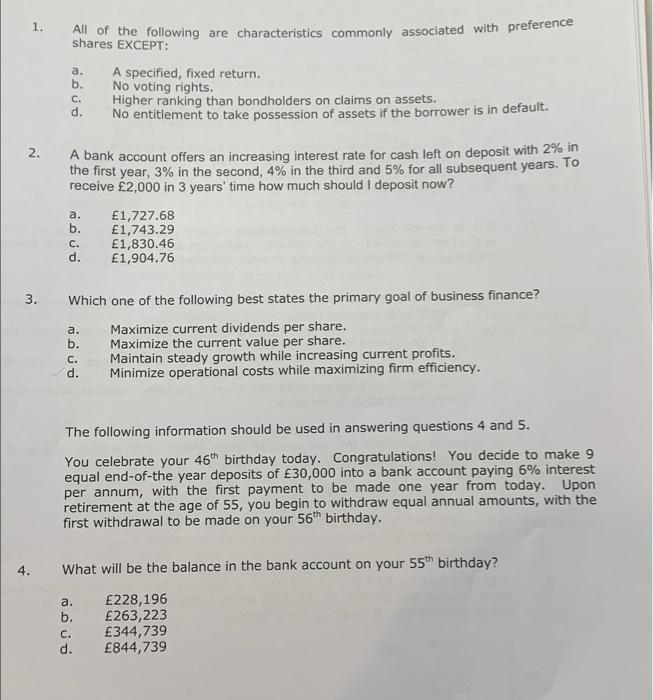

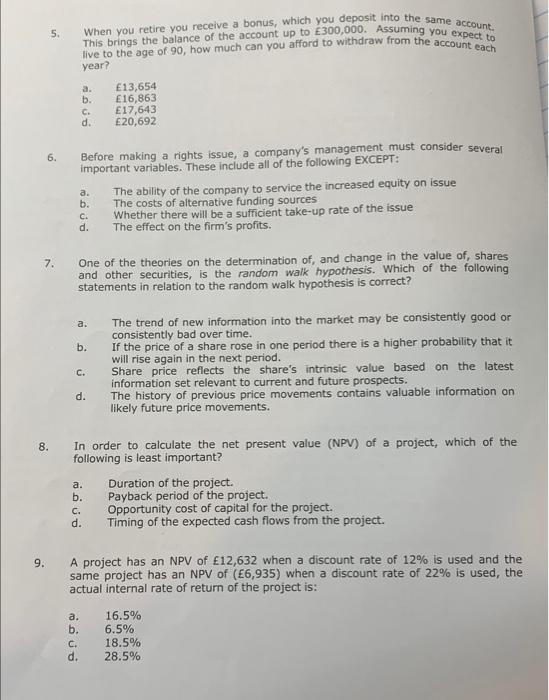

1. All of the following are characteristics commonly associated with preference shares EXCEPT: a. A specified, fixed return. b. No voting rights. C. Higher ranking than bondholders on claims on assets. d. No entitlement to take possession of assets if the borrower is in default. A bank account offers an increasing interest rate for cash left on deposit with 2% in the first year, 3% in the second, 4% in the third and 5% for all subsequent years. To receive 2,000 in 3 years' time how much should I deposit now? a. 1,727.68 b. 1,743.29 C. 1,830.46 1,904.76 d. 3. Which one of the following best states the primary goal of business finance? a. Maximize current dividends per share. b. Maximize the current value per share. Maintain steady growth while increasing current profits. d. Minimize operational costs while maximizing firm efficiency. The following information should be used in answering questions 4 and 5. You celebrate your 46th birthday today. Congratulations! You decide to make 9 equal end-of-the year deposits of 30,000 into a bank account paying 6% interest per annum, with the first payment to be made one year from today. Upon retirement at the age of 55, you begin to withdraw equal annual amounts, with the first withdrawal to be made on your 56th birthday. 4. What will be the balance in the bank account on your 55th birthday? a. 228,196 b. 263,223 C. 344,739 d. 844,739 5. When you retire you receive a bonus, which you deposit into the same account. This brings the balance of the account up to 300,000. Assuming you expect to live to the age of 90, how much can you afford to withdraw from the account each year? a. 13,654 b. 16,863 C. 17,643 d. 20,692 6. Before making a rights issue, a company's management must consider several important variables. These include all of the following EXCEPT: a. The ability of the company to service the increased equity on issue The costs of alternative funding sources b. C. Whether there will be a sufficient take-up rate of the issue The effect on the firm's profits. d. 7. One of the theories on the determination of, and change in the value of, shares and other securities, is the random walk hypothesis. Which of the following statements in relation to the random walk hypothesis is correct? a. The trend of new information into the market may be consistently good or consistently bad over time. b. If the price of a share rose in one period there is a higher probability that it will rise again in the next period. Share price reflects the share's intrinsic value based on the latest information set relevant to current and future prospects. d. The history of previous price movements contains valuable information on likely future price movements. 8. In order to calculate the net present value (NPV) of a project, which of the following is least important? a. Duration of the project. b. Payback period of the project. C. Opportunity cost of capital for the project. d. Timing of the expected cash flows from the project. 9. A project has an NPV of 12,632 when a discount rate of 12% is used and the same project has an NPV of (6,935) when a discount rate of 22% is used, the actual internal rate of return of the project is: a. 16.5% b. 6.5% 18.5% d. 28.5% di