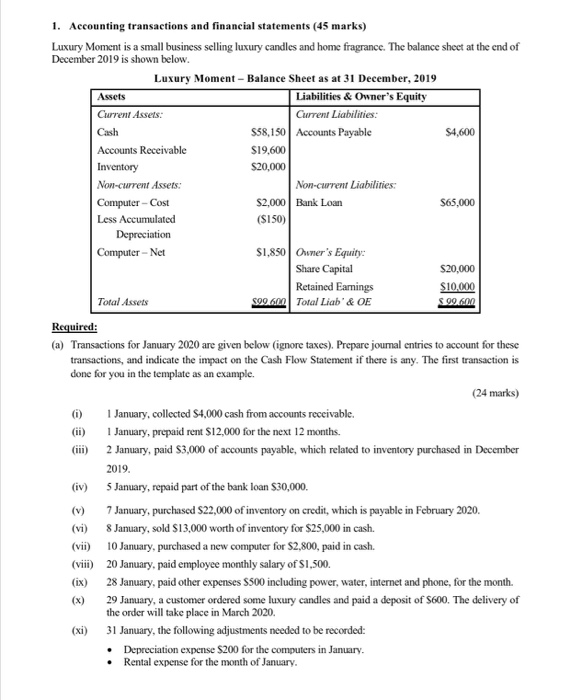

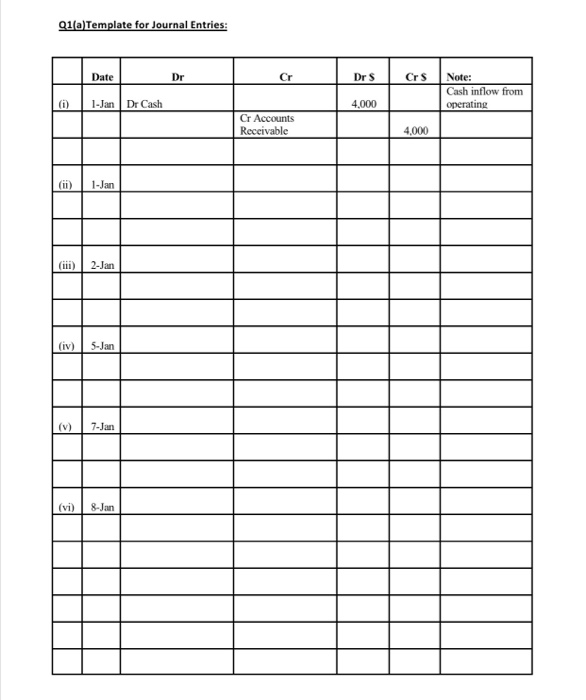

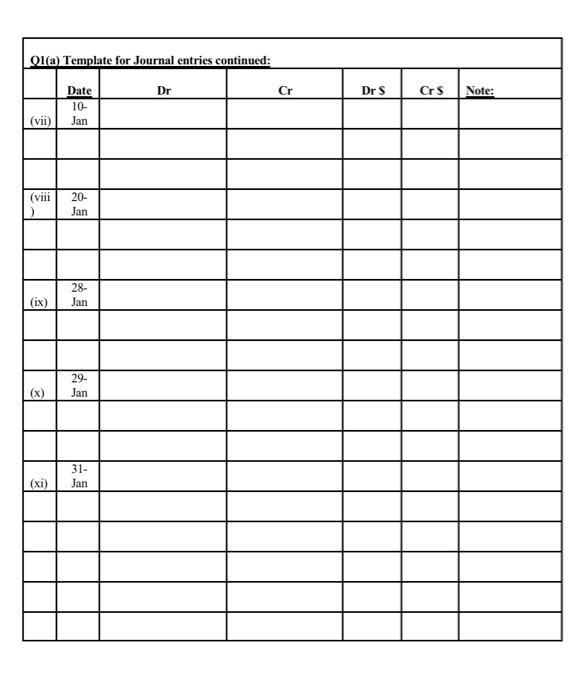

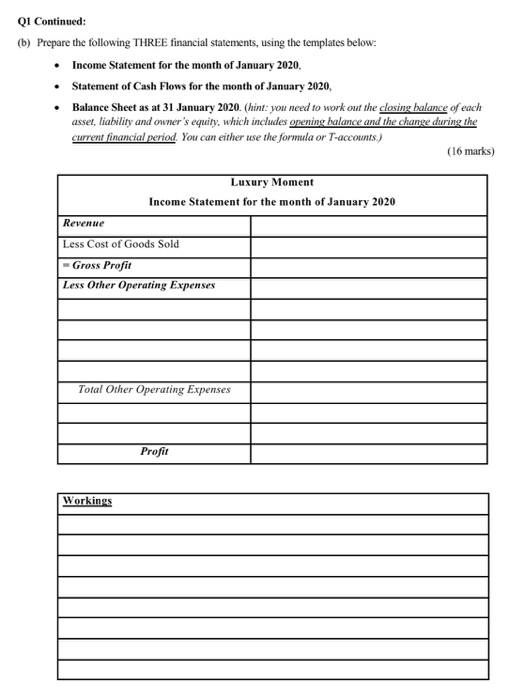

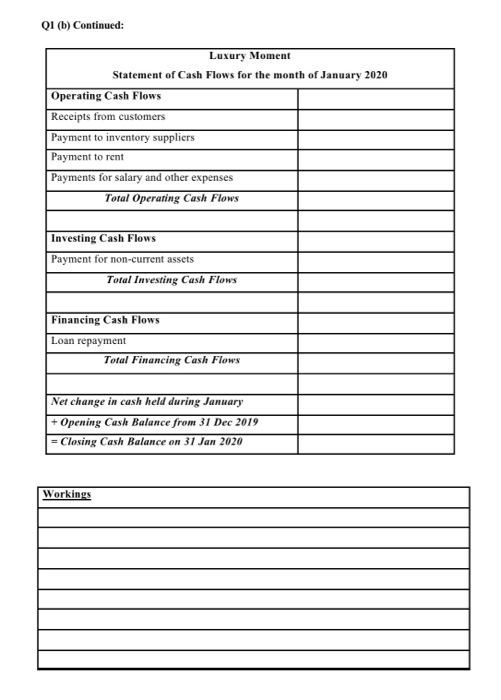

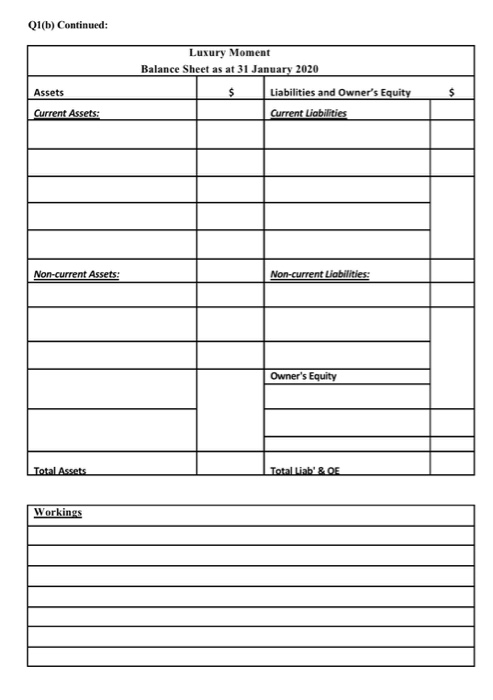

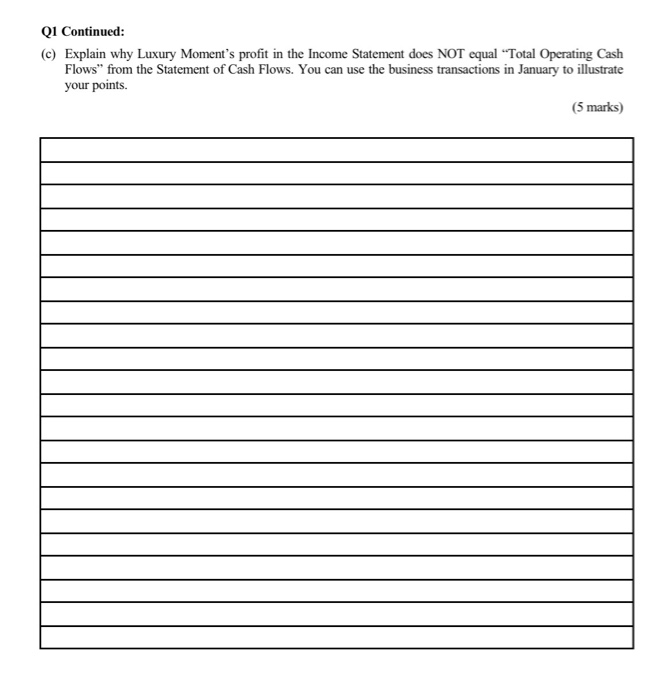

1. Accounting transactions and financial statements (45 marks) Luxury Moment is a small business selling luxury candles and home fragrance. The balance sheet at the end of December 2019 is shown below. Luxury Moment - Balance Sheet as at 31 December, 2019 Assets Liabilities & Owner's Equity Current Assets: Current Liabilities: Cash $58,150 Accounts Payable $4,600 Accounts Receivable $19,600 Inventory $20,000 Non-current Assets: Non-current Liabilities: Computer - Cost $2,000 Bank Loan $65,000 Less Accumulated ($150) Depreciation Computer - Net $1,850 Owner's Equity Share Capital $20,000 Retained Earnings $10,000 Total Assets 500.6L Total Liab' & OE $99.60 Required: (a) Transactions for January 2020 are given below (ignore taxes). Prepare journal entries to account for these transactions, and indicate the impact on the Cash Flow Statement if there is any. The first transaction is done for you in the template as an example. (24 marks) 1 January, collected $4,000 cash from accounts receivable. 1 January, prepaid rent $12,000 for the next 12 months. 