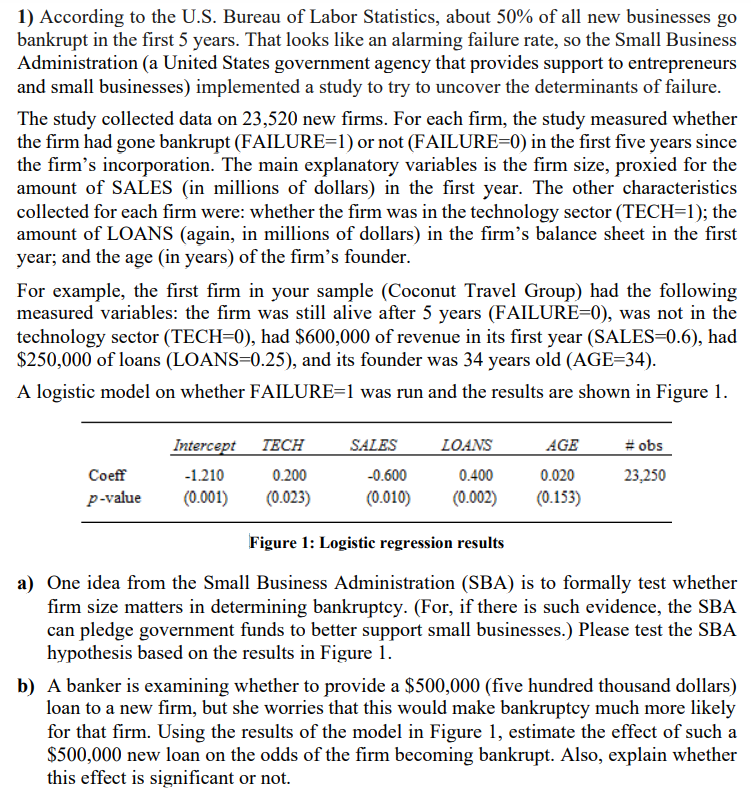

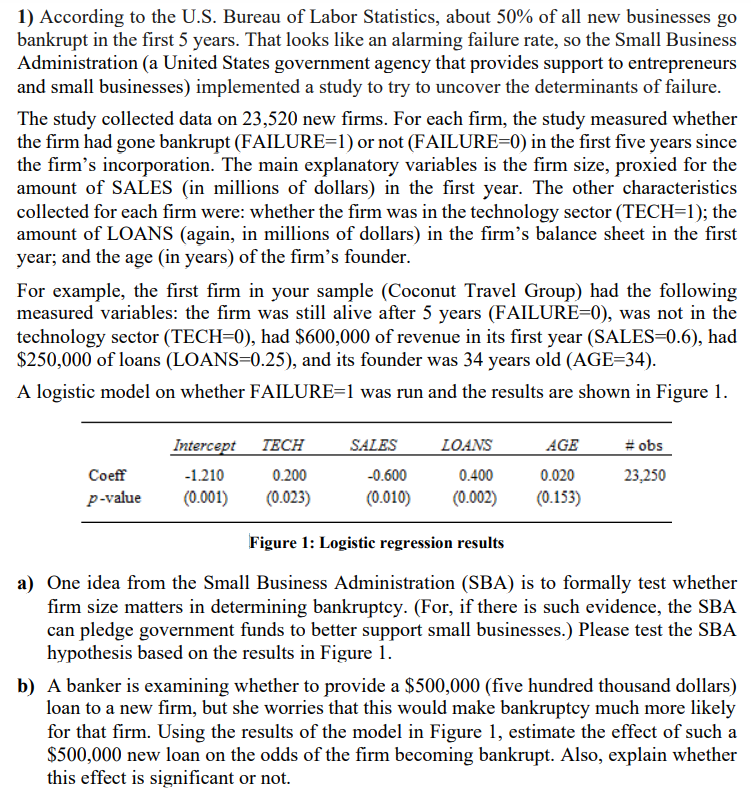

1) According to the U.S. Bureau of Labor Statistics, about 50% of all new businesses go bankrupt in the first 5 years. That looks like an alarming failure rate, so the Small Business Administration (a United States government agency that provides support to entrepreneurs and small businesses) implemented a study to try to uncover the determinants of failure. The study collected data on 23,520 new firms. For each firm, the study measured whether the firm had gone bankrupt (FAILURE=1) or not (FAILURE=0) in the first five years since the firm's incorporation. The main explanatory variables is the firm size, proxied for the amount of SALES (in millions of dollars) in the first year. The other characteristics collected for each firm were: whether the firm was in the technology sector (TECH=1); the amount of LOANS (again, in millions of dollars) in the firm's balance sheet in the first year; and the age (in years) of the firm's founder. For example, the first firm in your sample (Coconut Travel Group) had the following measured variables: the firm was still alive after 5 years (FAILURE=0), was not in the technology sector (TECH=0), had $600,000 of revenue in its first year (SALES=0.6), had $250,000 of loans (LOANS=0.25), and its founder was 34 years old (AGE=34). A logistic model on whether FAILURE=1 was run and the results are shown in Figure 1. TECH SALES LOANS AGE #obs Intercept -1.210 (0.001) Coeff p-value 23,250 0.200 (0.023) -0.600 (0.010) 0.400 (0.002) 0.020 (0.153) Figure 1: Logistic regression results a) One idea from the Small Business Administration (SBA) is to formally test whether firm size matters in determining bankruptcy. (For, if there is such evidence, the SBA can pledge government funds to better support small businesses.) Please test the SBA hypothesis based on the results in Figure 1. b) A banker is examining whether to provide a $500,000 (five hundred thousand dollars) loan to a new firm, but she worries that this would make bankruptcy much more likely for that firm. Using the results of the model in Figure 1, estimate the effect of such a $500,000 new loan on the odds of the firm becoming bankrupt. Also, explain