Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) A/c is credited and A/c is debited in case wages are paid for employees. A. Cash, Wages Expense B. Cash, Salary expense C. Wages

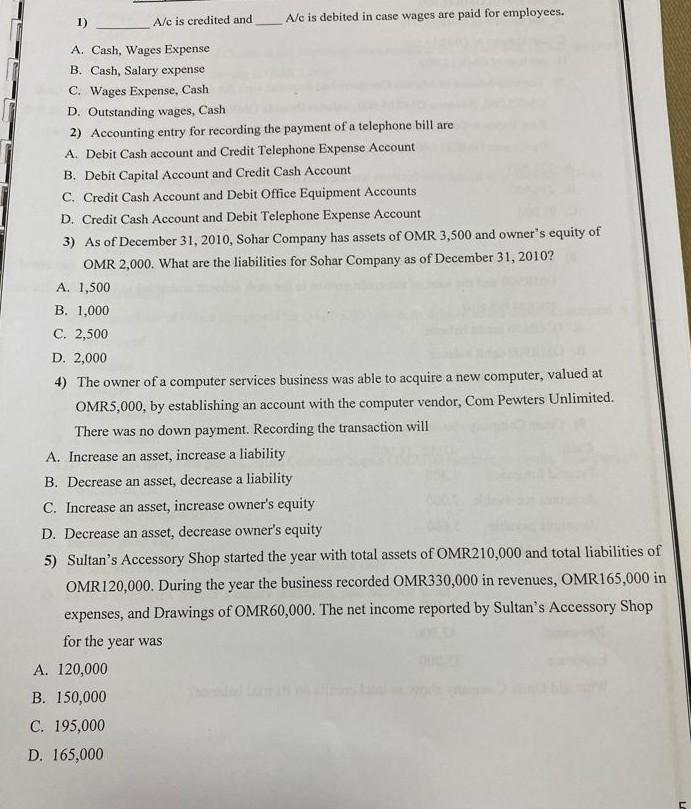

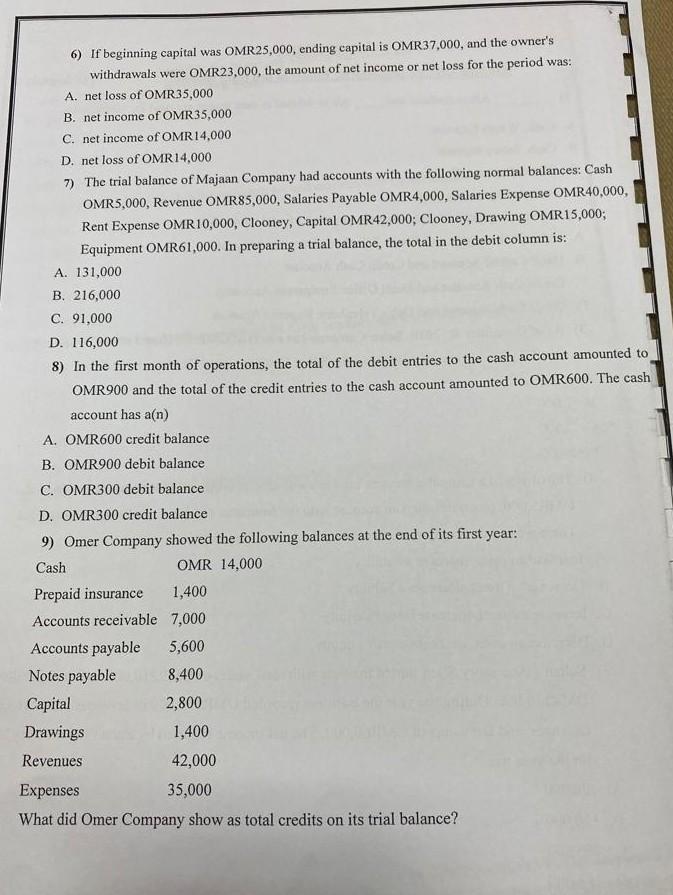

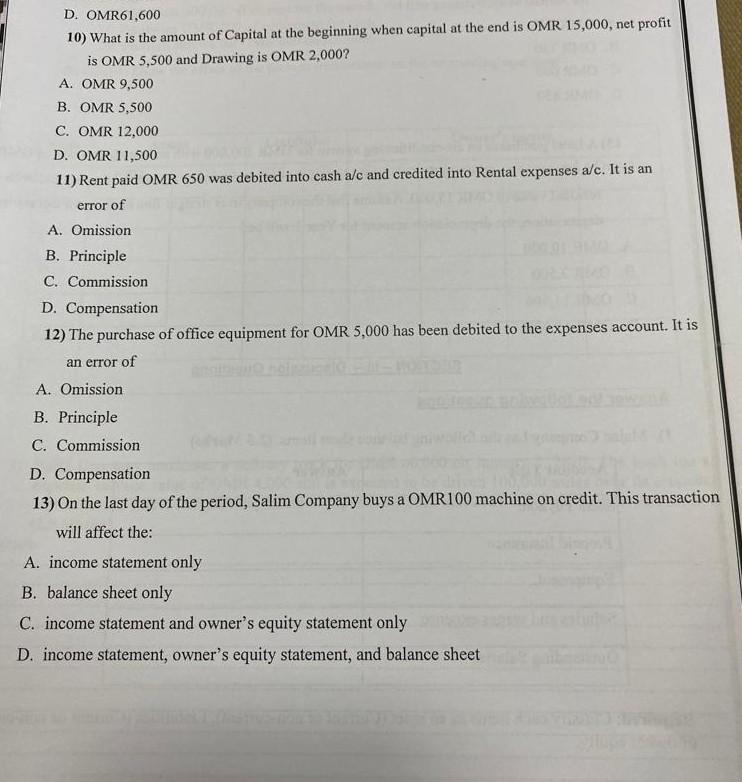

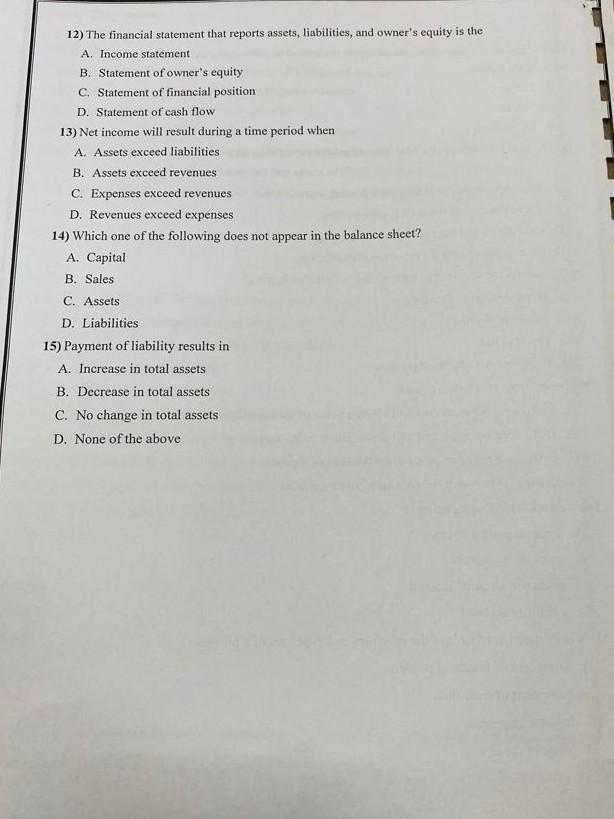

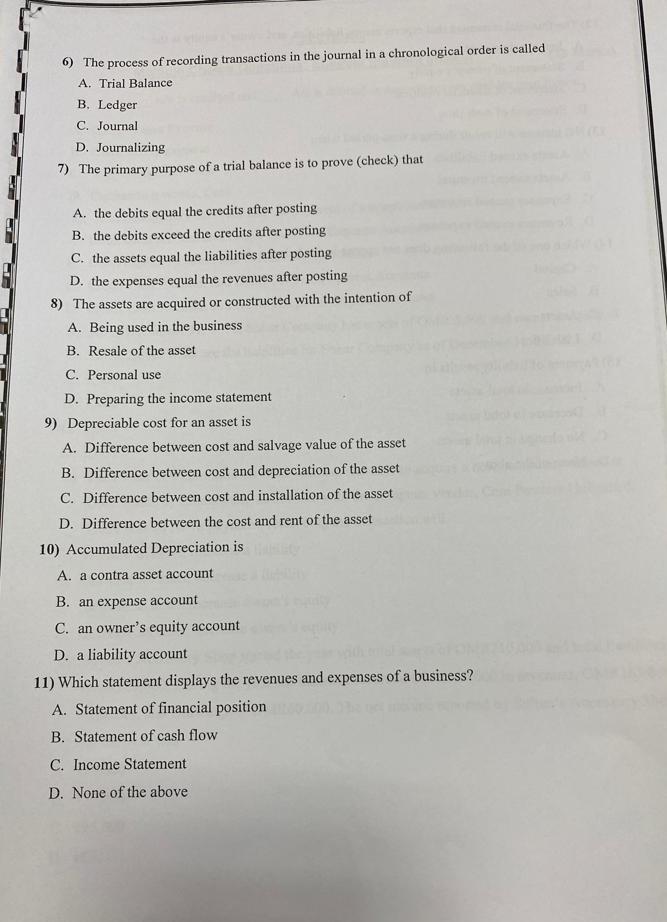

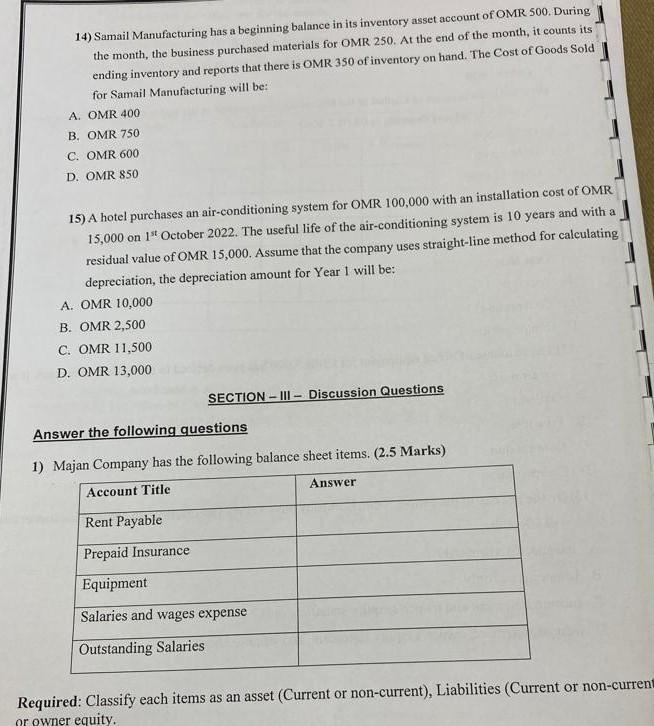

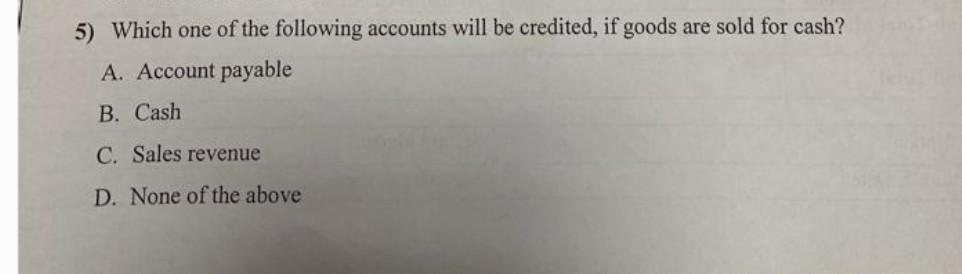

1) A/c is credited and A/c is debited in case wages are paid for employees. A. Cash, Wages Expense B. Cash, Salary expense C. Wages Expense, Cash D. Outstanding wages, Cash 2) Accounting entry for recording the payment of a telephone bill are A. Debit Cash account and Credit Telephone Expense Account B. Debit Capital Account and Credit Cash Account C. Credit Cash Account and Debit Office Equipment Accounts D. Credit Cash Account and Debit Telephone Expense Account 3) As of December 31,2010, Sohar Company has assets of OMR 3,500 and owner's equity of OMR 2,000. What are the liabilities for Sohar Company as of December 31, 2010? A. 1,500 B. 1,000 C. 2,500 D. 2,000 4) The owner of a computer services business was able to acquire a new computer, valued at OMR5,000, by establishing an account with the computer vendor, Com Pewters Unlimited. There was no down payment. Recording the transaction will A. Increase an asset, increase a liability B. Decrease an asset, decrease a liability C. Increase an asset, increase owner's equity D. Decrease an asset, decrease owner's equity 5) Sultan's Accessory Shop started the year with total assets of OMR210,000 and total liabilities of OMR120,000. During the year the business recorded OMR330,000 in revenues, OMR165,000 in expenses, and Drawings of OMR60,000. The net income reported by Sultan's Accessory Shop for the year was A. 120,000 B. 150,000 C. 195,000 D. 165,000 6) If beginning capital was OMR25,000, ending capital is OMR 37,000 , and the owner's withdrawals were OMR23,000, the amount of net income or net loss for the period was: A. net loss of OMR 35,000 B. net income of OMR35,000 C. net income of OMR14,000 D. net loss of OMR14,000 7) The