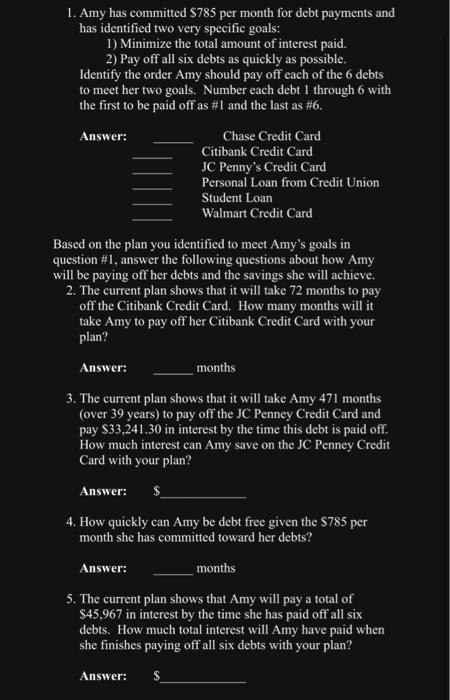

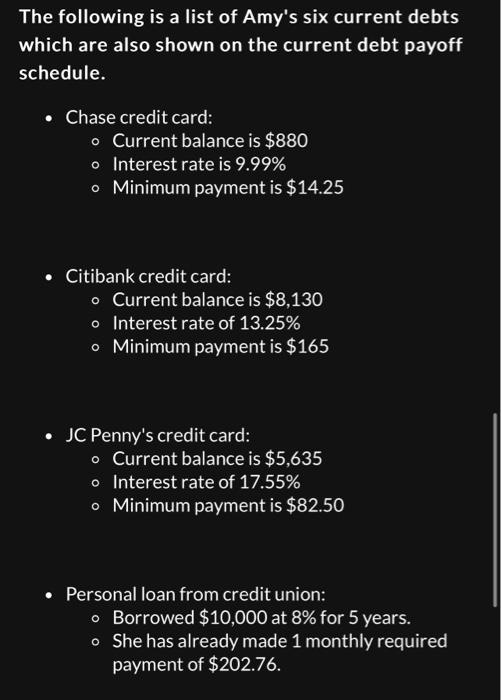

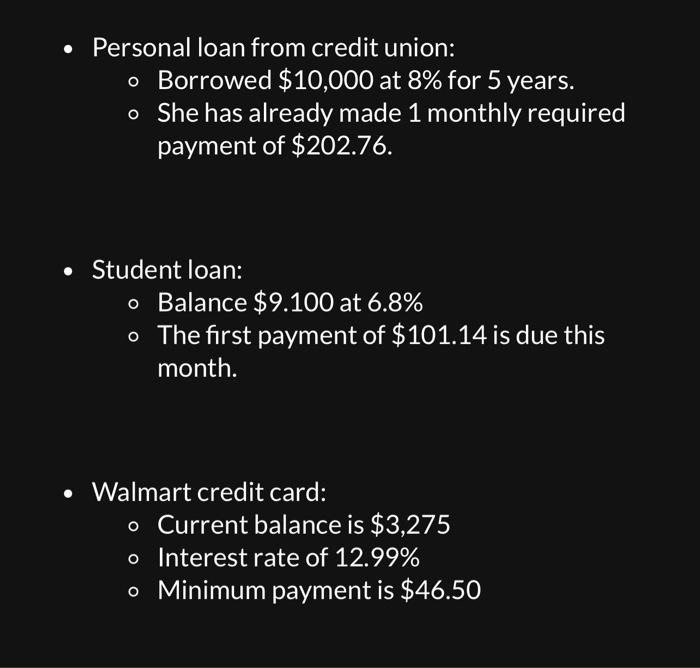

1. Amy has committed $785 per month for debt payments and has identified two very specific goals: 1) Minimize the total amount of interest paid. 2) Pay off all six debts as quickly as possible. Identify the order Amy should pay off each of the 6 debts to meet her two goals. Number each debt 1 through 6 with the first to be paid off as #1 and the last as #6. Answer: Based on the plan you identified to meet Amy's goals in question \#1, answer the following questions about how Amy will be paying off her debts and the savings she will achieve. 2. The current plan shows that it will take 72 months to pay off the Citibank Credit Card. How many months will it take Amy to pay off her Citibank Credit Card with your plan? Answer: months 3. The current plan shows that it will take Amy 471 months (over 39 years) to pay off the JC Penney Credit Card and pay $33,241.30 in interest by the time this debt is paid off. How much interest can Amy save on the JC Penney Credit Card with your plan? Answer: 4. How quickly can Amy be debt free given the $785 per month she has committed toward her debts? Answer: months 5. The current plan shows that Amy will pay a total of $45,967 in interest by the time she has paid off all six debts. How much total interest will Amy have paid when she finishes paying off all six debts with your plan? - Personal loan from credit union: - Borrowed $10,000 at 8% for 5 years. - She has already made 1 monthly required payment of $202.76. - Student loan: - Balance $9.100 at 6.8% - The first payment of $101.14 is due this month. - Walmart credit card: - Current balance is $3,275 - Interest rate of 12.99% - Minimum payment is $46.50 The following is a list of Amy's six current debts which are also shown on the current debt payoff schedule. - Chase credit card: - Current balance is $880 - Interest rate is 9.99% - Minimum payment is $14.25 - Citibank credit card: - Current balance is $8,130 - Interest rate of 13.25% - Minimum payment is $165 - JC Penny's credit card: - Current balance is $5,635 - Interest rate of 17.55% - Minimum payment is $82.50 - Personal loan from credit union: - Borrowed $10,000 at 8% for 5 years. - She has already made 1 monthly required payment of $202.76