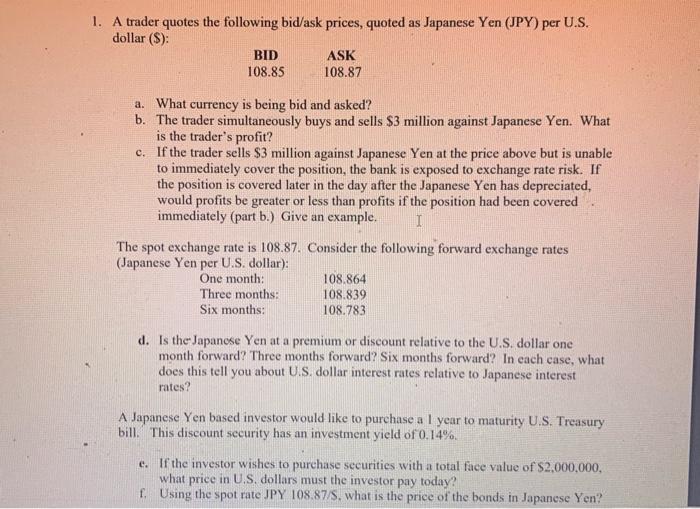

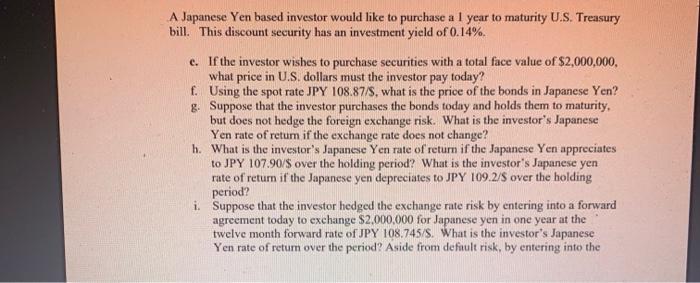

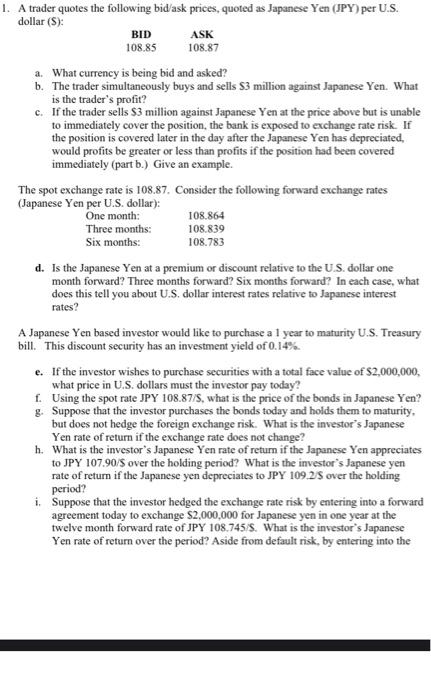

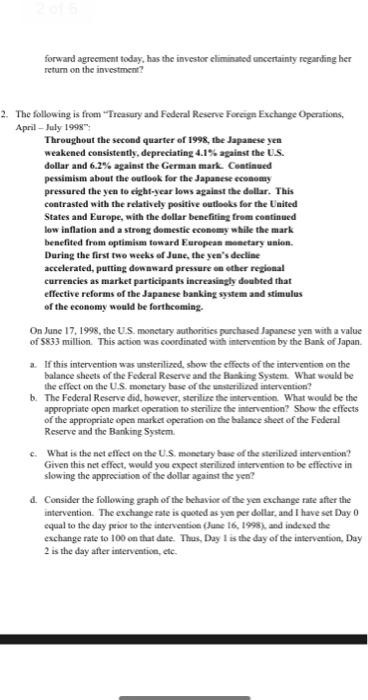

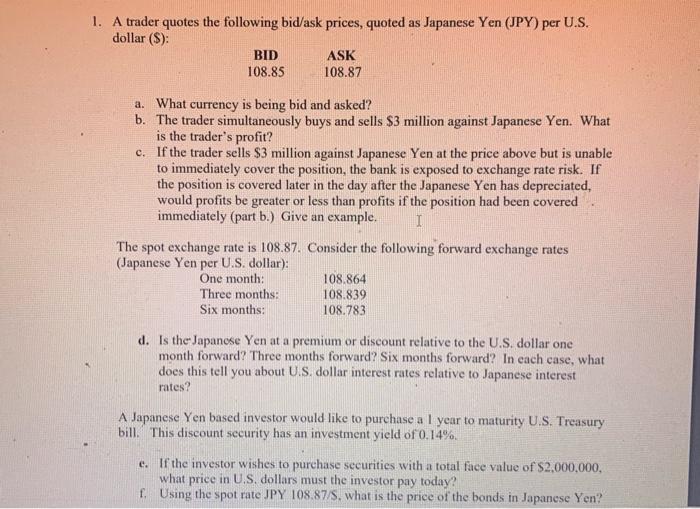

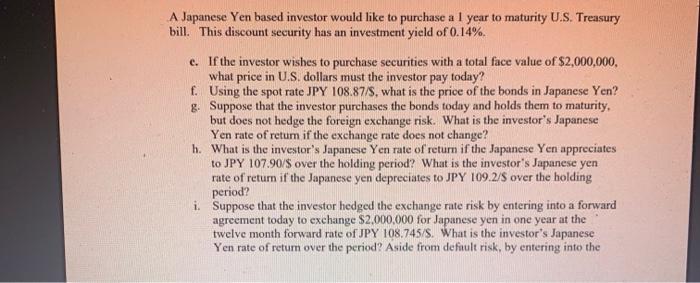

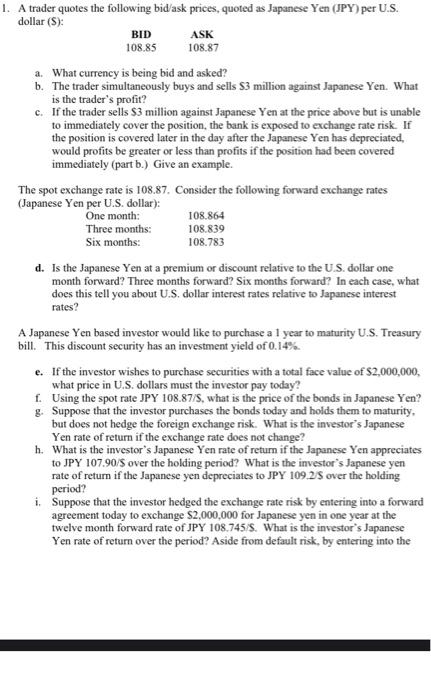

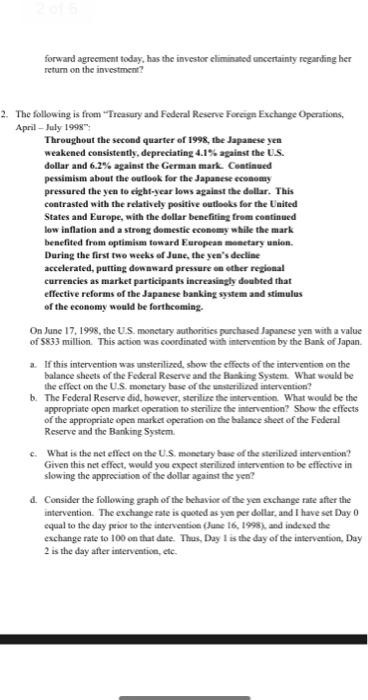

1. A trader quotes the following bid/ask prices, quoted as Japanese Yen (JPY) per U.S. dollar (S): BID ASK 108.85 108.87 a. What currency is being bid and asked? b. The trader simultaneously buys and sells $3 million against Japanese Yen. What is the trader's profit? c. If the trader sells $3 million against Japanese Yen at the price above but is unable to immediately cover the position, the bank is exposed to exchange rate risk. If the position is covered later in the day after the Japanese Yen has depreciated, would profits be greater or less than profits if the position had been covered immediately (part b.) Give an example. 1 The spot exchange rate is 108.87. Consider the following forward exchange rates (Japanese Yen per U.S. dollar): One month: 108.864 Three months: 108.839 Six months: 108.783 d. Is the Japanese Yen at a premium or discount relative to the U.S. dollar one month forward? Three months forward? Six months forward? In each case, what does this tell you about U.S. dollar interest rates relative to Japanese interest rates? A Japanese Yen based investor would like to purchase a 1 year to maturity U.S. Treasury bill. This discount security has an investment yield of 0.14%. e. If the investor wishes to purchase securities with a total face value of $2.000.000, what price in U.S. dollars must the investor pay today? f. Using the spot rate JPY 108.87/8, what is the price of the bonds in Japanese Yen? A Japanese Yen based investor would like to purchase a 1 year to maturity U.S. Treasury bill. This discount security has an investment yield of 0.14%. e. If the investor wishes to purchase securities with a total face value of $2,000,000, what price in U.S. dollars must the investor pay today? f. Using the spot rate JPY 108.87/S, what is the price of the bonds in Japanese Yen? g. Suppose that the investor purchases the bonds today and holds them to maturity, but does not hedge the foreign exchange risk. What is the investor's Japanese Yen rate of retum if the exchange rate does not change? h. What is the investor's Japanese Yen rate of return if the Japanese Yen appreciates to JPY 