trial balance of Majaan Company had accounts with the following normal balances: Cash OMR5,000, Revenue OMR85,000, Salaries Payable OMR4,000, Salaries Expense OMR40,000, Rent Expense OMR10,000, Clooney, Capital OMR42,000; Clooney, Drawing OMR15,000; Equipment OMR61,000. In preparing a trial balance, the total in the debit column is: A. 131,000 B. 216,000 C. 91,000 D. 116,000 8) In the first month of operations, the total of the debit entries to the cash account amounted to OMR900 and the total of the credit entries to the cash account amounted to OMR600. The cash account has a(n) A. OMR600 credit balance B. OMR900 debit balance C. OMR300 debit balance D. OMR 300 credit balance 9) Omer Company showed the following balances at the end of its first year: What did Omer Company show as total credits on its trial balance? D. OMR61,600 10) What is the amount of Capital at the beginning when capital at the end is OMR 15,000 , net profit is OMR 5,500 and Drawing is OMR 2,000? A. OMR 9,500 B. OMR 5,500 C. OMR 12,000 D. OMR 11,500 11) Rent paid OMR 650 was debited into cash a/c and credited into Rental expenses a/c. It is an error of A. Omission B. Principle C. Commission D. Compensation 12) The purchase of office equipment for OMR 5,000 has been debited to the expenses account. It is an error of A. Omission B. Principle C. Commission D. Compensation 13) On the last day of the period, Salim Company buys a OMR 100 machine on credit. This transaction will affect the: A. income statement only B. balance sheet only C. income statement and owner's equity statement only D. income statement, owner's equity statement, and balance sheet 12) The financial statement that reports assets, liabilities, and owner's equity is the A. Income statement B. Statement of owner's equity C. Statement of financial position D. Statement of cash flow 13) Net income will result during a time period when A. Assets exceed liabilities B. Assets exceed revenues C. Expenses exceed revenues D. Revenues exceed expenses 14) Which one of the following does not appear in the balance sheet? A. Capital B. Sales C. Assets D. Liabilities 15) Payment of liability results in A. Increase in total