Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. ABC Corporation is deciding whether to capitalize on the Artificial Intelligence craze by purchasing a popular AI chatbot. ABC Corporation could buy the chatbot

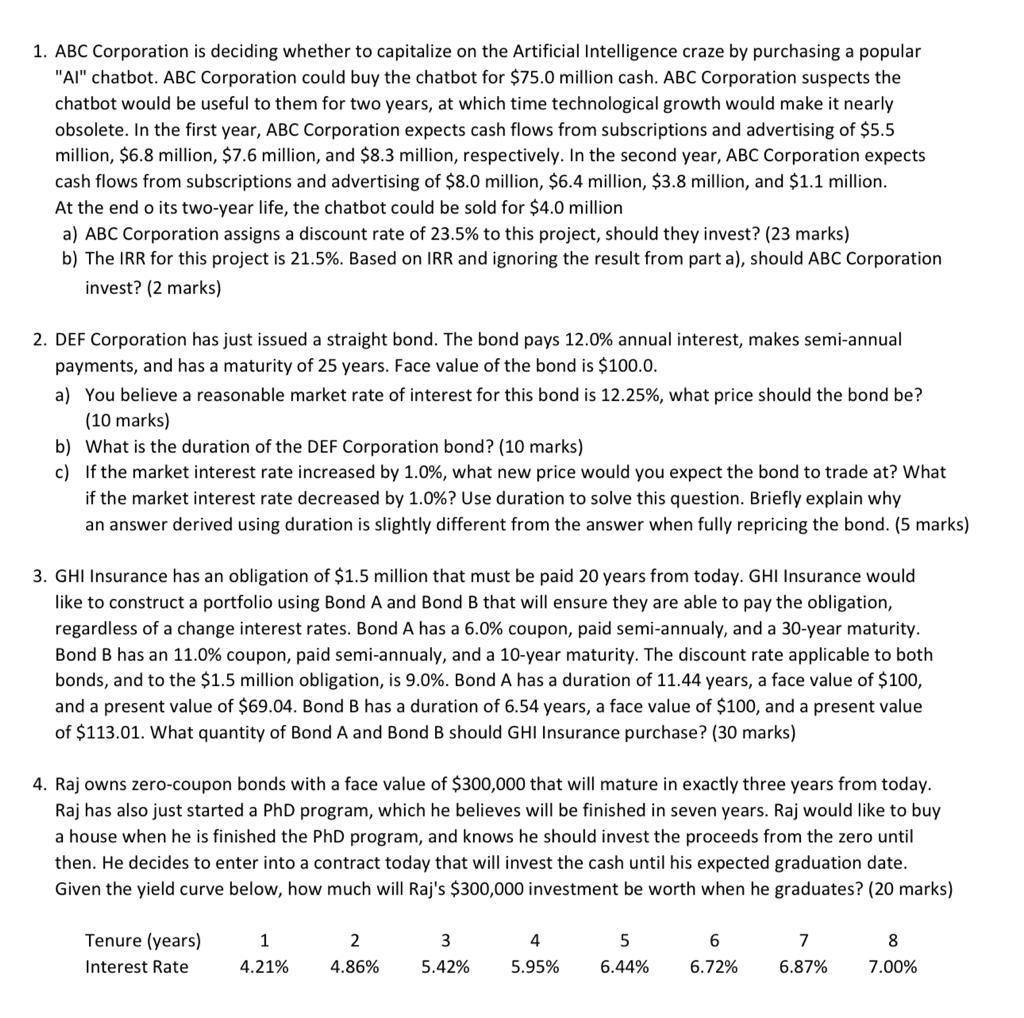

1. ABC Corporation is deciding whether to capitalize on the Artificial Intelligence craze by purchasing a popular "AI" chatbot. ABC Corporation could buy the chatbot for $75.0 million cash. ABC Corporation suspects the chatbot would be useful to them for two years, at which time technological growth would make it nearly obsolete. In the first year, ABC Corporation expects cash flows from subscriptions and advertising of $5.5 million, $6.8 million, $7.6 million, and $8.3 million, respectively. In the second year, ABC Corporation expects cash flows from subscriptions and advertising of \$8.0 million, \$6.4 million, \$3.8 million, and \$1.1 million. At the end o its two-year life, the chatbot could be sold for $4.0 million a) ABC Corporation assigns a discount rate of 23.5% to this project, should they invest? (23 marks) b) The IRR for this project is 21.5%. Based on IRR and ignoring the result from part a), should ABC Corporation invest? (2 marks) 2. DEF Corporation has just issued a straight bond. The bond pays 12.0% annual interest, makes semi-annual payments, and has a maturity of 25 years. Face value of the bond is $100.0. a) You believe a reasonable market rate of interest for this bond is 12.25%, what price should the bond be? (10 marks) b) What is the duration of the DEF Corporation bond? (10 marks) c) If the market interest rate increased by 1.0%, what new price would you expect the bond to trade at? What if the market interest rate decreased by 1.0% ? Use duration to solve this question. Briefly explain why an answer derived using duration is slightly different from the answer when fully repricing the bond. ( 5 marks) 3. GHI Insurance has an obligation of $1.5 million that must be paid 20 years from today. GHI Insurance would like to construct a portfolio using Bond A and Bond B that will ensure they are able to pay the obligation, regardless of a change interest rates. Bond A has a 6.0% coupon, paid semi-annualy, and a 30 -year maturity. Bond B has an 11.0% coupon, paid semi-annualy, and a 10 -year maturity. The discount rate applicable to both bonds, and to the $1.5 million obligation, is 9.0%. Bond A has a duration of 11.44 years, a face value of $100, and a present value of $69.04. Bond B has a duration of 6.54 years, a face value of $100, and a present value of $113.01. What quantity of Bond A and Bond B should GHI Insurance purchase? (30 marks) 4. Raj owns zero-coupon bonds with a face value of $300,000 that will mature in exactly three years from today. Raj has also just started a PhD program, which he believes will be finished in seven years. Raj would like to buy a house when he is finished the PhD program, and knows he should invest the proceeds from the zero until then. He decides to enter into a contract today that will invest the cash until his expected graduation date. Given the yield curve below, how much will Raj's $300,000 investment be worth when he graduates? ( 20 marks)

