Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2019, Jason and Vicki Hurting, who are married with two children and filing jointly, had the following tax information. Jason owns a cash-basis

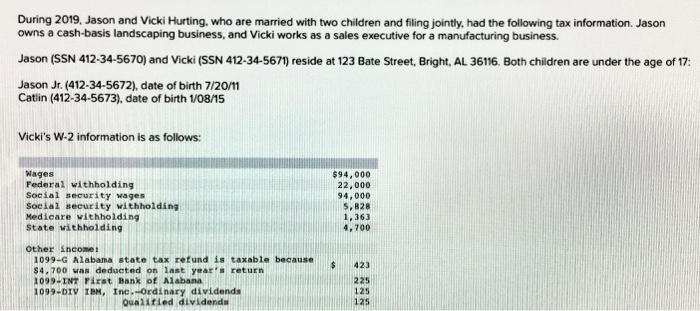

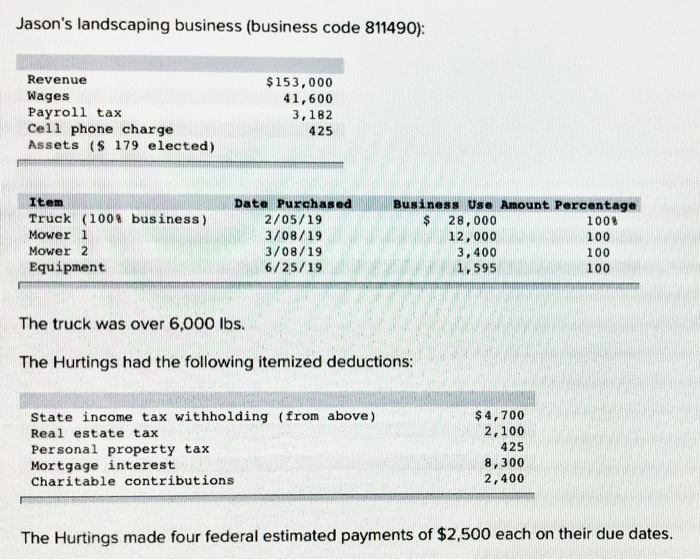

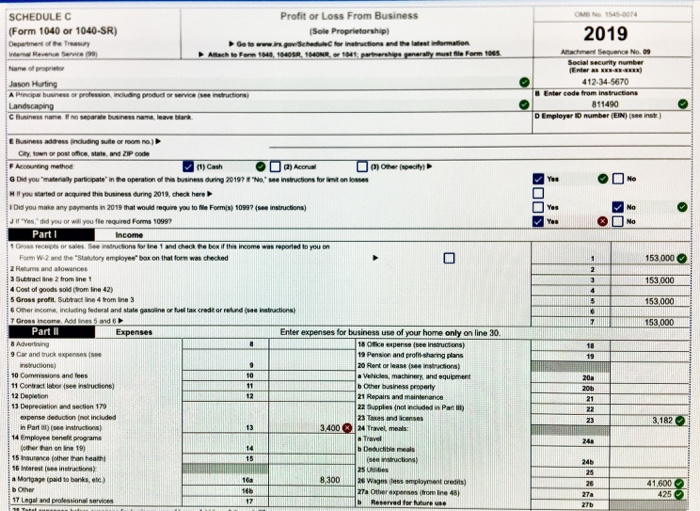

During 2019, Jason and Vicki Hurting, who are married with two children and filing jointly, had the following tax information. Jason owns a cash-basis landscaping business, and Vicki works as a sales executive for a manufacturing business. Jason (SSN 412-34-5670) and Vicki (SSN 412-34-5671) reside at 123 Bate Street, Bright, AL 36116. Both children are under the age of 17: Jason Jr. (412-34-5672), date of birth 7/20/11 Catlin (412-34-5673), date of birth 1/08/15 Vicki's W-2 information is as follows: Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholding. Other income: 1099-G Alabama state tax refund is taxable because $4,700 was deducted on last year's return 1099-INT First Bank of Alabana 1099-DIV IBM, Inc.-Ordinary dividends Qualified dividends $94,000 22,000 94,000 $ 5,828 1,363 4,700 423 225 125 125 Jason's landscaping business (business code 811490): Revenue Wages Payroll tax Cell phone charge Assets ($ 179 elected) Item Truck (100% business) Mower 1 Mower 2 Equipment $153,000 41,600 3,182 425 Date Purchased 2/05/19 3/08/19 3/08/19 6/25/19 Personal property tax Mortgage interest Charitable contributions The truck was over 6,000 lbs. The Hurtings had the following itemized deductions: State income tax withholding (from above) Real estate tax Business Use Amount Percentage $ 28,000 100% 12,000 100 100 100 3,400 1,595 $4,700 2,100 425 8,300 2,400 The Hurtings made four federal estimated payments of $2,500 each on their due dates. SCHEDULE C (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service (99) Name of proprietor Jason Hurting A Principal business or profession, including product or service (see instructions) Landscaping C Business name. If no separate business name, leave blank E Business address (including suite or room no.) City, town or post office, state, and ZIP code F Accounting method (1) Cash (2) Accrual G Did you "materially participate in the operation of this business during 2019? No see instructions for limit on losses If you started or acquired this business during 2019, check here Did you make any payments in 2019 that would require you to file Form(s) 10997 (see instructions) JI "Yes," did you or will you file required Forms 1099? Part I Income 1 Gross receipts or sales. See instructions for Ine 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 2 Returns and alowances 3 Subtract ane 2 from ine 1 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 7 Gross income. Add lines 5 and 6 Part II 8 Advertising 9 Car and truck expenses (see instructions) 10 Commissions and fees 11 Contract labor (see instructions) Profit or Loss From Business (Sole Proprietorship) Go to www.is.gov/Schedule for instructions and the latest information Attach to Form 1048, 10405R, 1040NR, or 1041, partnerships generally must file Form 1065 12 Depletion 13 Depreciation and section 179 expense deduction (not included in Part) (see instructions) 14 Employee benefit programs (other than on line 19) 15 Insurance (other than health 16 Interest (see instructions) Expenses a Mortgage (paid to banks, etc.) b Other 17 Legal and professional services a 9 10 11 12 13 14 15 16 166 17 3) Other (specity) Enter expenses for business use of your home only on line 30. 18 Office expense (see instructions) 19 Pension and profit-sharing plans 20 Rent or lease (see instructions) a Vehicles, machinery and equipment b Other business property 21 Repairs and maintenance 22 Supplies (not included in Par 23 Taxes and licenses 3,400 24 Travel, meals: Travel b Deductible meals (see instructions) 8,300 25 Ubbes 26 Wages Jess employment credits) 27a Other expenses (from line 45) bReserved for future use 8 Enter code from instructions 811490 D Employer ID number (EIN) (see instr) SOOD You OMB No 1545-0074 2019 Attachment Sequence No. 09 Social security number (Enter as xxx-xx-xxxx) 412-34-5670 Yes Yes 1 2 3 4552 7 18 19 20a 20b 21 22 23 24 24b 25 26 27a 27b ODO No No No 153,000 153,000 153,000 153,000 3,182 41,600 425 33

Step by Step Solution

★★★★★

3.63 Rating (230 Votes )

There are 3 Steps involved in it

Step: 1

Sec179 which refers assets are treated as an expense rather deprec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started