assets B. Decrease in total assets C. No change in total assets D. None of the above 6) The process of recording transactions in the journal in a chronological order is called A. Trial Balance B, Ledger C. Journal D. Journalizing 7) The primary purpose of a trial balance is to prove (check) that A. the debits equal the credits after posting B. the debits exceed the credits after posting C. the assets equal the liabilities after posting D. the expenses equal the revenues after posting 8) The assets are acquired or constructed with the intention of A. Being used in the business B. Resale of the asset C. Personal use D. Preparing the income statement 9) Depreciable cost for an asset is A. Difference between cost and salvage value of the asset B. Difference between cost and depreciation of the asset C. Difference between cost and installation of the asset D. Difference between the cost and rent of the asset 10) Accumulated Depreciation is A. a contra asset account B. an expense account C. an owner's equity account D. a liability account 11) Which statement displays the revenues and expenses of a business? A. Statement of financial position B. Statement of cash flow C. Income Statement D. None of the above 14) Samail Manufacturing has a beginning balance in its inventory asset account of OMR 500 . During the month, the business purchased materials for OMR 250. At the end of the month, it counts its ending inventory and reports that there is OMR 350 of inventory on hand. The Cost of Goods Sold for Samail Manufacturing will be: A. OMR 400 B. OMR 750 C. OMR 600 D. OMR 850 15) A hotel purchases an air-conditioning system for OMR 100,000 with an installation cost of OMR 15,000 on 1st Oetober 2022 . The useful life of the air-conditioning system is 10 years and with a residual value of OMR 15,000 . Assume that the company uses straight-line method for calculating depreciation, the depreciation amount for Year 1 will be: A. OMR 10,000 B. OMR2,500 C. OMR 11,500 D. OMR 13,000 SECTION - III - Discussion Questions Answer the following questions 1) Maian Combany has the following balance sheet items. (2.5 Marks) Required: Classify each items as an asset (Current or non-current), Liabilities (Current or non-curren or owner equity. 