Question

1. An equipment manufacturing company (ABC) is considering expanding its range of machinery products used for construction material production by manufacturing machine tables, saddles, machine

1. An equipment manufacturing company (ABC) is considering expanding its range of machinery products used for construction material production by manufacturing machine tables, saddles, machine bases, and other similar parts. Several combinations of new equipment and personnel could serve to fulfill this new function.

Option 1 (M1): New machining center with three operators.

Option 2 (M2): New machining center with an automatic pallet changer and three operators.

Option 3 (M3): New machining center with an automatic pallet changer and two task-sharing operators.

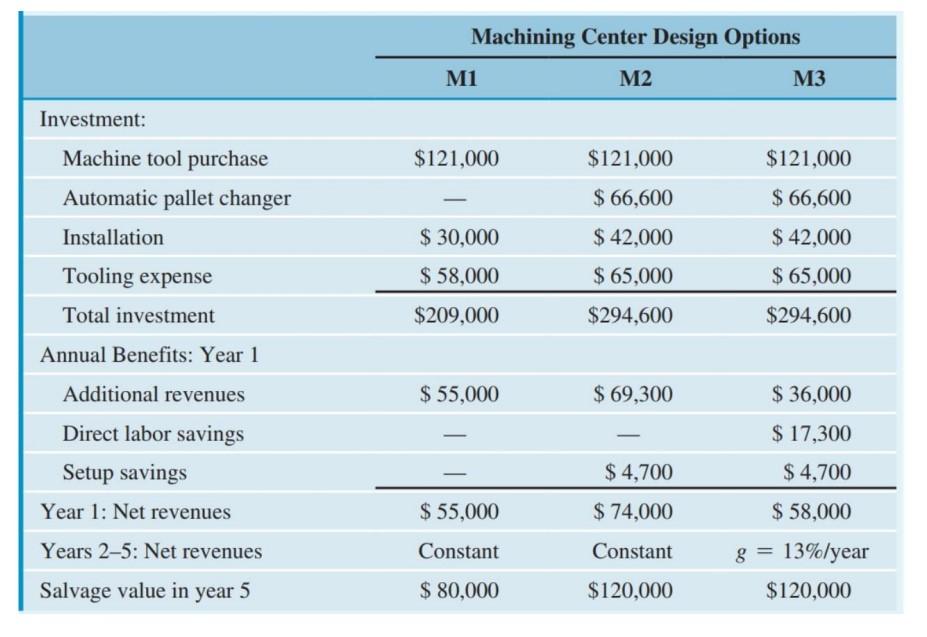

Each of these arrangements incurs different costs and revenues. The time taken to load and unload parts is reduced in the pallet-changer cases. Certainly, it costs more to acquire, install, and tool-fit a pallet changer, but because the device is more efficient and versatile, it can generate larger annual revenues. Although saving on labor costs, task-sharing operators take longer to train and are more inefficient initially. As the operators become more experienced at their tasks and get used to collaborating with each other, it is expected that the annual benefits will increase by 13% per year over the five-year study period. BC has estimated the investment costs and additional revenues as in Table.

All cash flows include all tax effects. Do nothing is obviously an option, since ABC company will not undertake this expansion if none of the proposed methods is economically viable. If a method is chosen, ABC company expects to operate the machining center over the next five years. On the basis of the use of the PW measure at i = 12%, which option would be selected?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started