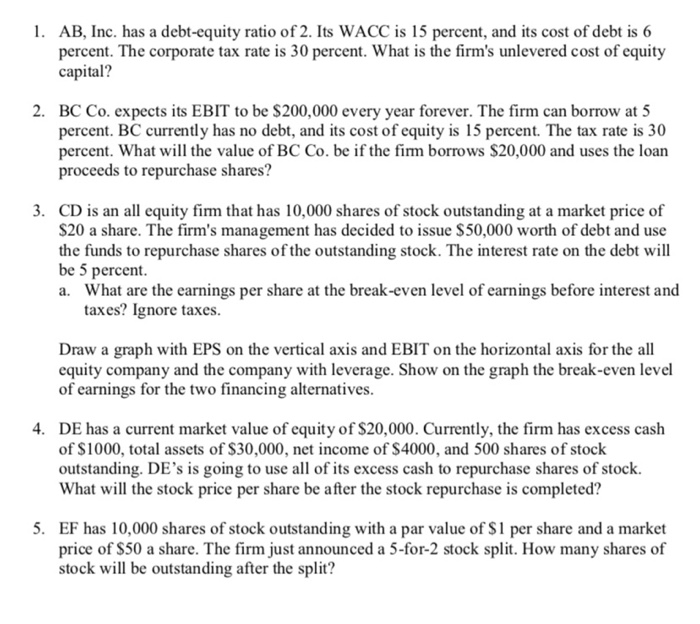

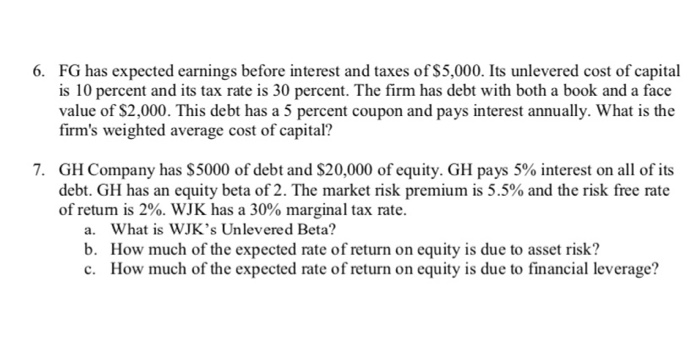

1. AB, Inc. has a debt-equity ratio of 2. Its WACC is 15 percent, and its cost of debt is 6 percent. The corporate tax rate is 30 percent. What is the firm's unlevered cost of equity capital? 2. BC Co. expects its EBIT to be $200,000 every year forever. The firm can borrow at 5 percent. BC currently has no debt, and its cost of equity is 15 percent. The tax rate is 30 percent. What will the value of BC Co. be if the firm borrows $20,000 and uses the loan proceeds to repurchase shares? 3. CD is an all equity firm that has 10,000 shares of stock outstanding at a market price of $20 a share. The firm's management has decided to issue $50,000 worth of debt and use the funds to repurchase shares of the outstanding stock. The interest rate on the debt will be 5 percent. a. What are the earnings per share at the break-even level of earnings before interest and taxes? Ignore taxes. Draw a graph with EPS on the vertical axis and EBIT on the horizontal axis for the all equity company and the company with leverage. Show on the graph the break-even level of earnings for the two financing alternatives. 4. DE has a current market value of equity of $20,000. Currently, the firm has excess cash of $1000, total assets of $30,000, net income of $4000, and 500 shares of stock outstanding. DE's is going to use all of its excess cash to repurchase shares of stock What will the stock price per share be after the stock repurchase is completed? 5. EF has 10,000 shares of stock outstanding with a par value of $1 per share and a market price of $50 a share. The firm just announced a 5-for-2 stock split. How many shares of stock will be outstanding after the split? 6. FG has expected earnings before interest and taxes of $5,000. Its unlevered cost of capital is 10 percent and its tax rate is 30 percent. The firm has debt with both a book and a face value of $2,000. This debt has a 5 percent coupon and pays interest annually. What is the firm's weighted average cost of capital? 7. GH Company has $5000 of debt and $20,000 of equity. GH pays 5% interest on all of its debt. GH has an equity beta of 2. The market risk premium is 5.5% and the risk free rate of retum is 2%. WJK has a 30% marginal tax rate. a. What is WJK's Unlevered Beta? b. How much of the expected rate of return on equity is due to asset risk? c. How much of the expected rate of return on equity is due to financial leverage