5) Which one of the following accounts will be credited, if goods are sold for cash? A. Account payable B. Cash C. Sales revenue D. None of the above 1) A/c is credited and A/c is debited in case wages are paid for employees. A. Cash, Wages Expense B. Cash, Salary expense C. Wages Expense, Cash D. Outstanding wages, Cash 2) Accounting entry for recording the payment of a telephone bill are A. Debit Cash account and Credit Telephone Expense Account B. Debit Capital Account and Credit Cash Account C. Credit Cash Account and Debit Office Equipment Accounts D. Credit Cash Account and Debit Telephone Expense Account 3) As of December 31,2010, Sohar Company has assets of OMR 3,500 and owner's equity of OMR 2,000. What are the liabilities for Sohar Company as of December 31, 2010? A. 1,500 B. 1,000 C. 2,500 D. 2,000 4) The owner of a computer services business was able to acquire a new computer, valued at OMR5,000, by establishing an account with the computer vendor, Com Pewters Unlimited. There was no down payment. Recording the transaction will A. Increase an asset, increase a liability B. Decrease an asset, decrease a liability C. Increase an asset, increase owner's equity D. Decrease an asset, decrease owner's equity 5) Sultan's Accessory Shop started the year with total assets of OMR210,000 and total liabilities of OMR120,000. During the year the business recorded OMR330,000 in revenues, OMR165,000 in expenses, and Drawings of OMR60,000. The net income reported by Sultan's Accessory Shop for the year was A. 120,000 B. 150,000 C. 195,000 D. 165,000 6) If beginning capital was OMR25,000, ending capital is OMR 37,000 , and the owner's withdrawals were OMR23,000, the amount of net income or net loss for the period was: A. net loss of OMR 35,000 B. net income of OMR35,000 C. net income of OMR14,000 D. net loss of OMR14,000 7) The trial balance of Majaan Company had accounts with the following normal balances: Cash OMR5,000, Revenue OMR85,000, Salaries Payable OMR4,000, Salaries Expense OMR40,000, Rent Expense OMR10,000, Clooney, Capital OMR42,000; Clooney, Drawing OMR15,000; Equipment