Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. According to the profitability index criterion, a project is acceptable if its profitability index is a. greater than 1 plus the cost of capital

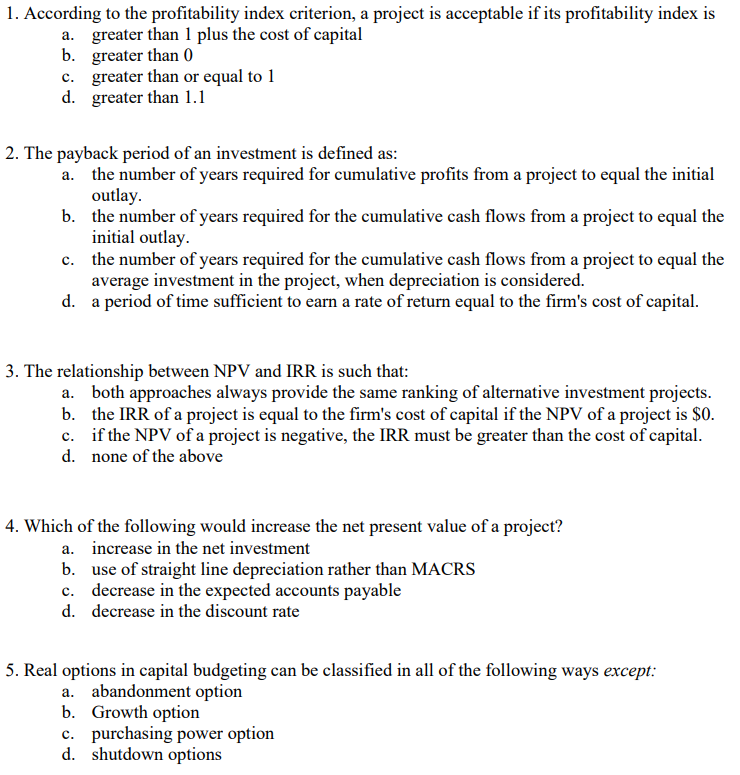

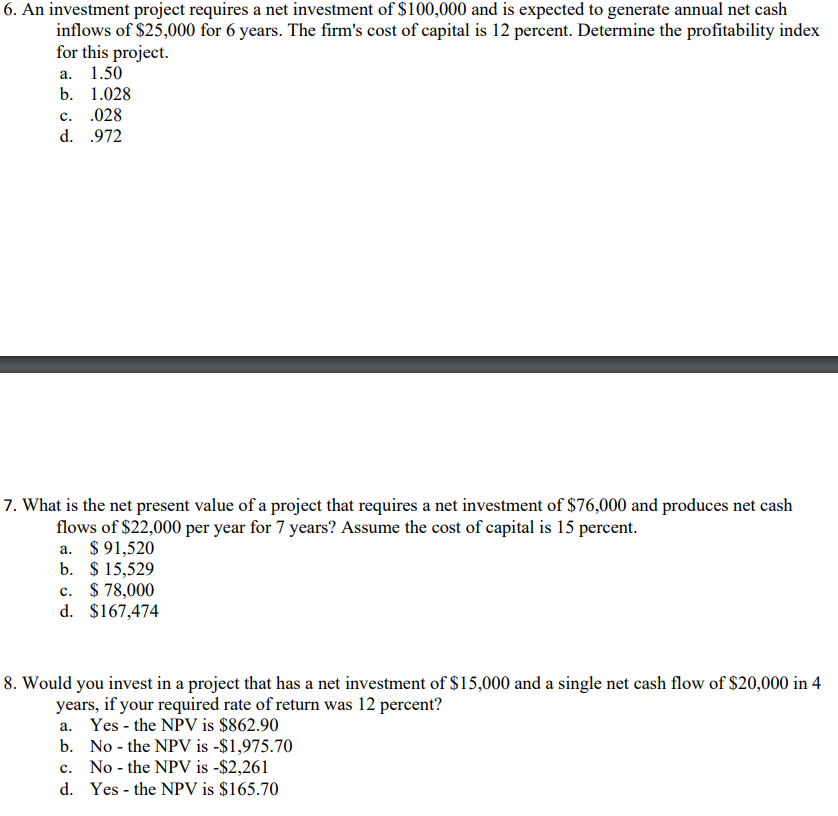

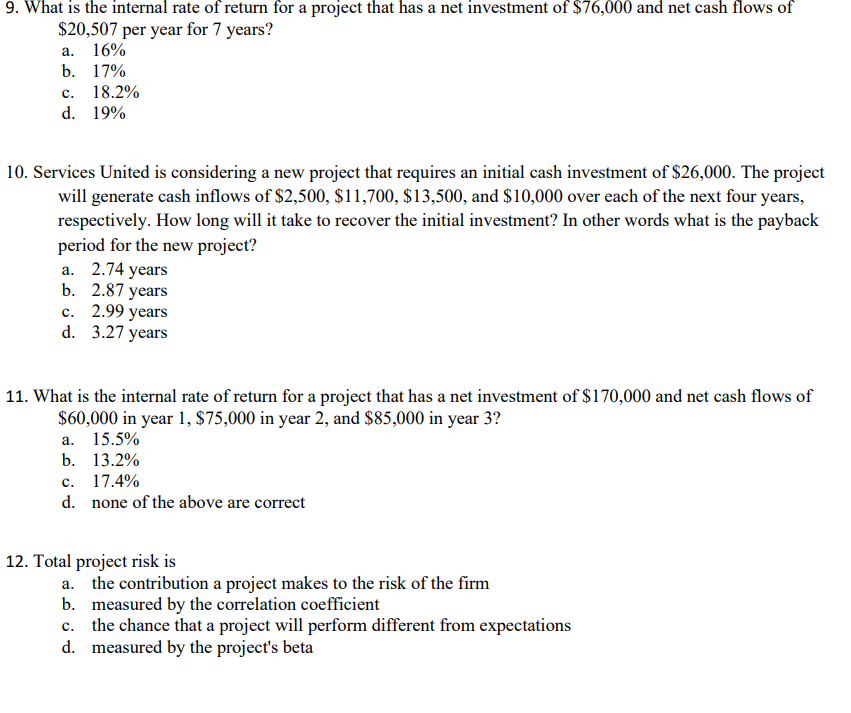

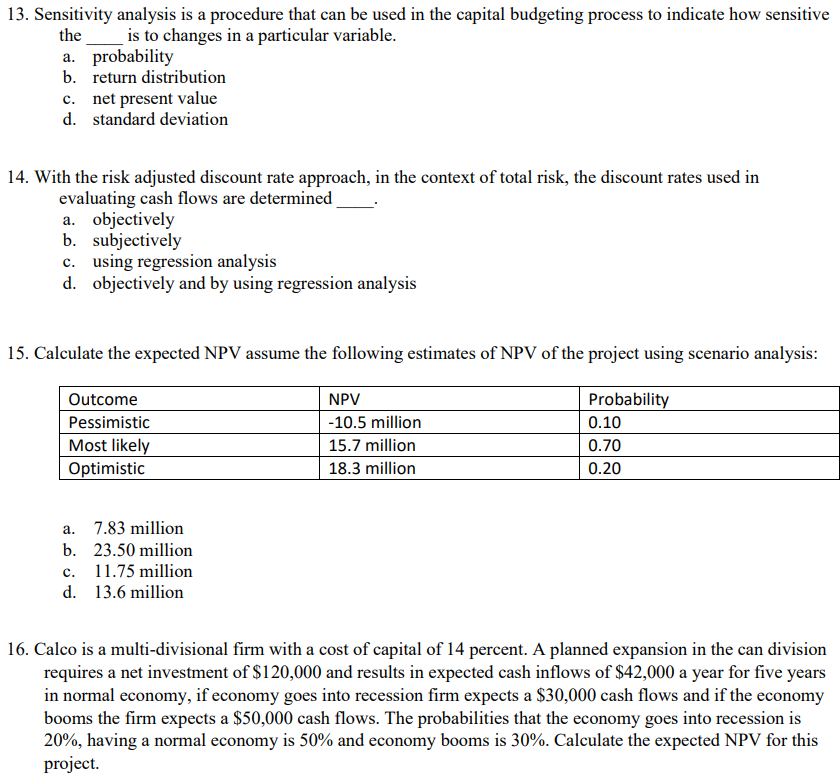

1. According to the profitability index criterion, a project is acceptable if its profitability index is a. greater than 1 plus the cost of capital b. greater than 0 c. greater than or equal to 1 d. greater than 1.1 2. The payback period of an investment is defined as: a. the number of years required for cumulative profits from a project to equal the initial outlay. b. the number of years required for the cumulative cash flows from a project to equal the initial outlay. c. the number of years required for the cumulative cash flows from a project to equal the average investment in the project, when depreciation is considered. d. a period of time sufficient to earn a rate of return equal to the firm's cost of capital. 3. The relationship between NPV and IRR is such that: a. both approaches always provide the same ranking of alternative investment projects. b. the IRR of a project is equal to the firm's cost of capital if the NPV of a project is $0. c. if the NPV of a project is negative, the IRR must be greater than the cost of capital. d. none of the above 4. Which of the following would increase the net present value of a project? a. increase in the net investment b. use of straight line depreciation rather than MACRS c. decrease in the expected accounts payable d. decrease in the discount rate 5. Real options in capital budgeting can be classified in all of the following ways except: a. abandonment option b. Growth option c. purchasing power option d. shutdown options 6. An investment project requires a net investment of $100,000 and is expected to generate annual net cash inflows of $25,000 for 6 years. The firm's cost of capital is 12 percent. Determine the profitability index for this project. a. 1.50 b. 1.028 c. .028 d. .972 7. What is the net present value of a project that requires a net investment of $76,000 and produces net cash flows of $22,000 per year for 7 years? Assume the cost of capital is 15 percent. a. $91,520 b. $15,529 c. $78,000 d. $167,474 