Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Amsterdam Company owns the mineral rights to land that has a deposit of ore. The company in uncertain if it should purchase equipment

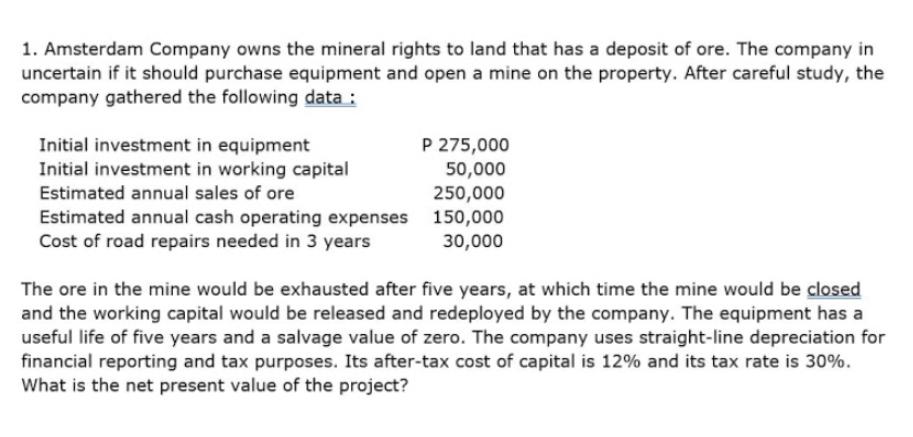

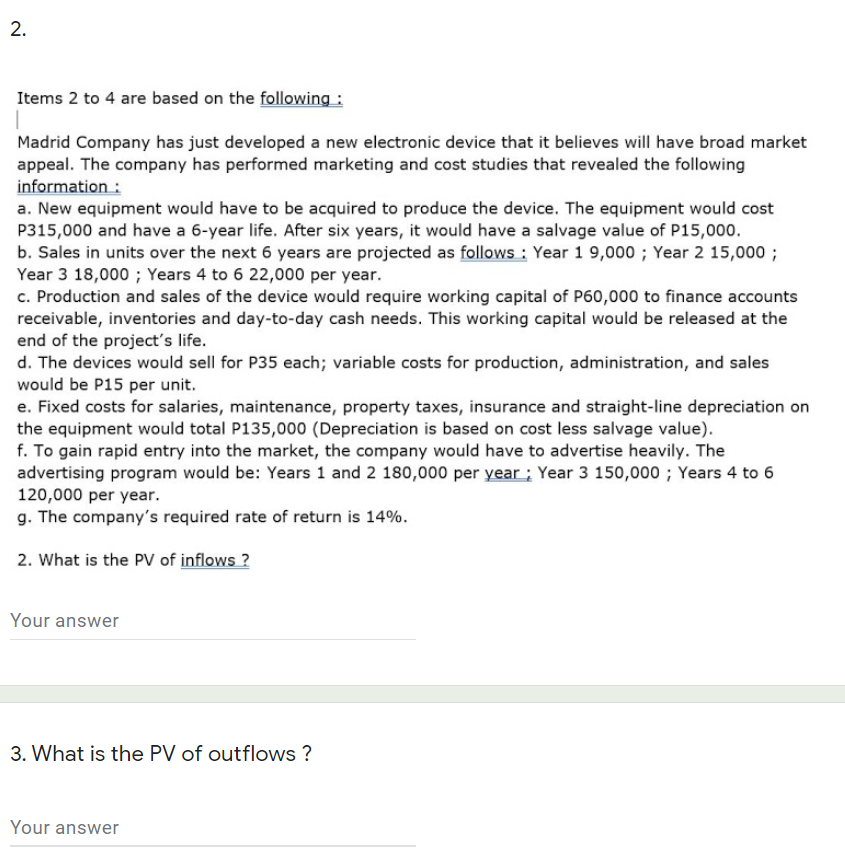

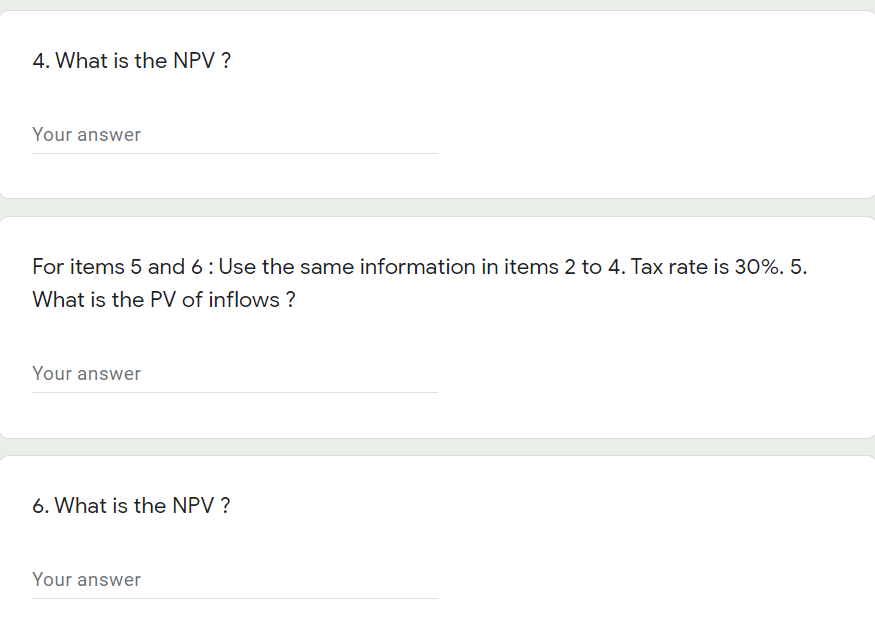

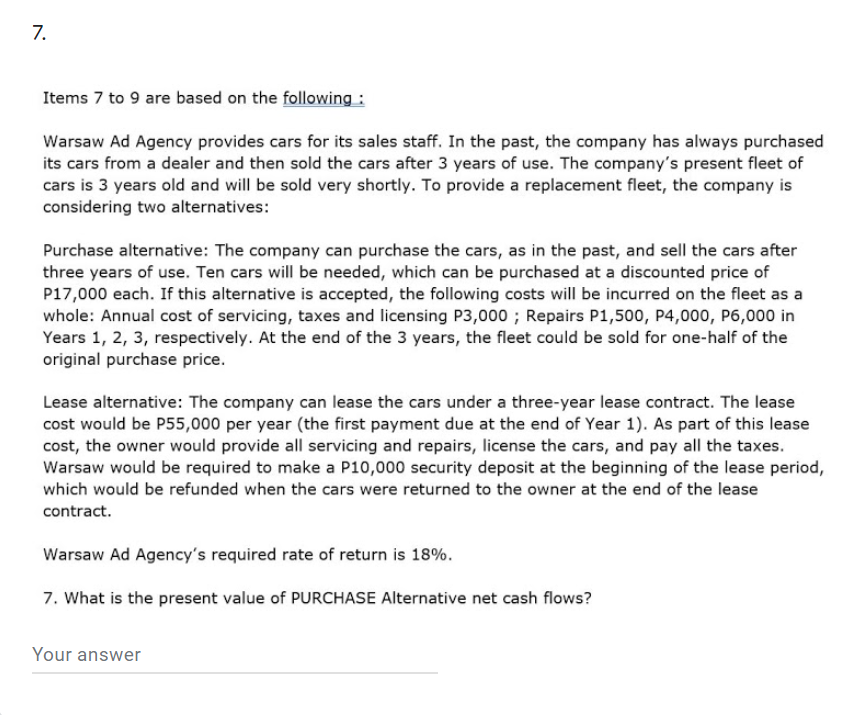

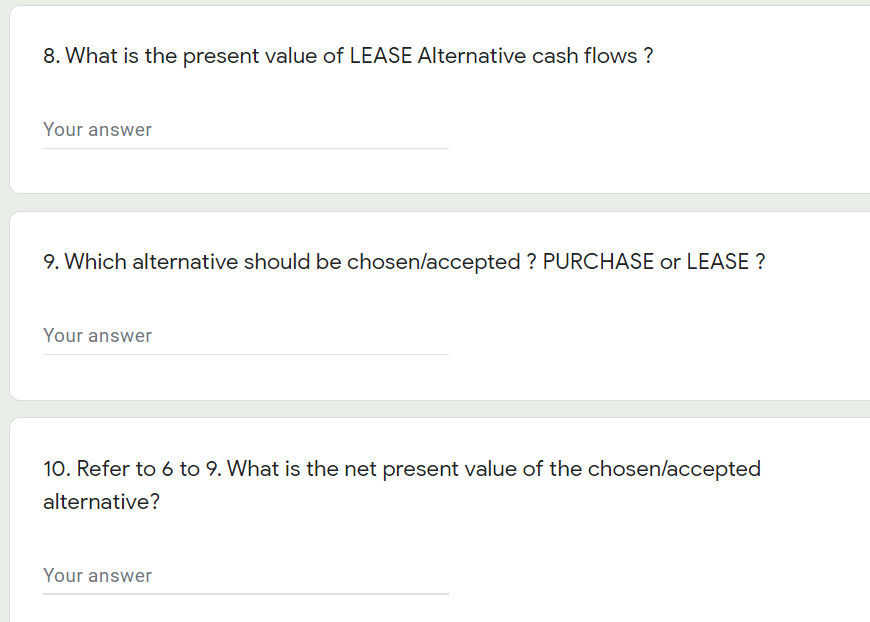

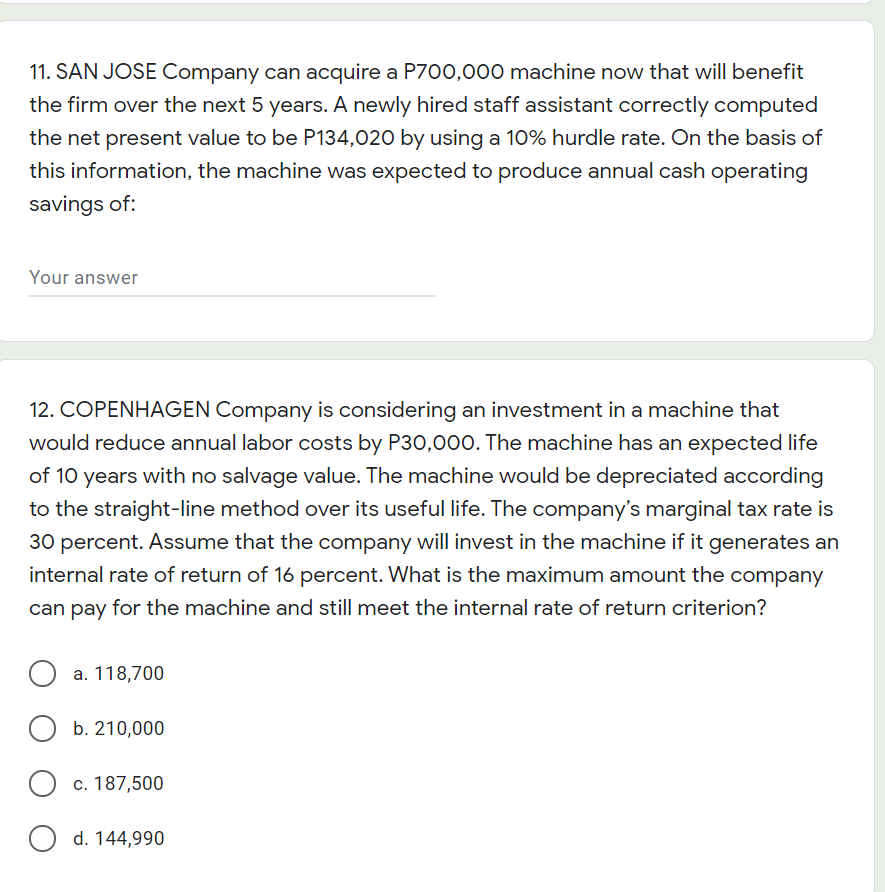

1. Amsterdam Company owns the mineral rights to land that has a deposit of ore. The company in uncertain if it should purchase equipment and open a mine on the property. After careful study, the company gathered the following data : Initial investment in equipment Initial investment in working capital Estimated annual sales of ore Estimated annual cash operating expenses Cost of road repairs needed in 3 years P 275,000 50,000 250,000 150,000 30,000 The ore in the mine would be exhausted after five years, at which time the mine would be closed and the working capital would be released and redeployed by the company. The equipment has a useful life of five years and a salvage value of zero. The company uses straight-line depreciation for financial reporting and tax purposes. Its after-tax cost of capital is 12% and its tax rate is 30%. What is the net present value of the project? 