Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An Australian investment advisor has conducted a meeting with wealthy individual investors and noted that they have high risk preferences and are seeking

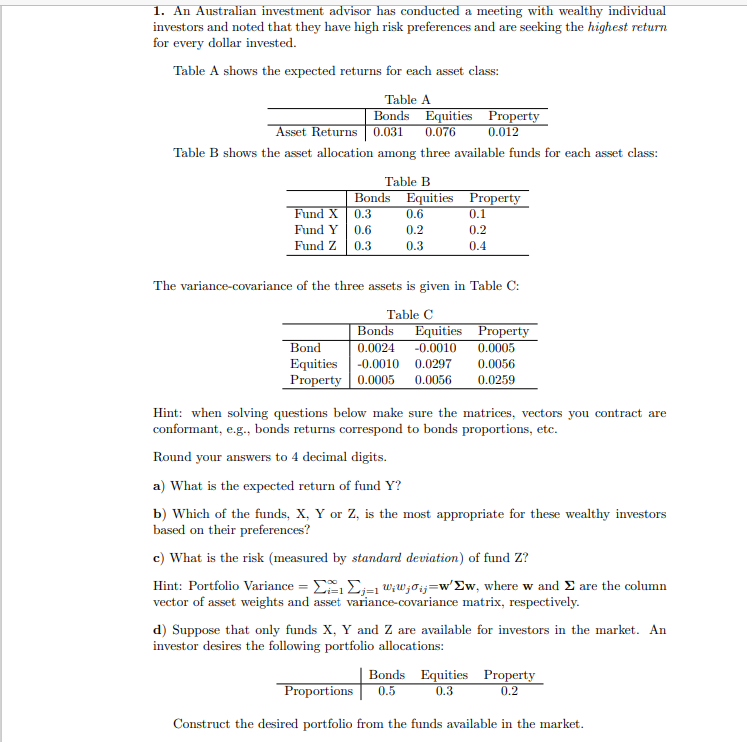

1. An Australian investment advisor has conducted a meeting with wealthy individual investors and noted that they have high risk preferences and are seeking the highest return for every dollar invested. Table A shows the expected returns for each asset class: Table A Bonds Equities Asset Returns 0.031 0.076 Table B shows the asset allocation among three available funds for each asset class: Table B Bonds Equities Property 0.012 Fund X 0.3 0.6 Fund Y 0.6 0.2 Fund Z 0.3 0.3 Property 0.1 0.2 0.4 The variance-covariance of the three assets is given in Table C: Table C Bonds Equities Property 0.0024 -0.0010 0.0005 Bond Equities -0.0010 0.0297 0.0056 Property 0.0005 0.0056 0.0259 Hint: when solving questions below make sure the matrices, vectors you contract are conformant, e.g., bonds returns correspond to bonds proportions, etc. Round your answers to 4 decimal digits. a) What is the expected return of fund Y? b) Which of the funds, X, Y or Z, is the most appropriate for these wealthy investors based on their preferences? c) What is the risk (measured by standard deviation) of fund Z? Hint: Portfolio Variance = Ei=1 =1 Wwoj-w'Ew, where w and are the column vector of asset weights and asset variance-covariance matrix, respectively. d) Suppose that only funds X, Y and Z are available for investors in the market. An investor desires the following portfolio allocations: Bonds Equities Property Proportions 0.5 0.3 0.2 Construct the desired portfolio from the funds available in the market.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return of fund Y we multiply the asset returns by the asset allocation weights for fund Y and sum them up Expected return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started