8. Would you invest in a project that has a net investment of $15,000 and a single net cash flow of $20,000 in 4 years, if your required rate of return was 12 percent? a. Yes - the NPV is $862.90 b. No - the NPV is $1,975.70 c. No - the NPV is $2,261 d. Yes - the NPV is $165.70 9. What is the internal rate of return for a project that has a net investment of $76,000 and net cash flows of $20,507 per year for 7 years? a. 16% b. 17% c. 18.2% d. 19% 10. Services United is considering a new project that requires an initial cash investment of $26,000. The project will generate cash inflows of $2,500,$11,700,$13,500, and $10,000 over each of the next four years, respectively. How long will it take to recover the initial investment? In other words what is the payback period for the new project? a. 2.74 years b. 2.87 years c. 2.99 years d. 3.27 years 11. What is the internal rate of return for a project that has a net investment of $170,000 and net cash flows of $60,000 in year 1,$75,000 in year 2 , and $85,000 in year 3 ? a. 15.5% b. 13.2% c. 17.4% d. none of the above are correct 12. Total project risk is a. the contribution a project makes to the risk of the firm b. measured by the correlation coefficient c. the chance that a project will perform different from expectations d. measured by the project's beta 13. Sensitivity analysis is a procedure that can be used in the capital budgeting process to indicate how sensitive the is to changes in a particular variable. a. probability b. return distribution c. net present value d. standard deviation 14. With the risk adjusted discount rate approach, in the context of total risk, the discount rates used in evaluating cash flows are determined a. objectively b. subjectively c. using regression analysis d. objectively and by using regression analysis 15. Calculate the expected NPV assume the following estimates of NPV of the project using scenario analysis: a. 7.83 million b. 23.50 million c. 11.75 million d. 13.6 million 16. Calco is a multi-divisional firm with a cost of capital of 14 percent. A planned expansion in the can division requires a net investment of $120,000 and results in expected cash inflows of $42,000 a year for five years in normal economy, if economy goes into recession firm expects a $30,000 cash flows and if the economy booms the firm expects a $50,000 cash flows. The probabilities that the economy goes into recession is 20%, having a normal economy is 50% and economy booms is 30%. Calculate the expected NPV for this project

