Answered step by step

Verified Expert Solution

Question

1 Approved Answer

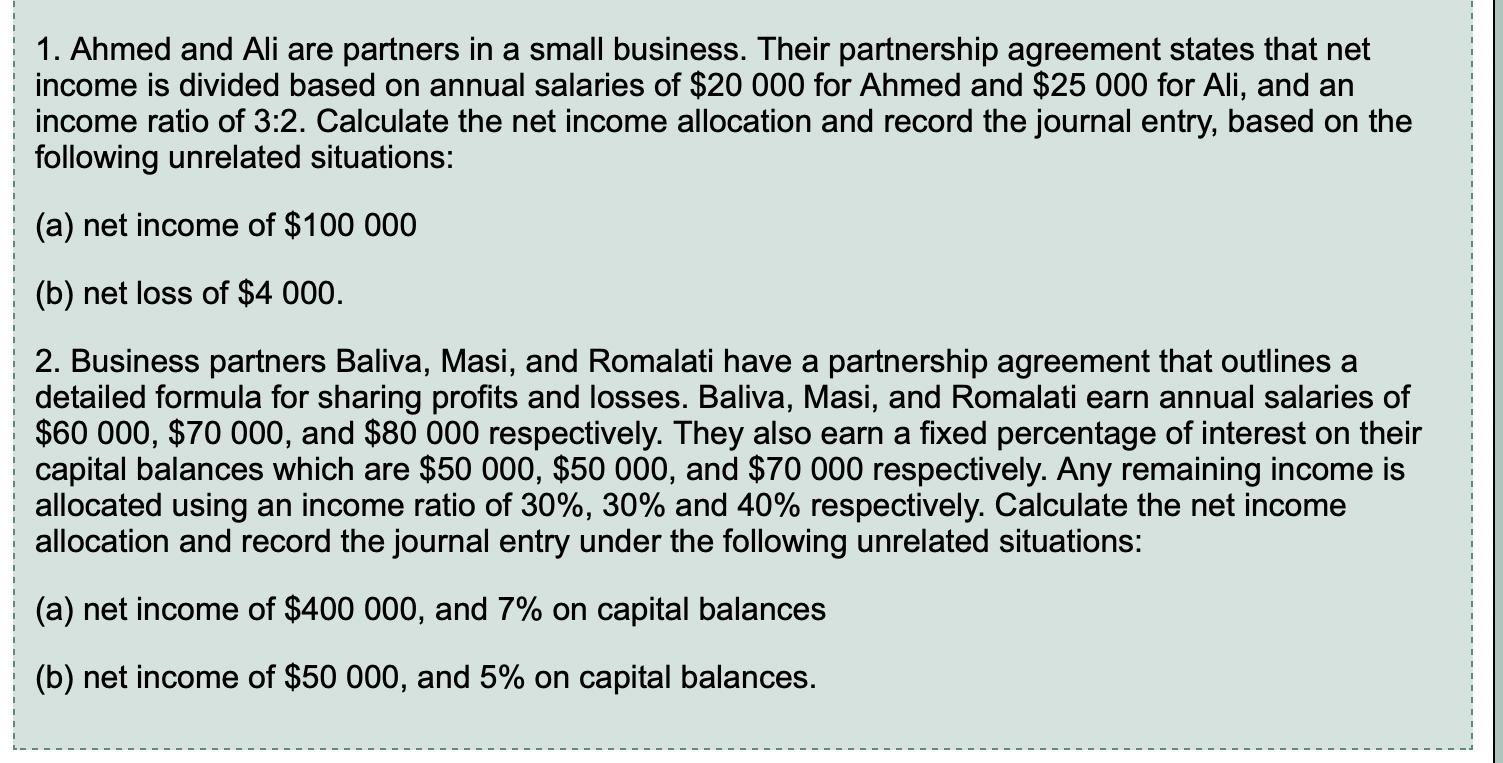

1. Ahmed and Ali are partners in a small business. Their partnership agreement states that net income is divided based on annual salaries of

