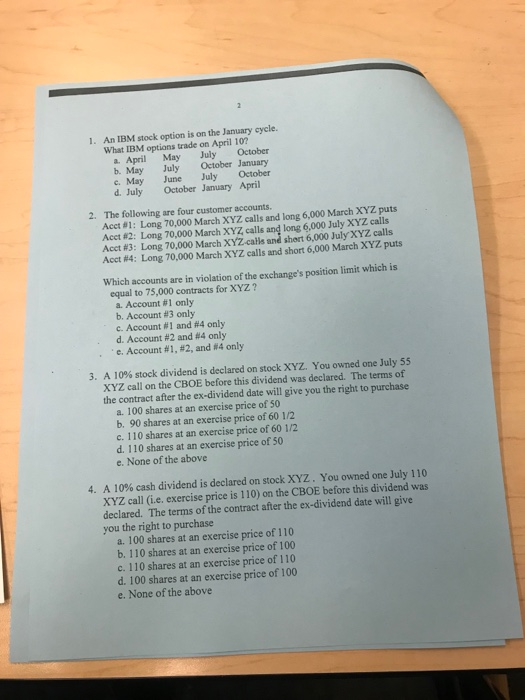

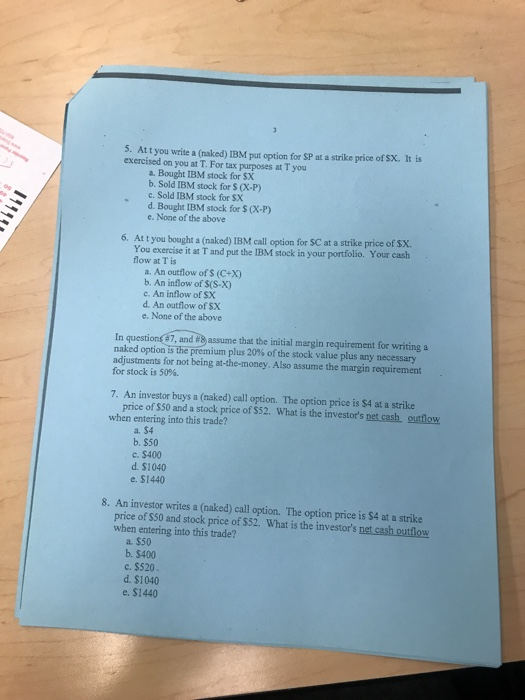

1. An IBM stock option is on the January cycle. What IBM options trade on April 10? a. April May July October b. May July October January c. May June July October d. July October January April 2. The following are four customer accounts. Acct #1 : Long 70,000 March XYZ calls and long 6,000 March XYZ puts Acct#2: Long 70,000 March XYZ calls and long 6,000 July XYZealls Acct #3: Long 70,000 March XYZ-calls and short 6,000 JulyXYZ calls Acct #4: Long 70,000 March XYZ calls and short 6,000 March XYZ puts Which accounts are in violation of the exchange's position limit which is equal to 75,000 contracts for XYZ? a. Account #1 only b. Account #3 only C. Account #1 and #4 only d. Account #2 and #4 only . e. Account #1, #2, and #4 only , A 10% stock dividend is declared on stock XYZ. You owned one July 55 XYZ call on the CBOE before this dividend was declared. The terms of the contract after the ex-dividend date will give you the right to purchase 3, a. 100 shares at an exercise price of 50 b. 90 shares at an exercise price of 60 1/2 c. 110 shares at an exercise price of 60 1/2 d. 110 shares at an exercise price of 50 e. None of the above A 10% cash dividend is declared on stock XYZ . You owned one July i 10 XYZ call (i.e. exercise price is 110) on the CBOE before this dividend was declared. The terms of the contract after the ex-dividend date will give you the right to purchase 4. a. 100 shares at an exercise price of 110 b. 110 shares at an exercise price of 100 c. 110 shares at an exercise price of 110 d. 100 shares at an exercise price of 100 e. None of the above 5. At t you write a (naked) IBM put option for SP at a strike price of SX. It is exercised on you at T. For tax purposes at T you a. Bought IBM stock for SX b. Sold IBM stock for S X.P) c. Sold IBM stock for SX d. Bought IBM stock for S CX-P) e. None of the above 6. At t you bought a (naked) IBM call option for SC at a strike price of SX. You exercise it at T and put the IBM stock in your portfolio. Your cash flow at T is a. An outflow of S (C+X) b. An inflow of S(S-X) c. An inflow of SX d. An outflow of SX e. None of the above In question 67, and Hb) assume that the initial margin requirement for writing a naked option isthe premium plus 20% of the stock value plus any necessary adjustments for not being at-the-money. Also assume the margin requirement for stock is 50%. 7. An investor buys a (naked) call option. The option price is $4 at a strike price of $50 and a stock price of $52. What is the investor's net cash outflow when entering into this trade? a. $4 b. $50 c. $400 d. $1040 e.