107.90/$ over the holding period? What is the investor's Japanese yen rate of return if the Japanese yen depreciates to JPY 109.2/S over the holding period? i. Suppose that the investor hedged the exchange rate risk by entering into a forward agreement today to exchange $2,000,000 for Japanese yen in one year at the twelve month forward rate of JPY 108.745/S. What is the investor's Japanese Yen rate of return over the period? Aside from default risk, by entering into the 1. A trader quotes the following bid/ask prices, quoted as Japanese Yen (JPY) per U.S. dollar ($): BID ASK 108.85 108.87 a. What currency is being bid and asked? b. The trader simultaneously buys and sells S3 million against Japanese Yen. What is the trader's profit? c. If the trader sells $3 million against Japanese Yen at the price above but is unable to immediately cover the position, the bank is exposed to exchange rate risk. If the position is covered later in the day after the Japanese Yen has depreciated, would profits be greater or less than profits if the position had been covered immediately (part b.) Give an example. The spot exchange rate is 108.87. Consider the following forward exchange rates (Japanese Yen per U.S. dollar): One month: 108.864 Three months: 108.839 Six months: 108.783 d. Is the Japanese Yen at a premium or discount relative to the U.S. dollar one month forward? Three months forward? Six months forward? In each case, what does this tell you about U.S. dollar interest rates relative to Japanese interest rates? A Japanese Yen based investor would like to purchase a 1 year to maturity U.S. Treasury bill. This discount security has an investment yield of 0.14% e. If the investor wishes to purchase securities with a total face value of $2,000,000, what price in U.S. dollars must the investor pay today? f. Using the spot rate JPY 108.87/S, what is the price of the bonds in Japanese Yen? g. Suppose that the investor purchases the bonds today and holds them to maturity, but does not hedge the foreign exchange risk. What is the investor's Japanese Yen rate of return if the exchange rate does not change? h. What is the investor's Japanese Yen rate of return if the Japanese Yen appreciates to JPY 107.90/S over the holding period? What is the investors Japanese yen rate of return if the Japanese yen depreciates to JPY 109.2/5 over the holding period? i. Suppose that the investor hedged the exchange rate risk by entering into a forward agreement today to exchange S2,000,000 for Japanese yen in one year at the twelve month forward rate of JPY 108.745/s. What is the investor's Japanese Yen rate of return over the period? Aside from default risk, by entering into the forward agreement today. has the investor eliminated uncertainty regarding her return on the investment? 