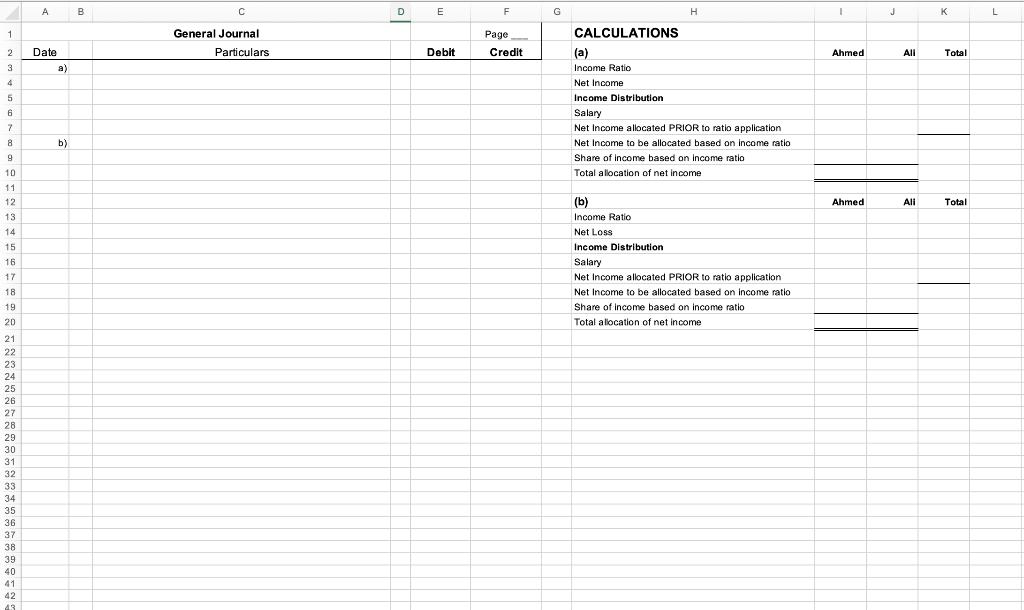

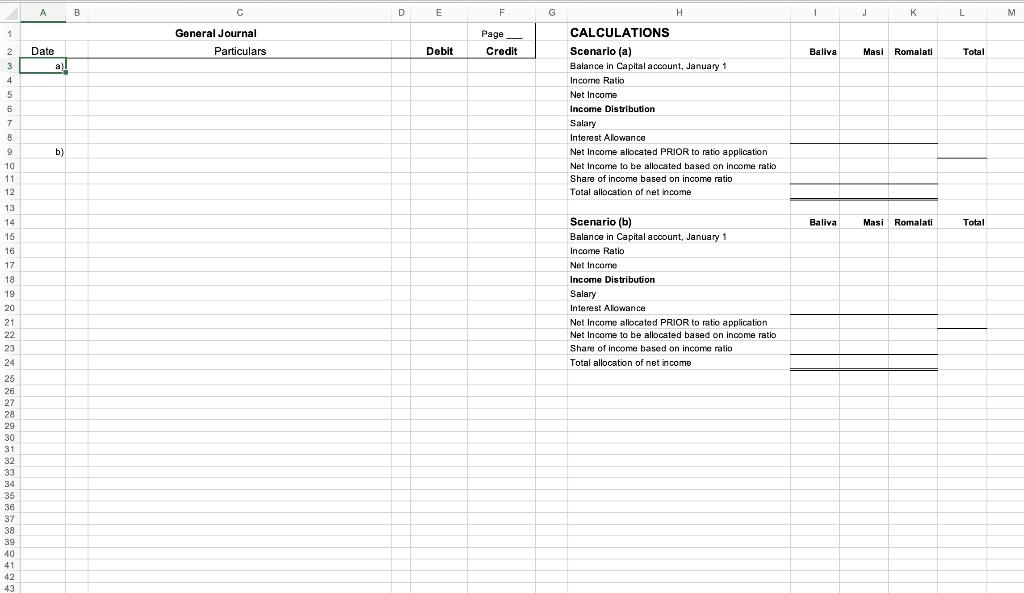

1. Ahmed and Ali are partners in a small business. Their partnership agreement states that net income is divided based on annual salaries of $20 000 for Ahmed and $25 000 for Ali, and an income ratio of 3:2. Calculate the net income allocation and record the journal entry, based on the following unrelated situations: (a) net income of $100 000 (b) net loss of $4 000. 2. Business partners Baliva, Masi, and Romalati have a partnership agreement that outlines a detailed formula for sharing profits and losses. Baliva, Masi, and Romalati earn annual salaries of $60 000, $70 000, and $80 000 respectively. They also earn a fixed percentage of interest on their capital balances which are $50 000, $50 000, and $70 000 respectively. Any remaining income is allocated using an income ratio of 30%, 30% and 40% respectively. Calculate the net income allocation and record the journal entry under the following unrelated situations: (a) net income of $400 000, and 7% on capital balances (b) net income of $50 000, and 5% on capital balances. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 A Date a) b) B C General Journal Particulars D E Debit F Page Credit G H CALCULATIONS (a) Income Ratio Net Income Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income (b) Income Ratio Net Loss Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income 1 Ahmed Ahmed All Ali K Total Total L 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 A Date a) b) B General Journal Particulars D E Debit F Page Credit G H CALCULATIONS Scenario (a) Balance in Capital account, January 1 Income Ratio Net Income Income Distribution Salary Interest Allowance Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income Scenario (b) Balance in Capital account, January 1 Income Ratio Net Income Income Distribution Salary Interest Allowance Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income 1 Baliva Balival J K Masi Romalati Masi Romalati L Total Total M

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Ahmed Ali Total Income ratio 35 25 55 Net income 100000 Income Distributi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started