1 . Alice's mother has worked at PT. ABC for several years. She plans to buy her own car and since 3 years ago, Ms.

1. Alice's mother has worked at PT. ABC for several years. She plans to buy her own car and since 3 years ago, Ms. Alice has put aside IDR 60,000,000 from her savings account, which pays her interest at 5% pa. Now she has decided to use the funds as a down payment for a car purchase. The price of the car that Mrs. Alice wants to buy is Rp. 300,000,000.

a. Based on the scenario above, calculate the amount Ms. Alice must pay in installments each quarter. Installment payments are made at the end of each period.

b. Prepare a comprehensive loan amortization schedule based on the following conditions: the applied interest rate is 10.5% pa and the loan tenor is 5 years.

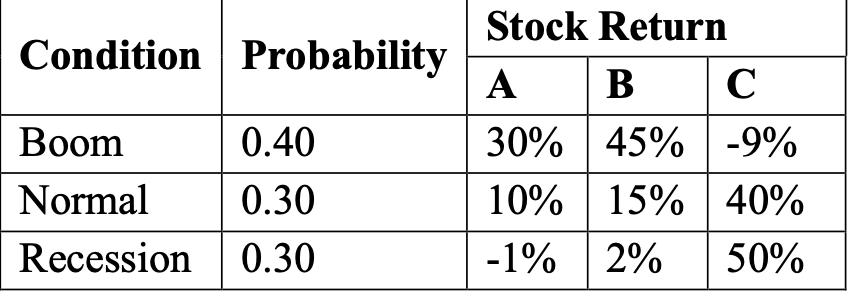

2. The following is information regarding shares D, E and F:

a. Calculate the Expected Return and Standard Deviation of each stock. Which stock do you recommend as the best stock?

b. If you make 2 portfolios, namely Portfolio 1 and Portfolio 2. Portfolio 1 consists of Stock A and Share B, with a proportion of 50:50 for each share. Portfolio 2 consists of Shares A and Shares C, with the proportion of each share also being 50:50. What is the Expected return and Standard Deviation of Portfolio 1?

3. The management team of PT. Z is currently valuing its bonds and stock.

a The company is currently exploring the possibility of increasing capital by issuing the first Corporate Bonds with a total face value of IDR. 125 Billion, with quarterly Coupon payments and Coupon rate = 8% pa Corporate Bonds will be issued with a tenor of 10 years.

Based on the above parameters, calculate the value of the Bonds at:

i. End of year 2, end of year 7 and end of year 9 of the Bond tenor; with a required rate of return of 10%.

ii. End of year 2, end of year 7 and end of year 9 of the Bond tenor; with a required rate of return of 6%.

b. What specific information can you conclude regarding the relationship between the value of the Bonds and the maturity date of the Bonds? Explain using your answer in point a and point

c. Provide a schematic graph to illustrate your answer

4. PT Z has 2 alternatives in its dividend policy.

The first alternative is to distribute dividends of Rp. 150 per share. To support the mid-term business plan, the management team intends to maintain the same figure next year. For the second and third year, management is targeting a dividend growth of 5%, while for the fourth and fifth year the dividend will increase by 15%. In the sixth year and so on dividend growth will be constant at 10% per year.

The second alternative, the dividend distributed is IDR 200 per share for the current year. The dividend will then increase by 10% in the second year. The company's dividend growth rate for the third year will be set at 20% and reduced to 15% for the fourth and fifth years. In the sixth year, and in subsequent years, the dividend growth rate will be constant at 5% per year.

Assume the required rate of return is set at 14%.

If the current stock price is known to be Rp. 3,500, from an investor's point of view, which alternative do you think is better?

5. Mrs. Pricilla is a financial manager at X Co. Currently, information related to the company's capital structure is as follows:

| Debt | 10,000 outstanding bonds, with a coupon rate of 7%/year, 30 years term, $1000 par value , sold at 93% of face value. |

| common stock | 300,000 shares outstanding at $60/share, beta of 0.95. |

| preffered stock | 20,000 shares outstanding at a price of $ 90 / share, the dividend is 10% of the price. |

| market | 7% market risk premium, 4% risk free rate |

| tax rate | 30% |

Mrs. Pricilla wants to determine the company's weighted average cost of capital . Based on the information available, help Mrs. Pricilla to determine the WACC of X Co.

6. XYZ, Inc. is a mixer manufacturer for industry. XYZ is quite expansive in running its business. To increase its production, the company is considering replacing the engine. The company has also conducted marketing research to analyze the market for industrial mixers. For the market research, the company has spent $125,000. The information obtained based on the results of market analysis is that the mixer industry will continue to grow for the next 4 years. Two years ago, the company purchased a machine for $2,000,000, depreciated using the 3-year MACRS method. Meanwhile, with the new engine, production is expected to increase by 40% from previous sales. With the new machine, XYZ will be able to sell 3,200, 4,300, 3,900 and 2 products. 800-units annually for the next 4 years for $780. Fixed costs for the project are $425,000 per year, and variable costs are 15 percent of sales. The machinery required for production will cost $3 million (including installation costs) and will be depreciated according to the MACRS method - 3 years. If the project is executed, the old machine will be sold and the funds will be used to increase the cost of buying a new machine. Currently the old machine has a market price of $900,000. At the end of the project, the new machine can be sold for a market value of $400,000. If this project were implemented, the net working capital required would be $125,000. If the old machine is not sold, then at the end of year 4 the machine has a market value of $200,000. 38 percent tax rate,

a. Determine the NPV of the project, is the project feasible to run?

b. Determine the IRR of the project.

c. What is the maximum rate of return for the project? Explain.

7. DTX, Co. has expectations of achieving an EBIT (operating profit) of $10,000 this year. This company has $20,000 bonds with a coupon rate of 10%. The company has also issued 600 shares of preferred stock with a dividend of $4 per share. DTX, Co. has a common stock of 1000 shares. Tax = 40%

a. Calculate the company's Degree of Financial Leverage (DFL).

b. If EBIT increases/decreases by 10%, how many % will EPS increase/decrease? What is your answer consistent with the answer to point a?

8. PT. EFG is a paint company, which uses 60,000 gallons of pigment per year. The cost of ordering pigments is $300 per order, and the cost of storing pigments is $2 per gallon per year. The company uses pigment at a constant rate every day of the year. Assuming 1 year = 365 days.

a. Calculate the company's EOQ. By using the EOQ method, what is the total cost to be incurred by the company.

b. If PT. EFG periodically orders 5,000 gallons or 3,000 gallons of pigment, is this optimal quantity? Explain your answer by comparing the total costs to be incurred by the company.

Condition Probability Boom 0.40 Normal 0.30 Recession 0.30 Stock Return A B 30% 10% 15% -1% C 45% -9% 40% 2% 50%

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the provided questions and address each part step by step 1 Car Purchase and Loan Amortization a Calculate installment payments each quarter based on the scenario provided b Prepare a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started