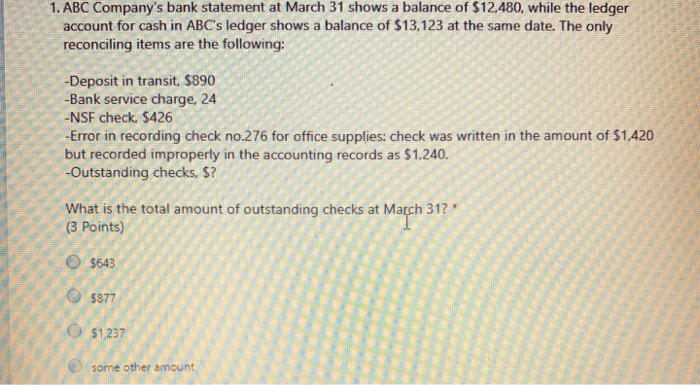

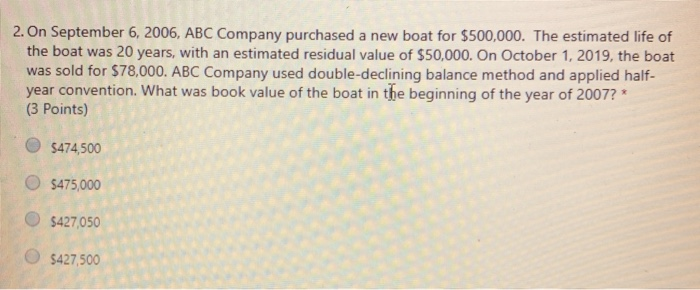

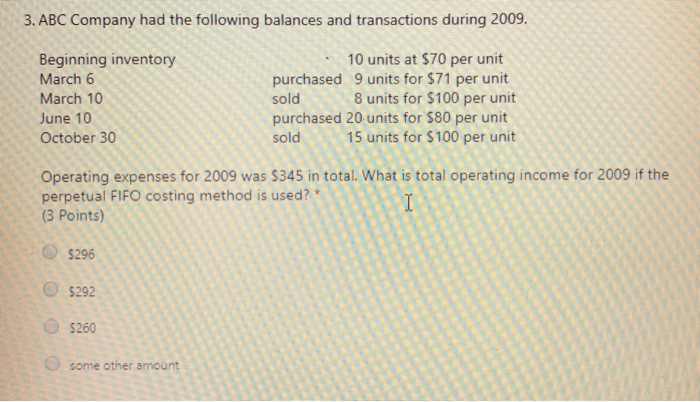

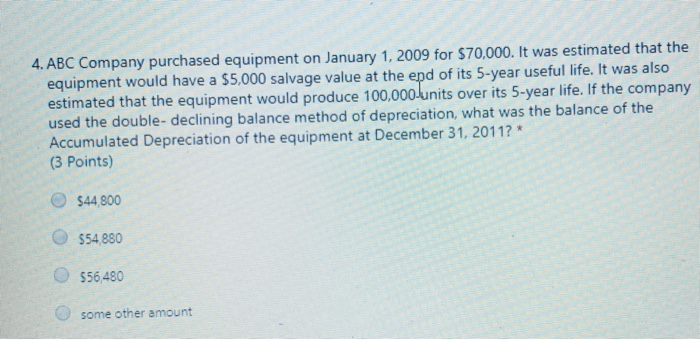

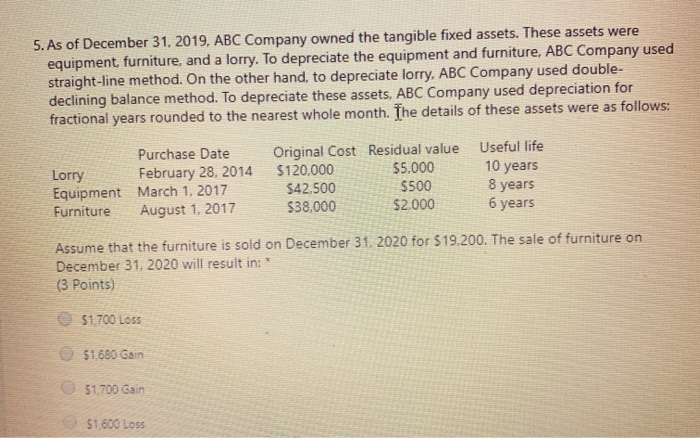

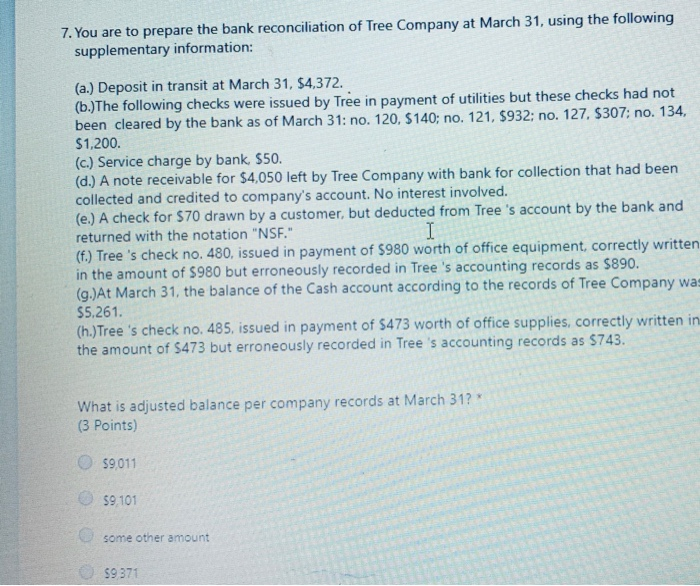

1. ABC Company's bank statement at March 31 shows a balance of $12,480, while the ledger account for cash in ABC's ledger shows a balance of $13,123 at the same date. The only reconciling items are the following: -Deposit in transit, $890 -Bank service charge, 24 - NSF check. $426 -Error in recording check no.276 for office supplies: check was written in the amount of $1,420 but recorded improperly in the accounting records as $1,240. -Outstanding checks, S? What is the total amount of outstanding checks at March 31?* (3 Points) $643 c 5877 O $1,237 some other amount 2. On September 6, 2006, ABC Company purchased a new boat for $500,000. The estimated life of the boat was 20 years, with an estimated residual value of $50,000. On October 1, 2019, the boat was sold for $78,000. ABC Company used double-declining balance method and applied half- year convention. What was book value of the boat in the beginning of the year of 2007?* (3 Points) $474,500 5475,000 $427,050 $427,500 3. ABC Company had the following balances and transactions during 2009. Beginning inventory 10 units at $70 per unit March 6 purchased 9 units for $71 per unit March 10 sold 8 units for $100 per unit June 10 purchased 20 units for $80 per unit October 30 sold 15 units for $100 per unit Operating expenses for 2009 was $345 in total. What is total operating income for 2009 if the perpetual FIFO costing method is used? * I (3 Points) $296 $292 5260 some other amount 4. ABC Company purchased equipment on January 1, 2009 for $70,000. It was estimated that the equipment would have a $5,000 salvage value at the end of its 5-year useful life. It was also estimated that the equipment would produce 100,000 units over its 5-year life. If the company used the double-declining balance method of depreciation, what was the balance of the Accumulated Depreciation of the equipment at December 31, 2011?