1. ABC Corporation is deciding whether to capitalize on the Artificial Intelligence craze by purchasing a popular "AI" chatbot. ABC Corporation could buy the chatbot for $75.0 million cash. ABC Corporation suspects the chatbot would be useful to them for two years, at which time technological growth would make it nearly obsolete. In the first year, ABC Corporation expects cash flows from subscriptions and advertising of $5.5 million, $6.8 million, $7.6 million, and $8.3 million, respectively. In the second year, ABC Corporation expects cash flows from subscriptions and advertising of \$8.0 million, \$6.4 million, \$3.8 million, and \$1.1 million. At the end o its two-year life, the chatbot could be sold for $4.0 million a) ABC Corporation assigns a discount rate of 23.5% to this project, should they invest? (23 marks) b) The IRR for this project is 21.5%. Based on IRR and ignoring the result from part a), should ABC Corporation invest? (2 marks) 2. DEF Corporation has just issued a straight bond. The bond pays 12.0% annual interest, makes semi-annual payments, and has a maturity of 25 years. Face value of the bond is $100.0. a) You believe a reasonable market rate of interest for this bond is 12.25%, what price should the bond be? (10 marks) b) What is the duration of the DEF Corporation bond? (10 marks) c) If the market interest rate increased by 1.0%, what new price would you expect the bond to trade at? What if the market interest rate decreased by 1.0% ? Use duration to solve this question. Briefly explain why an answer derived using duration is slightly different from the answer when fully repricing the bond. ( 5 marks) 3. GHI Insurance has an obligation of $1.5 million that must be paid 20 years from today. GHI Insurance would like to construct a portfolio using Bond A and Bond B that will ensure they are able to pay the obligation, regardless of a change interest rates. Bond A has a 6.0% coupon, paid semi-annualy, and a 30 -year maturity. Bond B has an 11.0% coupon, paid semi-annualy, and a 10 -year maturity. The discount rate applicable to both bonds, and to the $1.5 million obligation, is 9.0%. Bond A has a duration of 11.44 years, a face value of $100, and a present value of $69.04. Bond B has a duration of 6.54 years, a face value of $100, and a present value of $113.01. What quantity of Bond A and Bond B should GHI Insurance purchase? (30 marks) 4. Raj owns zero-coupon bonds with a face value of $300,000 that will mature in exactly three years from today. Raj has also just started a PhD program, which he believes will be finished in seven years. Raj would like to buy a house when he is finished the PhD program, and knows he should invest the proceeds from the zero until then. He decides to enter into a contract today that will invest the cash until his expected graduation date. Given the yield curve below, how much will Raj's $300,000 investment be worth when he graduates? ( 20 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started