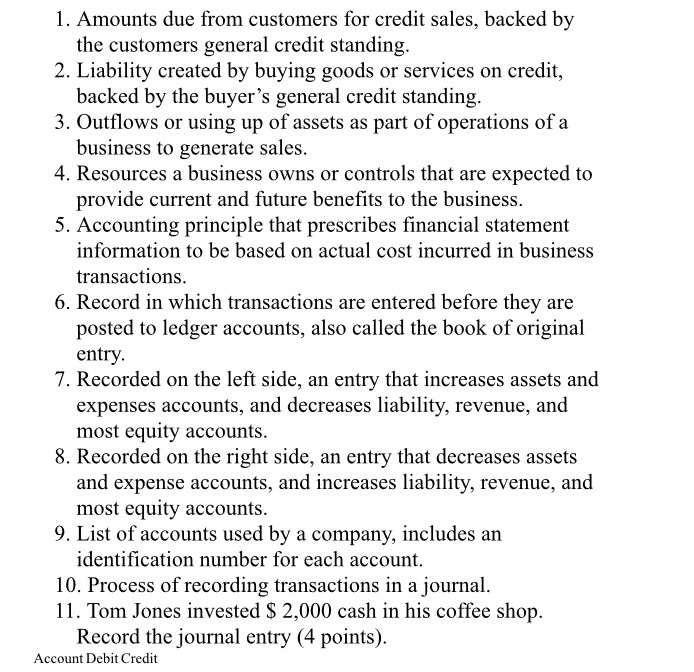

1. Amounts due from customers for credit sales, backed by the customers general credit standing. 2. Liability created by buying goods or services on credit, backed by the buyer's general credit standing. 3. Outflows or using up of assets as part of operations of a business to generate sales. 4. Resources a business owns or controls that are expected to provide current and future benefits to the business. 5. Accounting principle that prescribes financial statement information to be based on actual cost incurred in business transactions. 6. Record in which transactions are entered before they are posted to ledger accounts, also called the book of original entry. 7. Recorded on the left side, an entry that increases assets and expenses accounts, and decreases liability, revenue, and most equity accounts. 8. Recorded on the right side, an entry that decreases assets and expense accounts, and increases liability, revenue, and most equity accounts. 9. List of accounts used by a company, includes an identification number for each account. 10. Process of recording transactions in a journal. 11. Tom Jones invested $ 2,000 cash in his coffee shop. Record the journal entry (4 points). Account Debit Credit 1. Amounts due from customers for credit sales, backed by the customers general credit standing. 2. Liability created by buying goods or services on credit, backed by the buyer's general credit standing. 3. Outflows or using up of assets as part of operations of a business to generate sales. 4. Resources a business owns or controls that are expected to provide current and future benefits to the business. 5. Accounting principle that prescribes financial statement information to be based on actual cost incurred in business transactions. 6. Record in which transactions are entered before they are posted to ledger accounts, also called the book of original entry. 7. Recorded on the left side, an entry that increases assets and expenses accounts, and decreases liability, revenue, and most equity accounts. 8. Recorded on the right side, an entry that decreases assets and expense accounts, and increases liability, revenue, and most equity accounts. 9. List of accounts used by a company, includes an identification number for each account. 10. Process of recording transactions in a journal. 11. Tom Jones invested $ 2,000 cash in his coffee shop. Record the journal entry (4 points). Account Debit Credit