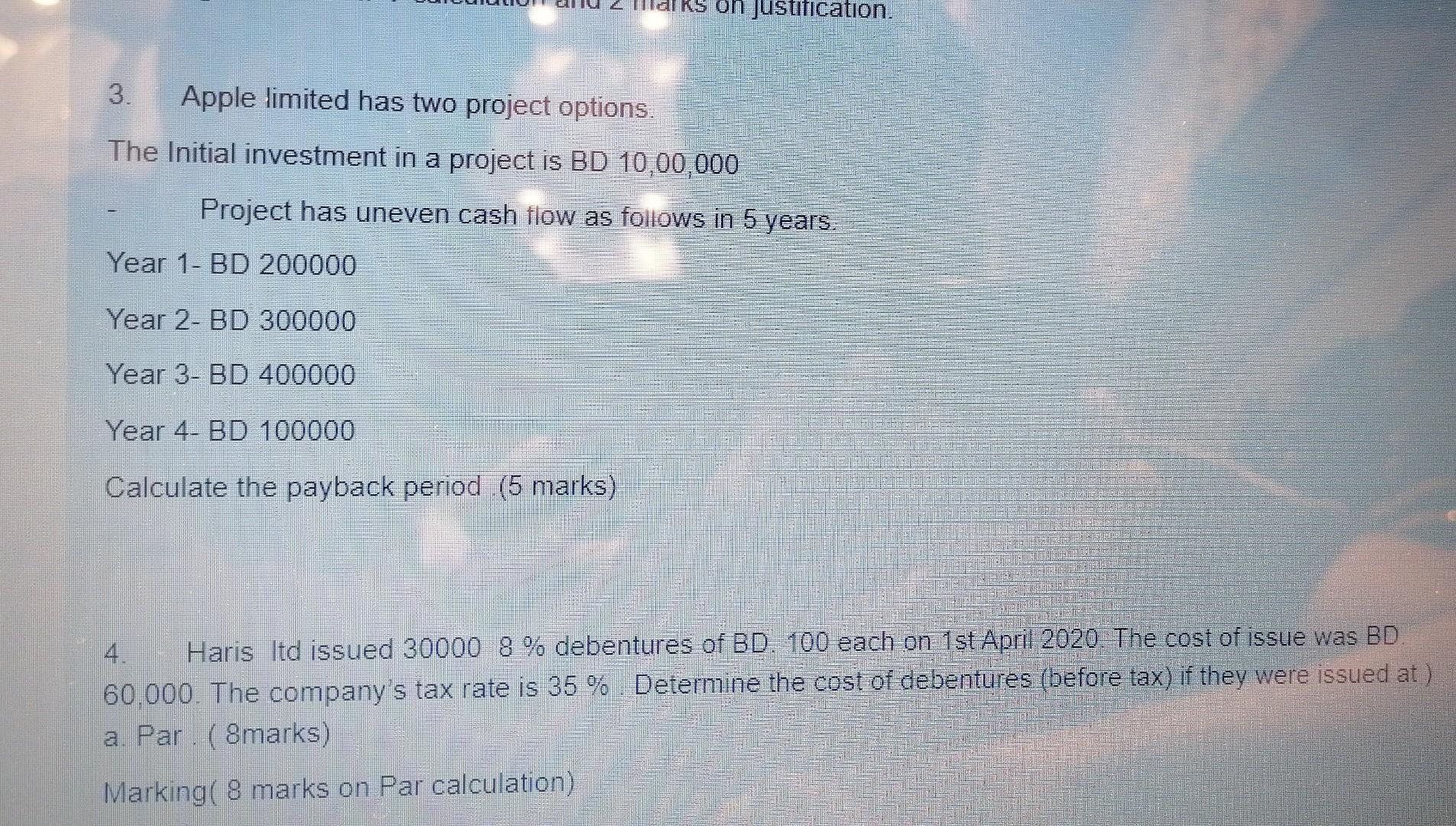

1. (A) Suppose you are comparing two companies that are in the same line of business. Company C has an operating cycle of 40 days, and Company D has an operating cycle of 60 days. Company C has a current ratio f3.0 and ompany D has a current re o of 2.5 Comment on the liquidity of the two companies. Which company has more risk of not satisfying its near-term obligation? Why? (3 marks) (B) Describe the cash conversion cycle. How can a financial manager use knowledge of the cash conversion cycle to better manage the working capital of a firm? (3 marks) (C)A company produce computers and it takes 73 days to convert raw materials to computers and then to sell them, another 24 days to collect on receivables However 30 days normally elapse between receipts of raw materials and payment for them. How many days would be cash conversion period?(4 marks) 2. A Company is considering whether to purchase a new machine. Machines A and B are available for BD 80000 each. Earnings after taxation are as follows. Year Machine A Machine B @ 10% 24000 1 18000 .909 24000 826 2 32000 32000 .751 13 40000 48000 .683 4 24000 32000 .621 5 16000 on justification. 3. Apple limited has two project options. The Initial investment in a project is BD 10,00,000 Project has uneven cash flow as follows in 5 years. Year 1- BD 200000 Year 2- BD 300000 Year 3- BD 400000 Year 4- BD 100000 Calculate the payback period (5 marks) 4. Haris Itd issued 30000 8 % debentures of BD. 100 each on 1st April 2020. The cost of issue was BD 60.000. The company's tax rate is 35 %. Determine the cost of debentures (before tax) if they were issued at ) a. Par ( 8marks) Marking( 8 marks on Par calculation)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started