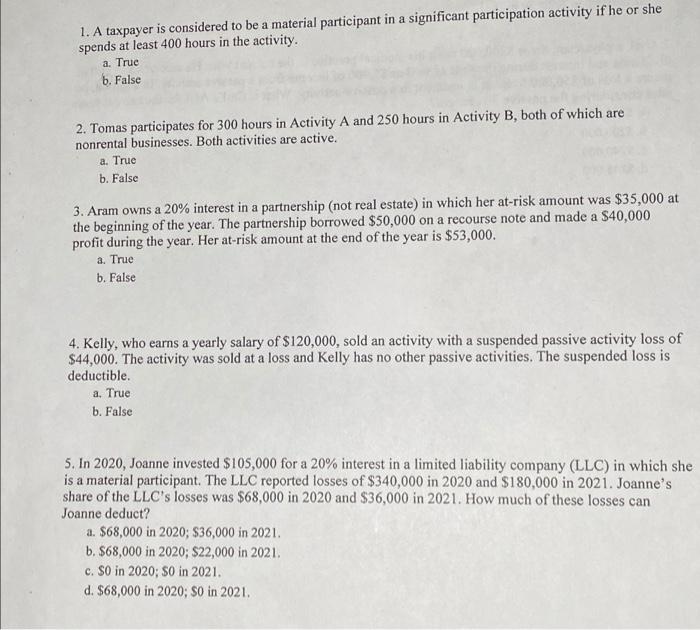

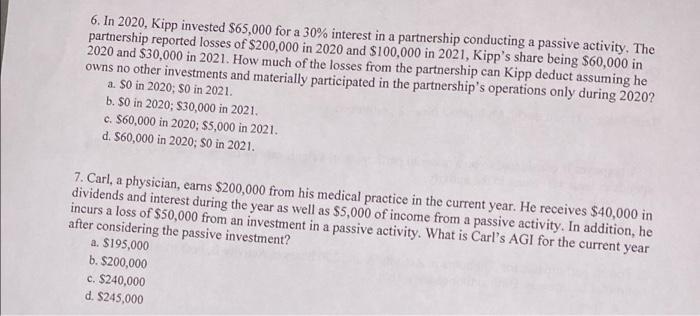

1. A taxpayer is considered to be a material participant in a significant participation activity if he or she spends at least 400 hours in the activity. a. True b. False 2. Tomas participates for 300 hours in Activity A and 250 hours in Activity B, both of which are nonrental businesses. Both activities are active. a. True b. False 3. Aram owns a 20% interest in a partnership (not real estate) in which her at-risk amount was $35,000 at the beginning of the year. The partnership borrowed $50,000 on a recourse note and made a $40,000 profit during the year. Her at-risk amount at the end of the year is $53,000. a. True b. False 4. Kelly, who earns a yearly salary of $120,000, sold an activity with a suspended passive activity loss of $44,000. The activity was sold at a loss and Kelly has no other passive activities. The suspended loss is deductible. a. True b. False 5. In 2020, Joanne invested $105,000 for a 20% interest in a limited liability company (LLC) in which she is a material participant. The LLC reported losses of $340,000 in 2020 and $180,000 in 2021. Joanne's share of the LLC's losses was $68,000 in 2020 and $36,000 in 2021. How much of these losses can Joanne deduct? a. $68,000 in 2020; S36,000 in 2021. b. $68,000 in 2020; $22,000 in 2021. c. SO in 2020; $0 in 2021. d. $68,000 in 2020; SO in 2021. 6. In 2020, Kipp invested $65,000 for a 30% interest in a partnership conducting a passive activity. The partnership reported losses of $200,000 in 2020 and $100,000 in 2021, Kipp's share being $60,000 in 2020 and $30,000 in 2021. How much of the losses from the partnership can Kipp deduct assuming he owns no other investments and materially participated in the partnership's operations only during 2020? a. S0 in 2020; $0 in 2021. b. $0 in 2020; 530,000 in 2021. c. $60,000 in 2020; $5,000 in 2021. d. $60,000 in 2020; SO in 2021. a 7. Carl, a physician, earns $200,000 from his medical practice in the current year. He receives $40,000 in dividends and interest during the year as well as $5,000 of income from a passive activity. In addition, he incurs a loss of $50,000 from an investment in a passive activity. What is Carl's AGI for the current year after considering the passive investment? a. $195,000 b. $200,000 c. $240,000 d. $245,000