2. The following is from "Treasury and Federal Reserve Foreign Exchange Operations, April - July 1998 Throughout the second quarter of 1998, the Japanese yes weakened consistently, depreciating 4.1% against the US. dollar and 6.2% against the German mark. Continued pessimism about the outlook for the Japanese economy pressured the yen to eight-year lows against the dollar. This contrasted with the relatively positive outlooks for the United States and Europe, with the dollar benefiting from continued low inflation and a strong domestic economy while the mark benefited from optimism toward European monetary union. During the first two weeks of June, the yea's decline accelerated, putting downward pressure another regional currencies as market participants increasingly doubted that effective reforms of the Japanese banking system and stimulus of the economy would be forthcoming. On June 17, 1998, the US monetary authorities purchased Japanese yen with a value of 833 million. This action was coordinated with intervention by the Bank of Japan a. If this intervention was unsterilized, show the effects of the intervention on the balance sheets of the Federal Reserve and the Banking System. What would be the effect on the US monetary base of the umerilired intervention? b. The Federal Reserve did, however, sterilize the intervention. What would be the appropriate open market operation to sterilize the intervention? Show the effects of the appropriate open market operation on the balance sheet of the Federal Reserve and the Banking System What is the net effect on the U.S. monetary base of the sterilized intervention? Given this net effect, would you expect sterilized intervention to be effective in slowing the appreciation of the dollar against the yen? d. Consider the following graph of the behavior of the yen exchange rate after the intervention. The exchange rate is quoted as yen per dollar, and I have set Day 0 equal to the day prior to the intervention (June 16, 1998). and indexed the exchange rate to 100 on that date. Thus, Day 1 is the day of the intervention, Day 2 is the day after intervention, etc