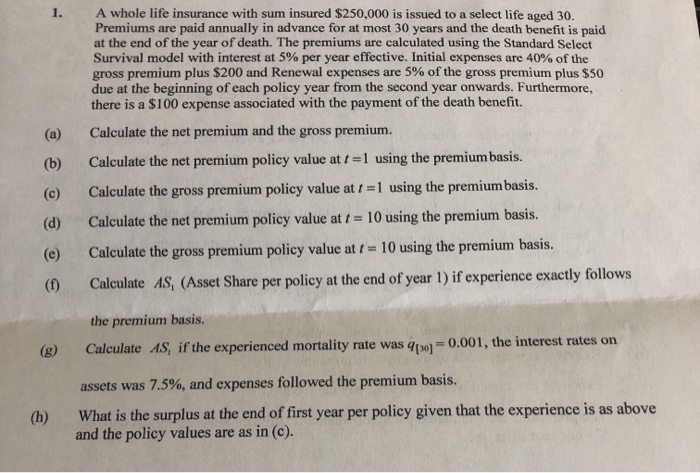

1. A whole life insurance with sum insured $250,000 is issued to a select life aged 30. Premiums are paid annually in advance for at most 30 years and the death benefit is paid at the end of the year of death. The premiums are calculated using the Standard Select Survival model with interest at 5% per year effective. Initial expenses are 40% of the gross premium plus $200 and Renewal expenses are 5% of the gross premium plus $50 due at the beginning of each policy year from the second year onwards. Furthermore, there is a $100 expense associated with the payment of the death benefit. (a) Calculate the net premium and the gross premium (b) Calculate the net premium policy value at 1 using the premium basis. (c) Calculate the gross premium policy value at 1 using the premiumbasis. (d) Calculate the net premium policy value at t 10 using the premium basis. (e) Calculate the gross premium policy value at t- 10 using the premium basis. (0 Calculate AS, (Asset Share per policy at the end of year l) if experience exactly follows the premium basis Calculate AS, if the experienced mortality rate was (so) 0.001, the interest rates on assets was 7.5%, and expenses followed the premium basis. What is the surplus at the end of first year per policy given that the experience is as above (g) (h) and the policy values are as in (c). 1. A whole life insurance with sum insured $250,000 is issued to a select life aged 30. Premiums are paid annually in advance for at most 30 years and the death benefit is paid at the end of the year of death. The premiums are calculated using the Standard Select Survival model with interest at 5% per year effective. Initial expenses are 40% of the gross premium plus $200 and Renewal expenses are 5% of the gross premium plus $50 due at the beginning of each policy year from the second year onwards. Furthermore, there is a $100 expense associated with the payment of the death benefit. (a) Calculate the net premium and the gross premium (b) Calculate the net premium policy value at 1 using the premium basis. (c) Calculate the gross premium policy value at 1 using the premiumbasis. (d) Calculate the net premium policy value at t 10 using the premium basis. (e) Calculate the gross premium policy value at t- 10 using the premium basis. (0 Calculate AS, (Asset Share per policy at the end of year l) if experience exactly follows the premium basis Calculate AS, if the experienced mortality rate was (so) 0.001, the interest rates on assets was 7.5%, and expenses followed the premium basis. What is the surplus at the end of first year per policy given that the experience is as above (g) (h) and the policy values are as in (c)