OMR61,000. In preparing a trial balance, the total in the debit column is: A. 131,000 B. 216,000 C. 91,000 D. 116,000 8) In the first month of operations, the total of the debit entries to the cash account amounted to OMR900 and the total of the credit entries to the cash account amounted to OMR600. The cash account has a(n) A. OMR600 credit balance B. OMR900 debit balance C. OMR300 debit balance D. OMR 300 credit balance 9) Omer Company showed the following balances at the end of its first year: What did Omer Company show as total credits on its trial balance? D. OMR61,600 10) What is the amount of Capital at the beginning when capital at the end is OMR 15,000 , net profit is OMR 5,500 and Drawing is OMR 2,000? A. OMR 9,500 B. OMR 5,500 C. OMR 12,000 D. OMR 11,500 11) Rent paid OMR 650 was debited into cash a/c and credited into Rental expenses a/c. It is an error of A. Omission B. Principle C. Commission D. Compensation 12) The purchase of office equipment for OMR 5,000 has been debited to the expenses account. It is an error of A. Omission B. Principle C. Commission D. Compensation 13) On the last day of the period, Salim Company buys a OMR 100 machine on credit. This transaction will affect the: A. income statement only B. balance sheet only C. income statement and owner's equity statement only D. income statement, owner's equity statement, and balance sheet 12) The financial statement that reports assets, liabilities, and owner's equity is the A. Income statement B. Statement of owner's equity C. Statement of financial position D. Statement of cash flow 13) Net income will result during a time period when A. Assets exceed liabilities B. Assets exceed revenues C. Expenses exceed revenues D. Revenues exceed expenses 14) Which one of the following does not appear in the balance sheet? A. Capital B. Sales C. Assets D. Liabilities 15) Payment of liability results in A. Increase in total assets B. Decrease in total assets C. No change in total assets D. None of the above 6) The process of recording transactions in the journal in a chronological order is called A. Trial Balance B, Ledger C. Journal D. Journalizing 7) The primary purpose of a