whether this effect is significant or not. 1) According to the U.S. Bureau of Labor Statistics, about 50% of all new businesses go bankrupt in the first 5 years. That looks like an alarming failure rate, so the Small Business Administration (a United States government agency that provides support to entrepreneurs and small businesses) implemented a study to try to uncover the determinants of failure. The study collected data on 23,520 new firms. For each firm, the study measured whether the firm had gone bankrupt (FAILURE=1) or not (FAILURE=0) in the first five years since the firm's incorporation. The main explanatory variables is the firm size, proxied for the amount of SALES (in millions of dollars) in the first year. The other characteristics collected for each firm were: whether the firm was in the technology sector (TECH=1); the amount of LOANS (again, in millions of dollars) in the firm's balance sheet in the first year; and the age (in years) of the firm's founder. For example, the first firm in your sample (Coconut Travel Group) had the following measured variables: the firm was still alive after 5 years (FAILURE=0), was not in the technology sector (TECH=0), had $600,000 of revenue in its first year (SALES=0.6), had $250,000 of loans (LOANS=0.25), and its founder was 34 years old (AGE=34). A logistic model on whether FAILURE=1 was run and the results are shown in Figure 1. TECH SALES LOANS AGE #obs Intercept -1.210 (0.001) Coeff p-value 23,250 0.200 (0.023) -0.600 (0.010) 0.400 (0.002) 0.020 (0.153) Figure 1: Logistic regression results a) One idea from the Small Business Administration (SBA) is to formally test whether firm size matters in determining bankruptcy. (For, if there is such evidence, the SBA can pledge government funds to better support small businesses.) Please test the SBA hypothesis based on the results in Figure 1. b) A banker is examining whether to provide a $500,000 (five hundred thousand dollars) loan to a new firm, but she worries that this would make bankruptcy much more likely for that firm. Using the results of the model in Figure 1, estimate the effect of such a $500,000 new loan on the odds of the firm becoming bankrupt. Also, explain whether this effect is significant or not