2 January, paid $3,000 of accounts payable, which related to inventory purchased in December 2019. 5 January, repaid part of the bank loan $30,000. (v) 7 January, purchased $22,000 of inventory on credit, which is payable in February 2020. (vi) 8 January, sold $13,000 worth of inventory for $25,000 in cash. (vii) 10 January, purchased a new computer for $2,800, paid in cash. (viii) 20 January, paid employee monthly salary of $1,500. 28 January, paid other expenses S500 including power, water, internet and phone, for the month. 29 January, a customer ordered some luxury candles and paid a deposit of S600. The delivery of the order will take place in March 2020. (xi) 31 January, the following adjustments needed to be recorded: Depreciation expense S200 for the computers in January Rental expense for the month of January. Q1(a)Template for Journal Entries: Date Dr Cr Drs Crs Note: Cash inflow from operating (i) 1-Jan Dr Cash 4.000 Cr Accounts Receivable 4,000 1 - Jan (1 ) 2. Jan 5.Jan (V) 7-Jan (vi) 8-Jan Q1(a) Template for Journal entries continued: Date Note: 10- (vii) Jan Jan 1 TTTT (xi) Jan Q1 Continued: (b) Prepare the following THREE financial statements, using the templates below: Income Statement for the month of January 2020, Statement of Cash Flows for the month of January 2020, asset, liability and owner's equity, which includes opening balance and the change during the current financial period. You can either use the formula or T-accounts) (16 marks) Luxury Moment Income Statement for the month of January 2020 Revenue Less Cost of Goods Sold -Gross Profit Less Other Operating Expenses Total Other Operating Expenses Profit Q1 (b) Continued: Luxury Moment Statement of Cash Flows for the month of January 2020 Operating Cash Flows Receipts from customers Payment to inventory suppliers Payment to rent Payments for salary and other expenses Total Operating Cash Flows Investing Cash Flows Payment for non-current assets Total Investing Cash Flows Financing Cash Flows Loan repayment Total Financing Cash Flows Net change in cash held during January + Opening Cash Balance from 31 Dec 2019 - Closing Cash Balance on 31 Jan 2020 Workings Q1(b) Continued: Luxury Moment Balance Sheet as at 31 January 2020 Assets Liabilities and Owner's Equity Current Liabilities Current Assets: Non-current Assets: Non-current Liabilities: Owner's Equity Total Assets Total Liab' & OE Workings Q1 Continued: (c) Explain why Luxury Moment's profit in the Income Statement does NOT equal "Total Operating Cash Flows" from the Statement of Cash Flows. You can use the business transactions in January to illustrate your points