trial balance is to prove (check) that A. the debits equal the credits after posting B. the debits exceed the credits after posting C. the assets equal the liabilities after posting D. the expenses equal the revenues after posting 8) The assets are acquired or constructed with the intention of A. Being used in the business B. Resale of the asset C. Personal use D. Preparing the income statement 9) Depreciable cost for an asset is A. Difference between cost and salvage value of the asset B. Difference between cost and depreciation of the asset C. Difference between cost and installation of the asset D. Difference between the cost and rent of the asset 10) Accumulated Depreciation is A. a contra asset account B. an expense account C. an owner's equity account D. a liability account 11) Which statement displays the revenues and expenses of a business? A. Statement of financial position B. Statement of cash flow C. Income Statement D. None of the above 14) Samail Manufacturing has a beginning balance in its inventory asset account of OMR 500 . During the month, the business purchased materials for OMR 250. At the end of the month, it counts its ending inventory and reports that there is OMR 350 of inventory on hand. The Cost of Goods Sold for Samail Manufacturing will be: A. OMR 400 B. OMR 750 C. OMR 600 D. OMR 850 15) A hotel purchases an air-conditioning system for OMR 100,000 with an installation cost of OMR 15,000 on 1st Oetober 2022 . The useful life of the air-conditioning system is 10 years and with a residual value of OMR 15,000 . Assume that the company uses straight-line method for calculating depreciation, the depreciation amount for Year 1 will be: A. OMR 10,000 B. OMR2,500 C. OMR 11,500 D. OMR 13,000 SECTION - III - Discussion Questions Answer the following questions 1) Maian Combany has the following balance sheet items. (2.5 Marks) Required: Classify each items as an asset (Current or non-current), Liabilities (Current or non-curren or owner equity. 5) Which one of the following accounts will be credited, if goods are sold for cash? A. Account payable B. Cash C. Sales revenue D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started