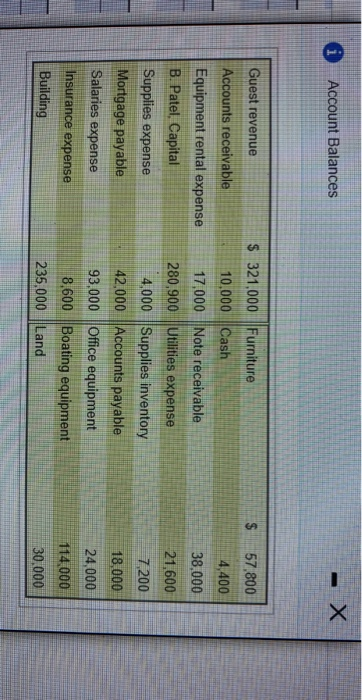

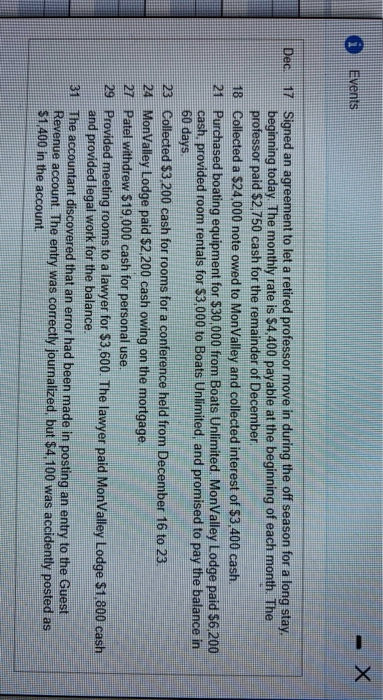

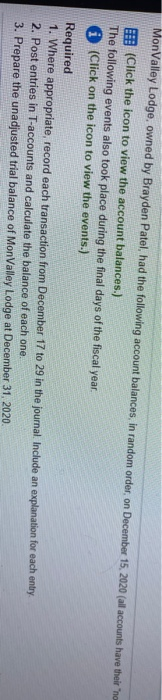

1 Account Balances - x Guest revenue $ 57,800 Accounts receivable 4,400 38,000 Equipment rental expense B. Patel, Capital Supplies expense Mortgage payable Salaries expense Insurance expense Building $ 321,000 Furniture 10,000 Cash 17,000 Note receivable 280,900 Utilities expense 4,000 Supplies inventory 42,000 Accounts payable 93,000 Office equipment 8,600 Boating equipment 235,000 Land 21,600 7,200 18,000 24,000 114.000 30.000 A Events Dec 17 Signed an agreement to let a retired professor move in during the off season for a long stay. beginning today. The monthly rate is $4.400 payable at the beginning of each month. The professor paid $2,750 cash for the remainder of December 18 Collected a $24,000 note owed to MonValley and collected interest of $3,400 cash. 21 Purchased boating equipment for $30,000 from Boats Unlimited MonValley Lodge paid $6,200 cash, provided room rentals for $3,000 to Boats Unlimited, and promised to pay the balance in 60 days 23 Collected $3,200 cash for rooms for a conference held from December 16 to 23. 24. MonValley Lodge paid $2,200 cash owing on the mortgage. 27 Patel withdrew $19,000 cash for personal use. 29 Provided meeting rooms to a lawyer for $3,600. The lawyer paid MonValley Lodge $1,800 cash and provided legal work for the balance. 31 The accountant discovered that an error had been made in posting an entry to the Guest Revenue account. The entry was correctly journalized, but $4,100 was accidently posted as $1,400 in the account. MonValley Lodge, owned by Brayden Patel, had the following account balances, in random order, on December 15, 2020 (all accounts have their "no F (Click the icon to view the account balances.) The following events also took place during the final days of the fiscal year, (Click on the icon to view the events.) Required 1. Where appropriate, record each transaction from December 17 to 29 in the journal. Include an explanation for each entry. 2. Post entries in T-accounts and calculate the balance of each one. 3. Prepare the unadjusted trial balance of MonValley Lodge at December 31, 2020 1 Account Balances - x Guest revenue $ 57,800 Accounts receivable 4,400 38,000 Equipment rental expense B. Patel, Capital Supplies expense Mortgage payable Salaries expense Insurance expense Building $ 321,000 Furniture 10,000 Cash 17,000 Note receivable 280,900 Utilities expense 4,000 Supplies inventory 42,000 Accounts payable 93,000 Office equipment 8,600 Boating equipment 235,000 Land 21,600 7,200 18,000 24,000 114.000 30.000 A Events Dec 17 Signed an agreement to let a retired professor move in during the off season for a long stay. beginning today. The monthly rate is $4.400 payable at the beginning of each month. The professor paid $2,750 cash for the remainder of December 18 Collected a $24,000 note owed to MonValley and collected interest of $3,400 cash. 21 Purchased boating equipment for $30,000 from Boats Unlimited MonValley Lodge paid $6,200 cash, provided room rentals for $3,000 to Boats Unlimited, and promised to pay the balance in 60 days 23 Collected $3,200 cash for rooms for a conference held from December 16 to 23. 24. MonValley Lodge paid $2,200 cash owing on the mortgage. 27 Patel withdrew $19,000 cash for personal use. 29 Provided meeting rooms to a lawyer for $3,600. The lawyer paid MonValley Lodge $1,800 cash and provided legal work for the balance. 31 The accountant discovered that an error had been made in posting an entry to the Guest Revenue account. The entry was correctly journalized, but $4,100 was accidently posted as $1,400 in the account. MonValley Lodge, owned by Brayden Patel, had the following account balances, in random order, on December 15, 2020 (all accounts have their "no F (Click the icon to view the account balances.) The following events also took place during the final days of the fiscal year, (Click on the icon to view the events.) Required 1. Where appropriate, record each transaction from December 17 to 29 in the journal. Include an explanation for each entry. 2. Post entries in T-accounts and calculate the balance of each one. 3. Prepare the unadjusted trial balance of MonValley Lodge at December 31, 2020