Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Allstate Body Works purchased exercise equipment 5 years ago which cost $180,000. They have $20,000 of accumulated depreciation recorded on the balance sheet. Today,

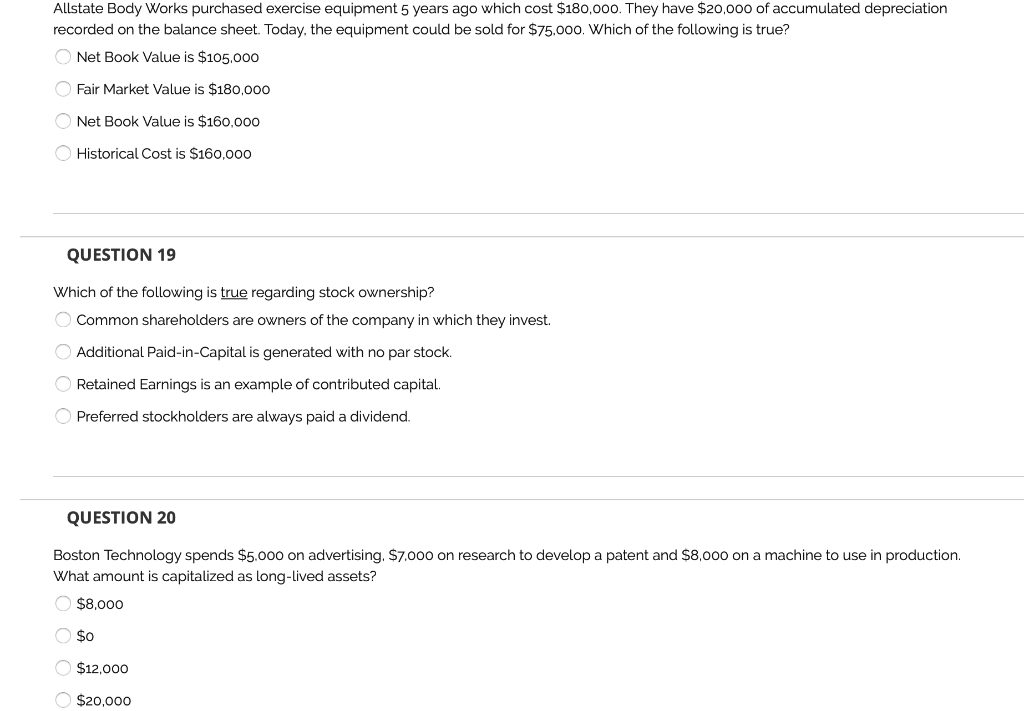

1. Allstate Body Works purchased exercise equipment 5 years ago which cost $180,000. They have $20,000 of accumulated depreciation recorded on the balance sheet. Today, the equipment could be sold for $75,000. Which of the following is true?

2. Which of the following is true regarding stock ownership?

3. Boston Technology spends $5,000 on advertising, $7,000 on research to develop a patent and $8,000 on a machine to use in production. What amount is capitalized as long-lived assets?

Allstate Body Works purchased exercise equipment 5 years ago which cost $180,000. They have $20,000 of accumulated depreciation recorded on the balance sheet. Today, the equipment could be sold for $75,000. Which of the following is true? ONet Book Value is $105.000 Fair Market value is $180,000 ONet Book Value is $160,000 O Historical Cost is $160,000 QUESTION 19 Which of the following is true regarding stock ownership? Common shareholders are owners of the company in which they invest. Additional Paid-in-Capital is generated with no par stock. Retained Earnings is an example of contributed capital. O Preferred stockholders are always paid a dividend. QUESTION 20 Boston Technology spends $5,000 on advertising, $7.000 on research to develop a patent and $8,000 on a machine to use in production. What amount is capitalized as long-lived assets? $8,000 $0 $12,000 $20,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started