Question

1. ABC stock is currently trading at a market price (S) of $50. You do not own the stock, but you are long a put

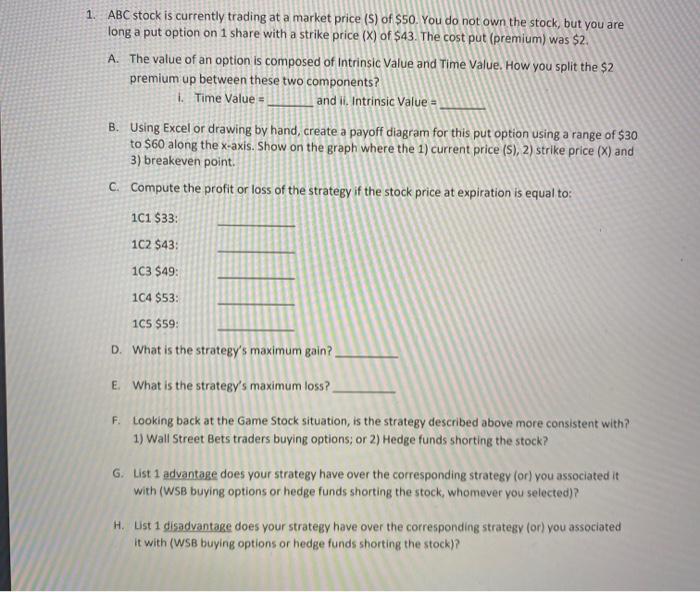

1. ABC stock is currently trading at a market price (S) of $50. You do not own the stock, but you are long a put option on 1 share with a strike price (X) of $43. The cost put (premium) was $2.

A. The value of an option is composed of Intrinsic Value and Time Value. How you split the $2 premium up between these two components? i. Time Value = _______ and ii. Intrinsic Value = _______

B. Using Excel or drawing by hand, payoff diagram for this put option using a range of $30 to $60 along the x-axis. Show on the graph where the 1) current price (S), 2) strike price (X) and 3) breakeven point.

C. Compute the profit or loss of the strategy if the stock price at expiration is equal to: 1C1 $33: ____________ 1C2 $43: ____________ 1C3 $49: ____________ 1C4 $53: ____________ 1C5 $59: ____________

D. What is the strategy's maximum gain? __________

E. What is the strategy's maximum loss? __________

F. Looking back at the Game Stock situation, is the strategy described above more consistent with? 1) Wall Street Bets traders buying options; or 2) Hedge funds shorting the stock?

G. List 1 advantage does your strategy have over the corresponding strategy (or) you associated it with (WSB buying options or hedge funds shorting the stock, whomever you selected)?

H. List 1 disadvantage does your strategy have over the corresponding strategy (or) you associated it with (WSB buying options or hedge funds shorting the stock)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started