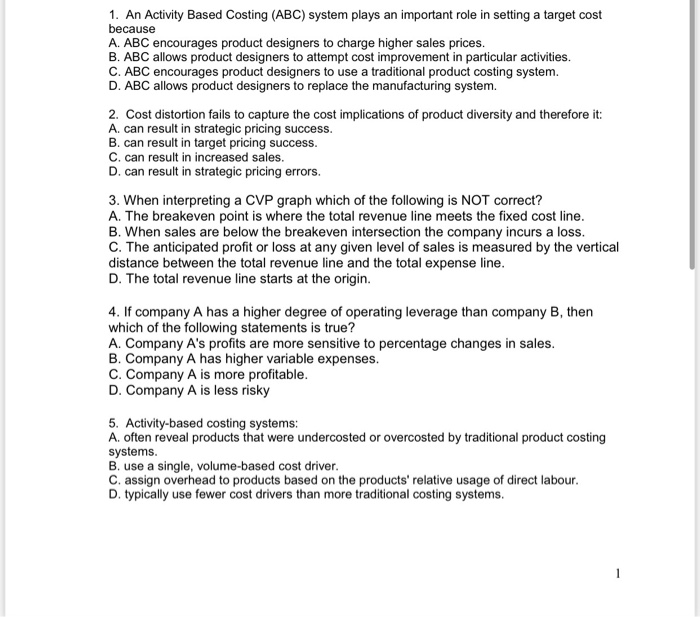

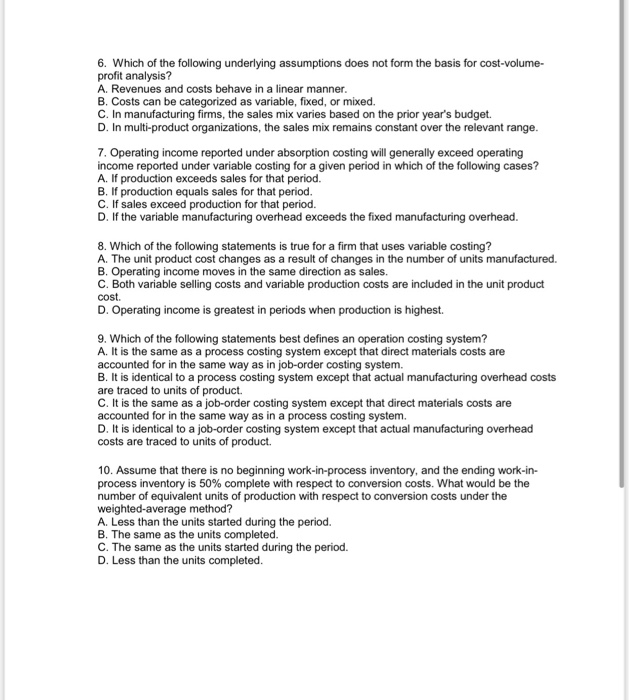

1. An Activity Based Costing (ABC) system plays an important role in setting a target cost because A. ABC encourages product designers to charge higher sales prices. B. ABC allows product designers to attempt cost improvement in particular activities. C. ABC encourages product designers to use a traditional product costing system. D. ABC allows product designers to replace the manufacturing system. 2. Cost distortion fails to capture the cost implications of product diversity and therefore it: A. can result in strategic pricing success. B. can result in target pricing success. C. can result in increased sales. D. can result in strategic pricing errors. 3. When interpreting a CVP graph which of the following is NOT correct? A. The breakeven point is where the total revenue line meets the fixed cost line. B. When sales are below the breakeven intersection the company incurs a loss. C. The anticipated profit or loss at any given level of sales is measured by the vertical distance between the total revenue line and the total expense line. D. The total revenue line starts at the origin. 4. If company A has a higher degree of operating leverage than company B, then which of the following statements is true? A. Company A's profits are more sensitive to percentage changes in sales. B. Company A has higher variable expenses. C. Company A is more profitable. D. Company A is less risky 5. Activity-based costing systems: A. often reveal products that were undercosted or overcosted by traditional product costing systems. B. use a single, volume-based cost driver. C. assign overhead to products based on the products' relative usage of direct labour. D. typically use fewer cost drivers than more traditional costing systems. 6. Which of the following underlying assumptions does not form the basis for cost-volume- profit analysis? A. Revenues and costs behave in a linear manner. B. Costs can be categorized as variable, fixed, or mixed. C. In manufacturing firms, the sales mix varies based on the prior year's budget. D. In multi-product organizations, the sales mix remains constant over the relevant range. 7. Operating income reported under absorption costing will generally exceed operating income reported under variable costing for a given period in which of the following cases? A. If production exceeds sales for that period. B. If production equals sales for that period. C. If sales exceed production for that period. D. If the variable manufacturing overhead exceeds the fixed manufacturing overhead. 8. Which of the following statements is true for a firm that uses variable costing? A. The unit product cost changes as a result of changes in the number of units manufactured. B. Operating income moves in the same direction as sales. C. Both variable selling costs and variable production costs are included in the unit product cost. D. Operating income is greatest in periods when production is highest 9. Which of the following statements best defines an operation costing system? A. It is the same as a process costing system except that direct materials costs are accounted for in the same way as in job-order costing system. B. It is identical to a process costing system except that actual manufacturing overhead costs are traced to units of product. C. It is the same as a job-order costing system except that direct materials costs are accounted for in the same way as in a process costing system. D. It is identical to a job-order costing system except that actual manufacturing overhead costs are traced to units of product. 10. Assume that there is no beginning work-in-process inventory, and the ending work-in- process inventory is 50% complete with respect to conversion costs. What would be the number of equivalent units of production with respect to conversion costs under the weighted-average method? A. Less than the units started during the period. B. The same as the units completed. C. The same as the units started during the period. D. Less than the units completed