* (3 Points) O $44.800 554 880 556 480 some other amount 5. As of December 31, 2019, ABC Company owned the tangible fixed assets. These assets were equipment furniture, and a lorry. To depreciate the equipment and furniture, ABC Company used straight-line method. On the other hand, to depreciate lorry, ABC Company used double- declining balance method. To depreciate these assets, ABC Company used depreciation for fractional years rounded to the nearest whole month. The details of these assets were as follows: Purchase Date Lorry February 28, 2014 Equipment March 1, 2017 Furniture August 1, 2017 Original Cost Residual value $120.000 $5.000 $42.500 $500 $38,000 $2,000 Useful life 10 years 8 years 6 years Assume that the furniture is sold on December 31, 2020 for $19.200. The sale of furniture on December 31, 2020 will result in: * (3 Points) $1,700 Loss $1680 Gain 51700 Gain $1,600 Loss 7. You are to prepare the bank reconciliation of Tree Company at March 31, using the following supplementary information: (a.) Deposit in transit at March 31, $4,372. (b.) The following checks were issued by Tree in payment of utilities but these checks had not been cleared by the bank as of March 31: no. 120. $140; no. 121, $932; no. 127. $307; no. 134, $1,200. (c.) Service charge by bank $50. (d.) A note receivable for $4,050 left by Tree Company with bank for collection that had been collected and credited to company's account. No interest involved. (e.) A check for $70 drawn by a customer, but deducted from Tree's account by the bank and returned with the notation "NSF." I (f.) Tree's check no. 480, issued in payment of $980 worth of office equipment correctly written in the amount of $980 but erroneously recorded in Tree's accounting records as $890. (9.)At March 31. the balance of the Cash account according to the records of Tree Company was $5.261. (h.)Tree's check no. 485, issued in payment of $473 worth of office supplies, correctly written in the amount of 5473 but erroneously recorded in Tree's accounting records as 5743. What is adjusted balance per company records at March 31? * (3 Points) $9.011 59,101 some other amount $9371