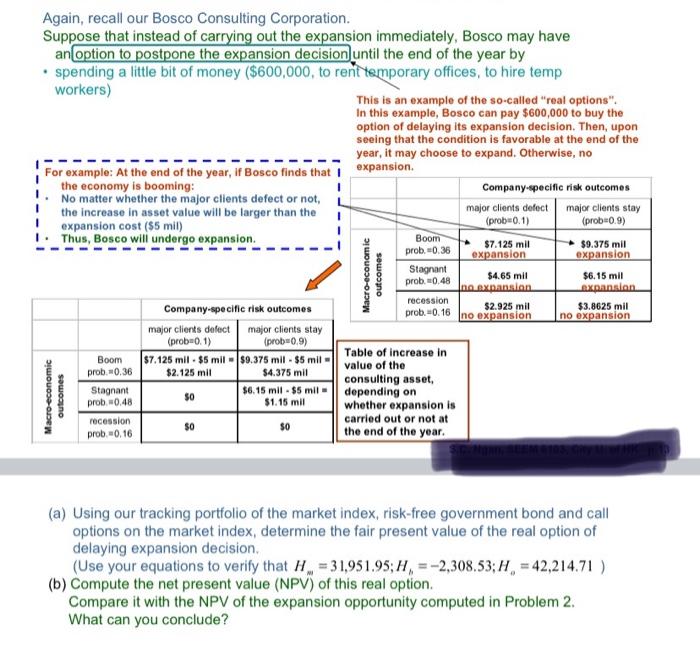

1 Again, recall our Bosco Consulting Corporation. Suppose that instead of carrying out the expansion immediately, Bosco may have an option to postpone the expansion decision until the end of the year by spending a little bit of money ($600,000, to rent temporary offices, to hire temp workers) This is an example of the so-called "real options". In this example, Bosco can pay $600,000 to buy the option of delaying its expansion decision. Then, upon seeing that the condition is favorable at the end of the year, it may choose to expand. Otherwise, no For example: At the end of the year, if Bosco finds that expansion. the economy is booming: 1. Company specific risk outcomes No matter whether the major clients defect or not, i ! the increase in asset value will be larger than the major clients defect major clients stay expansion cost ($5 mil) (prob0.1) (prob0.9) 1. Thus, Bosco will undergo expansion $7.125 mil prob. 0.36 expansion expansion Stagnant $4.65 mil $6.15 mil no expansion expansion recession Company-specific risk outcomes $2.925 mil $3.8625 mil prob.0.16 no expansion no expansion major clients defect major clients stay (prob=0.1) (prob=0.9) 7.125 mil - $5 mil - 59.375 mil - $5 mil- Table of increase in prob.0.36 $2.125 mil $4.375 mil value of the consulting asset Stagnant $6.15 mil - $5 mil || depending on prob.0.48 $1.15 mil whether expansion is recession carried out or not at $0 $0 prob. 0.16 the end of the year. Boom $9.375 mil Macro-economic outcomes prob. 0.48 Boom Macro-economic outcomes $0 (a) Using our tracking portfolio of the market index, risk-free government bond and call options on the market index, determine the fair present value of the real option of delaying expansion decision (Use your equations to verify that H. = 31,951.95; H, = -2,308.53; H, = 42,214.71 ) (b) Compute the net present value (NPV) of this real option. Compare it with the NPV of the expansion opportunity computed in Problem 2. What can you conclude? 1 Again, recall our Bosco Consulting Corporation. Suppose that instead of carrying out the expansion immediately, Bosco may have an option to postpone the expansion decision until the end of the year by spending a little bit of money ($600,000, to rent temporary offices, to hire temp workers) This is an example of the so-called "real options". In this example, Bosco can pay $600,000 to buy the option of delaying its expansion decision. Then, upon seeing that the condition is favorable at the end of the year, it may choose to expand. Otherwise, no For example: At the end of the year, if Bosco finds that expansion. the economy is booming: 1. Company specific risk outcomes No matter whether the major clients defect or not, i ! the increase in asset value will be larger than the major clients defect major clients stay expansion cost ($5 mil) (prob0.1) (prob0.9) 1. Thus, Bosco will undergo expansion $7.125 mil prob. 0.36 expansion expansion Stagnant $4.65 mil $6.15 mil no expansion expansion recession Company-specific risk outcomes $2.925 mil $3.8625 mil prob.0.16 no expansion no expansion major clients defect major clients stay (prob=0.1) (prob=0.9) 7.125 mil - $5 mil - 59.375 mil - $5 mil- Table of increase in prob.0.36 $2.125 mil $4.375 mil value of the consulting asset Stagnant $6.15 mil - $5 mil || depending on prob.0.48 $1.15 mil whether expansion is recession carried out or not at $0 $0 prob. 0.16 the end of the year. Boom $9.375 mil Macro-economic outcomes prob. 0.48 Boom Macro-economic outcomes $0 (a) Using our tracking portfolio of the market index, risk-free government bond and call options on the market index, determine the fair present value of the real option of delaying expansion decision (Use your equations to verify that H. = 31,951.95; H, = -2,308.53; H, = 42,214.71 ) (b) Compute the net present value (NPV) of this real option. Compare it with the NPV of the expansion opportunity computed in Problem 2. What can you conclude