$1440 8. An investor writes a (naked) call option. The option price is $4 at a strike price of S50 and stock price of $52. What is the investor's net cash outflow when entering into this trade? a. $50 b. $400 c. $520 d. $1040 e. $1440 1. An IBM stock option is on the January cycle. What IBM options trade on April 10? a. April May July October b. May July October January c. May June July October d. July October January April 2. The following are four customer accounts. Acct #1 : Long 70,000 March XYZ calls and long 6,000 March XYZ puts Acct#2: Long 70,000 March XYZ calls and long 6,000 July XYZealls Acct #3: Long 70,000 March XYZ-calls and short 6,000 JulyXYZ calls Acct #4: Long 70,000 March XYZ calls and short 6,000 March XYZ puts Which accounts are in violation of the exchange's position limit which is equal to 75,000 contracts for XYZ? a. Account #1 only b. Account #3 only C. Account #1 and #4 only d. Account #2 and #4 only . e. Account #1, #2, and #4 only , A 10% stock dividend is declared on stock XYZ. You owned one July 55 XYZ call on the CBOE before this dividend was declared. The terms of the contract after the ex-dividend date will give you the right to purchase 3, a. 100 shares at an exercise price of 50 b. 90 shares at an exercise price of 60 1/2 c. 110 shares at an exercise price of 60 1/2 d. 110 shares at an exercise price of 50 e. None of the above A 10% cash dividend is declared on stock XYZ . You owned one July i 10 XYZ call (i.e. exercise price is 110) on the CBOE before this dividend was declared. The terms of the contract after the ex-dividend date will give you the right to purchase 4. a. 100 shares at an exercise price of 110 b. 110 shares at an exercise price of 100 c. 110 shares at an exercise price of 110 d. 100 shares at an exercise price of 100 e. None of the above 5. At t you write a (naked) IBM put option for SP at a strike price of SX. It is exercised on you at T. For tax purposes at T you a. Bought IBM stock for SX b. Sold IBM stock for S X.P) c. Sold IBM stock for SX d. Bought IBM stock for S CX-P) e. None of the above 6. At t you bought a (naked) IBM call option for SC at a strike price of SX. You exercise it at T and put the IBM stock in your portfolio. Your cash flow at T is a. An outflow of S (C+X) b. An inflow of S(S-X) c. An inflow of SX d. An outflow of SX e. None of the above In question 67, and Hb) assume that the initial margin requirement for writing a naked option isthe premium plus 20% of the stock value plus any necessary adjustments for not being at-the-money. Also assume the margin requirement for stock is 50%. 7. An investor buys a (naked) call option. The option price is $4 at a strike price of $50 and a stock price of $52. What is the investor's net cash outflow when entering into this trade? a. $4 b. $50 c. $400 d. $1040 e.$1440 8. An investor writes a (naked) call option. The option price is $4 at a strike price of S50 and stock price of $52. What is the investor's net cash outflow when entering into this trade? a. $50 b. $400 c. $520 d. $1040 e. $1440