Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short

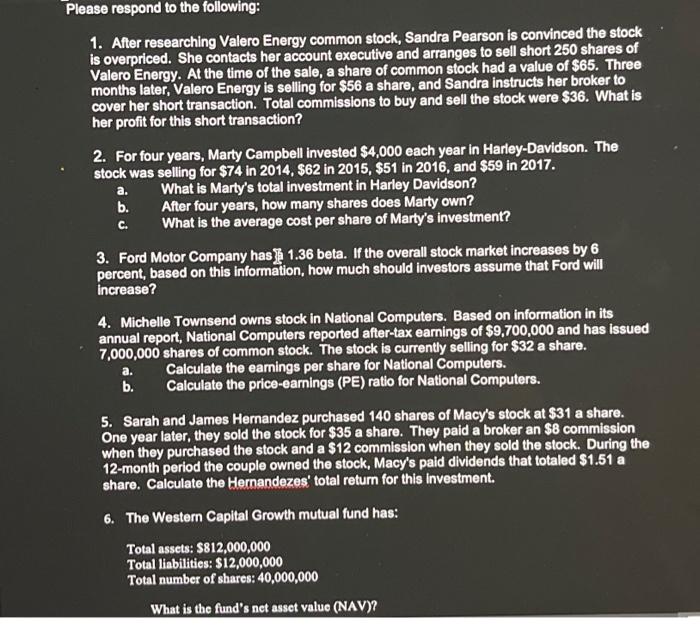

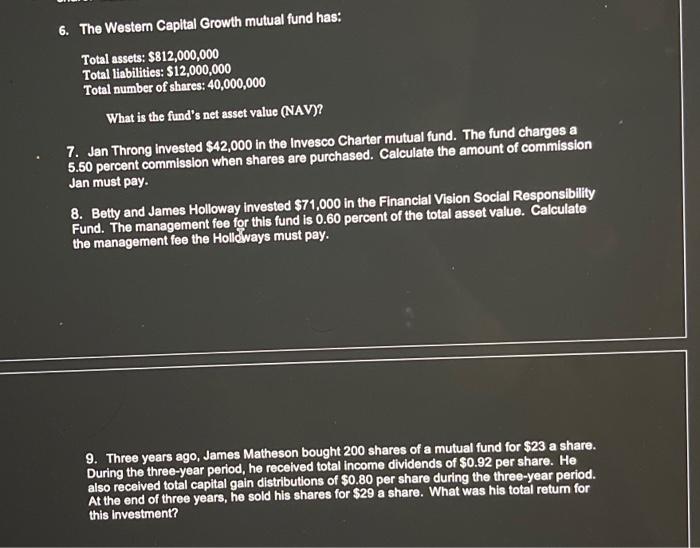

1. After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 250 shares of Valero Energy. At the time of the sale, a share of common stock had a value of $65. Three months later, Valero Energy is selling for $56 a share, and Sandra instructs her broker to cover her short transaction. Total commissions to buy and sell the stock were \$36. What is her profit for this short transaction? 2. For four years, Marty Campbell invested $4,000 each year in Harley-Davidson. The stock was selling for $74 in 2014, $62 in 2015 , $51 in 2016, and $59 in 2017. a. What is Marty's total investment in Harley Davidson? b. After four years, how many shares does Marty own? c. What is the average cost per share of Marty's investment? 3. Ford Motor Company has 1.36 beta. If the overall stock market increases by 6 percent, based on this information, how much should investors assume that Ford will increase? 4. Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers reported after-tax earnings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a share. a. Calculate the eamings per share for National Computers. b. Calculate the price-earnings (PE) ratio for National Computers. 5. Sarah and James Hemandez purchased 140 shares of Macy's stock at $31 a share. One year later, they sold the stock for $35 a share. They paid a broker an $8 commission when they purchased the stock and a $12 commission when they sold the stock. During the 12-month period the couple owned the stock, Macy's paid dividends that totaled $1.51 a share. Calculate the Hernandezes' total retum for this investment. 6. The Western Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 6. The Westem Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 7. Jan Throng invested $42,000 in the Invesco Charter mutual fund. The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Jan must pay. 8. Betty and James Holloway invested $71,000 in the Financial Vision Social Responsibility Fund. The management fee for this fund is 0.60 percent of the total asset value. Calculate the management fee the Holldways must pay. 9. Three years ago, James Matheson bought 200 shares of a mutual fund for $23 a share. During the three-year period, he received total income dividends of $0.92 per share. He also received total capital gain distributions of $0.80 per share during the three-year period. At the end of three years, he sold his shares for $29 a share. What was his total retum for this investment? 1. After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 250 shares of Valero Energy. At the time of the sale, a share of common stock had a value of $65. Three months later, Valero Energy is selling for $56 a share, and Sandra instructs her broker to cover her short transaction. Total commissions to buy and sell the stock were \$36. What is her profit for this short transaction? 2. For four years, Marty Campbell invested $4,000 each year in Harley-Davidson. The stock was selling for $74 in 2014, $62 in 2015 , $51 in 2016, and $59 in 2017. a. What is Marty's total investment in Harley Davidson? b. After four years, how many shares does Marty own? c. What is the average cost per share of Marty's investment? 3. Ford Motor Company has 1.36 beta. If the overall stock market increases by 6 percent, based on this information, how much should investors assume that Ford will increase? 4. Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers reported after-tax earnings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a share. a. Calculate the eamings per share for National Computers. b. Calculate the price-earnings (PE) ratio for National Computers. 5. Sarah and James Hemandez purchased 140 shares of Macy's stock at $31 a share. One year later, they sold the stock for $35 a share. They paid a broker an $8 commission when they purchased the stock and a $12 commission when they sold the stock. During the 12-month period the couple owned the stock, Macy's paid dividends that totaled $1.51 a share. Calculate the Hernandezes' total retum for this investment. 6. The Western Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 6. The Westem Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 7. Jan Throng invested $42,000 in the Invesco Charter mutual fund. The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Jan must pay. 8. Betty and James Holloway invested $71,000 in the Financial Vision Social Responsibility Fund. The management fee for this fund is 0.60 percent of the total asset value. Calculate the management fee the Holldways must pay. 9. Three years ago, James Matheson bought 200 shares of a mutual fund for $23 a share. During the three-year period, he received total income dividends of $0.92 per share. He also received total capital gain distributions of $0.80 per share during the three-year period. At the end of three years, he sold his shares for $29 a share. What was his total retum for this investment

