Question

1. According to the mean-variance criterion, which one of the following investments dominates all others? A. E(r) = 0.15; Variance = 0.20 B. E(r)

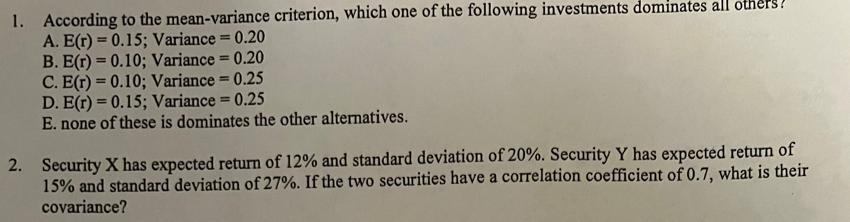

1. According to the mean-variance criterion, which one of the following investments dominates all others? A. E(r) = 0.15; Variance = 0.20 B. E(r) = 0.10; Variance = 0.20 C. E(r) = 0.10; Variance = 0.25 D. E(r) = 0.15; Variance = 0.25 E. none of these is dominates the other alternatives. 2. Security X has expected return of 12% and standard deviation of 20%. Security Y has expected return of 15% and standard deviation of 27%. If the two securities have a correlation coefficient of 0.7, what is their covariance?

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

According to the meanvariance criterion the investment that dominates all others is the one t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Physics With An Integrated Approach To Forces And Kinematics

Authors: Alan Giambattista

5th Edition

126054771X, 978-1260547719

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App