2. Items 2 to 4 are based on the following: I Madrid Company has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following information: a. New equipment would have to be acquired to produce the device. The equipment would cost P315,000 and have a 6-year life. After six years, it would have a salvage value of P15,000. b. Sales in units over the next 6 years are projected as follows: Year 1 9,000; Year 2 15,000; Year 3 18,000; Years 4 to 6 22,000 per year. c. Production and sales of the device would require working capital of P60,000 to finance accounts receivable, inventories and day-to-day cash needs. This working capital would be released at the end of the project's life. d. The devices would sell for P35 each; variable costs for production, administration, and sales would be P15 per unit. e. Fixed costs for salaries, maintenance, property taxes, insurance and straight-line depreciation on the equipment would total P135,000 (Depreciation is based on cost less salvage value). f. To gain rapid entry into the market, the company would have to advertise heavily. The advertising program would be: Years 1 and 2 180,000 per year; Year 3 150,000; Years 4 to 6 120,000 per year. g. The company's required rate of return is 14%. 2. What is the PV of inflows ? Your answer 3. What is the PV of outflows ? Your answer 4. What is the NPV ? Your answer For items 5 and 6: Use the same information in items 2 to 4. Tax rate is 30%. 5. What is the PV of inflows? Your answer 6. What is the NPV ? Your answer 7. Items 7 to 9 are based on the following: Warsaw Ad Agency provides cars for its sales staff. In the past, the company has always purchased its cars from a dealer and then sold the cars after 3 years of use. The company's present fleet of cars is 3 years old and will be sold very shortly. To provide a replacement fleet, the company is considering two alternatives: Purchase alternative: The company can purchase the cars, as in the past, and sell the cars after three years of use. Ten cars will be needed, which can be purchased at a discounted price of P17,000 each. If this alternative is accepted, the following costs will be incurred on the fleet as a whole: Annual cost of servicing, taxes and licensing P3,000; Repairs P1,500, P4,000, P6,000 in Years 1, 2, 3, respectively. At the end of the 3 years, the fleet could be sold for one-half of the original purchase price. Lease alternative: The company can lease the cars under a three-year lease contract. The lease cost would be P55,000 per year (the first payment due at the end of Year 1). As part of this lease cost, the owner would provide all servicing and repairs, license the cars, and pay all the taxes. Warsaw would be required to make a P10,000 security deposit at the beginning of the lease period, which would be refunded when the cars were returned to the owner at the end of the lease contract. Warsaw Ad Agency's required rate of return is 18%. 7. What is the present value of PURCHASE Alternative net cash flows? Your answer 8. What is the present value of LEASE Alternative cash flows? Your answer 9. Which alternative should be chosen/accepted ? PURCHASE or LEASE? Your answer 10. Refer to 6 to 9. What is the net present value of the chosen/accepted alternative? Your answer 11. SAN JOSE Company can acquire a P700,000 machine now that will benefit the firm over the next 5 years. A newly hired staff assistant correctly computed the net present value to be P134,020 by using a 10% hurdle rate. On the basis of this information, the machine was expected to produce annual cash operating savings of: Your answer 12. COPENHAGEN Company is considering an investment in a machine that would reduce annual labor costs by P30,000. The machine has an expected life of 10 years with no salvage value. The machine would be depreciated according to the straight-line method over its useful life. The company's marginal tax rate is 30 percent. Assume that the company will invest in the machine if it generates an internal rate of return of 16 percent. What is the maximum amount the company can pay for the machine and still meet the internal rate of return criterion? O a. 118,700 O b. 210,000 O c. 187,500 O d. 144,990

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the net present value NPV of the project we need to find the present value of inflows and outflows and then take the difference between them Given Initial investment in equipment P27500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started