1. After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 250 shares of Valero Energy. At the time of the sale, a share of common stock had a value of $65. Three months later, Valero Energy is selling for $56 a share, and Sandra instructs her broker to cover her short transaction. Total commissions to buy and sell the stock were \$36. What is her profit for this short transaction? 2. For four years, Marty Campbell invested $4,000 each year in Harley-Davidson. The stock was selling for $74 in 2014, $62 in 2015 , $51 in 2016, and $59 in 2017. a. What is Marty's total investment in Harley Davidson? b. After four years, how many shares does Marty own? c. What is the average cost per share of Marty's investment? 3. Ford Motor Company has 1.36 beta. If the overall stock market increases by 6 percent, based on this information, how much should investors assume that Ford will increase? 4. Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers reported after-tax earnings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a share. a. Calculate the eamings per share for National Computers. b. Calculate the price-earnings (PE) ratio for National Computers. 5. Sarah and James Hemandez purchased 140 shares of Macy's stock at $31 a share. One year later, they sold the stock for $35 a share. They paid a broker an $8 commission when they purchased the stock and a $12 commission when they sold the stock. During the 12-month period the couple owned the stock, Macy's paid dividends that totaled $1.51 a share. Calculate the Hernandezes' total retum for this investment. 6. The Western Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 6. The Westem Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 7. Jan Throng invested $42,000 in the Invesco Charter mutual fund. The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Jan must pay. 8. Betty and James Holloway invested $71,000 in the Financial Vision Social Responsibility Fund. The management fee for this fund is 0.60 percent of the total asset value. Calculate the management fee the Holldways must pay. 9. Three years ago, James Matheson bought 200 shares of a mutual fund for $23 a share. During the three-year period, he received total income dividends of $0.92 per share. He also received total capital gain distributions of $0.80 per share during the three-year period. At the end of three years, he sold his shares for $29 a share. What was his total retum for this investment? 1. After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 250 shares of Valero Energy. At the time of the sale, a share of common stock had a value of $65. Three months later, Valero Energy is selling for $56 a share, and Sandra instructs her broker to cover her short transaction. Total commissions to buy and sell the stock were \$36. What is her profit for this short transaction? 2. For four years, Marty Campbell invested $4,000 each year in Harley-Davidson. The stock was selling for $74 in 2014, $62 in 2015 , $51 in 2016, and $59 in 2017. a. What is Marty's total investment in Harley Davidson? b. After four years, how many shares does Marty own? c. What is the average cost per share of Marty's investment? 3. Ford Motor Company has 1.36 beta. If the overall stock market increases by 6 percent, based on this information, how much should investors assume that Ford will increase? 4. Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers reported after-tax earnings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a share. a. Calculate the eamings per share for National Computers. b. Calculate the price-earnings (PE) ratio for National Computers. 5. Sarah and James Hemandez purchased 140 shares of Macy's stock at $31 a share. One year later, they sold the stock for $35 a share. They paid a broker an $8 commission when they purchased the stock and a $12 commission when they sold the stock. During the 12-month period the couple owned the stock, Macy's paid dividends that totaled $1.51 a share. Calculate the Hernandezes' total retum for this investment. 6. The Western Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 6. The Westem Capital Growth mutual fund has: Total assets: $812,000,000 Total liabilities: $12,000,000 Total number of shares: 40,000,000 What is the fund's net asset value (NAV)? 7. Jan Throng invested $42,000 in the Invesco Charter mutual fund. The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Jan must pay. 8. Betty and James Holloway invested $71,000 in the Financial Vision Social Responsibility Fund. The management fee for this fund is 0.60 percent of the total asset value. Calculate the management fee the Holldways must pay. 9. Three years ago, James Matheson bought 200 shares of a mutual fund for $23 a share. During the three-year period, he received total income dividends of $0.92 per share. He also received total capital gain distributions of $0.80 per share during the three-year period. At the end of three years, he sold his shares for $29 a share. What was his total retum for this investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started