1. According to the profitability index criterion, a project is acceptable if its profitability index is a. greater than 1 plus the cost of capital b. greater than 0 c. greater than or equal to 1 d. greater than 1.1 2. The payback period of an investment is defined as: a. the number of years required for cumulative profits from a project to equal the initial outlay. b. the number of years required for the cumulative cash flows from a project to equal the initial outlay. c. the number of years required for the cumulative cash flows from a project to equal the average investment in the project, when depreciation is considered. d. a period of time sufficient to earn a rate of return equal to the firm's cost of capital. 3. The relationship between NPV and IRR is such that: a. both approaches always provide the same ranking of alternative investment projects. b. the IRR of a project is equal to the firm's cost of capital if the NPV of a project is $0. c. if the NPV of a project is negative, the IRR must be greater than the cost of capital. d. none of the above 4. Which of the following would increase the net present value of a project? a. increase in the net investment b. use of straight line depreciation rather than MACRS c. decrease in the expected accounts payable d. decrease in the discount rate 5. Real options in capital budgeting can be classified in all of the following ways except: a. abandonment option b. Growth option c. purchasing power option d. shutdown options 6. An investment project requires a net investment of $100,000 and is expected to generate annual net cash inflows of $25,000 for 6 years. The firm's cost of capital is 12 percent. Determine the profitability index for this project. a. 1.50 b. 1.028 c. .028 d. .972 7. What is the net present value of a project that requires a net investment of $76,000 and produces net cash flows of $22,000 per year for 7 years? Assume the cost of capital is 15 percent. a. $91,520 b. $15,529 c. $78,000 d. $167,474 8. Would you invest in a project that has a net investment of $15,000 and a single net cash flow of $20,000 in 4 years, if your required rate of return was 12 percent? a. Yes - the NPV is $862.90 b. No - the NPV is $1,975.70 c. No - the NPV is $2,261 d. Yes - the NPV is $165.70 9. What is the internal rate of return for a project that has a net investment of $76,000 and net cash flows of $20,507 per year for 7 years? a. 16% b. 17% c. 18.2% d. 19% 10. Services United is considering a new project that requires an initial cash investment of $26,000. The project will generate cash inflows of $2,500,$11,700,$13,500, and $10,000 over each of the next four years, respectively. How long will it take to recover the initial investment? In other words what is the payback period for the new project? a. 2.74 years b. 2.87 years c. 2.99 years d. 3.27 years 11. What is the internal rate of return for a project that has a net investment of $170,000 and net cash flows of $60,000 in year 1,$75,000 in year 2 , and $85,000 in year 3 ? a. 15.5% b. 13.2% c. 17.4% d. none of the above are correct 12. Total project risk is a. the contribution a project makes to the risk of the firm b. measured by the correlation coefficient c. the chance that a project will perform different from expectations d. measured by the project's beta 13. Sensitivity analysis is a procedure that can be used in the capital budgeting process to indicate how sensitive the is to changes in a particular variable. a. probability b. return distribution c. net present value d. standard deviation 14. With the risk adjusted discount rate approach, in the context of total risk, the discount rates used in evaluating cash flows are determined a. objectively b. subjectively c. using regression analysis d. objectively and by using regression analysis 15. Calculate the expected NPV assume the following estimates of NPV of the project using scenario analysis: a. 7.83 million b. 23.50 million c. 11.75 million d. 13.6 million 16. Calco is a multi-divisional firm with a cost of capital of 14 percent. A planned expansion in the can division requires a net investment of $120,000 and results in expected cash inflows of $42,000 a year for five years in normal economy, if economy goes into recession firm expects a $30,000 cash flows and if the economy booms the firm expects a $50,000 cash flows. The probabilities that the economy goes into recession is 20%, having a normal economy is 50% and economy booms is 30%. Calculate the expected NPV for this project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started