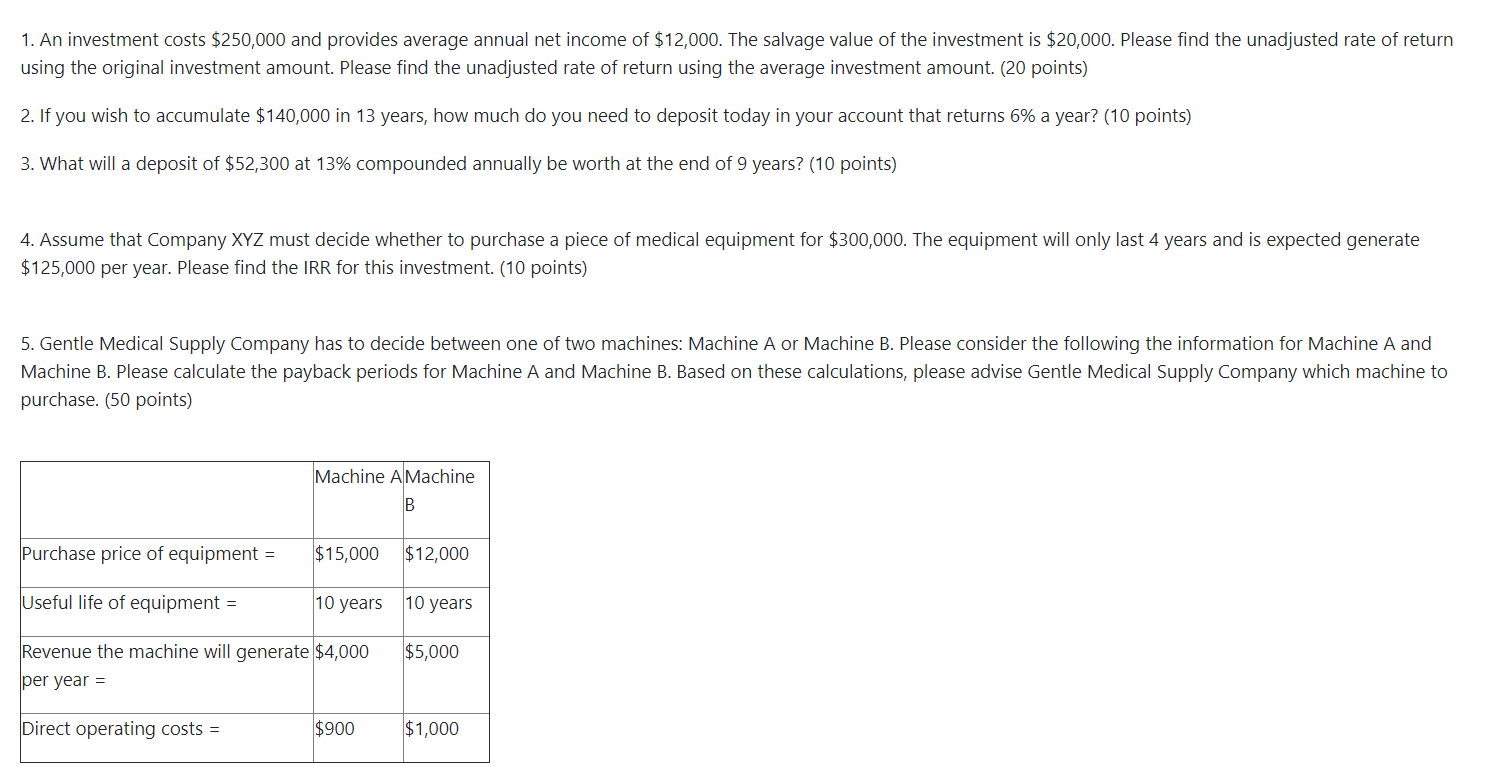

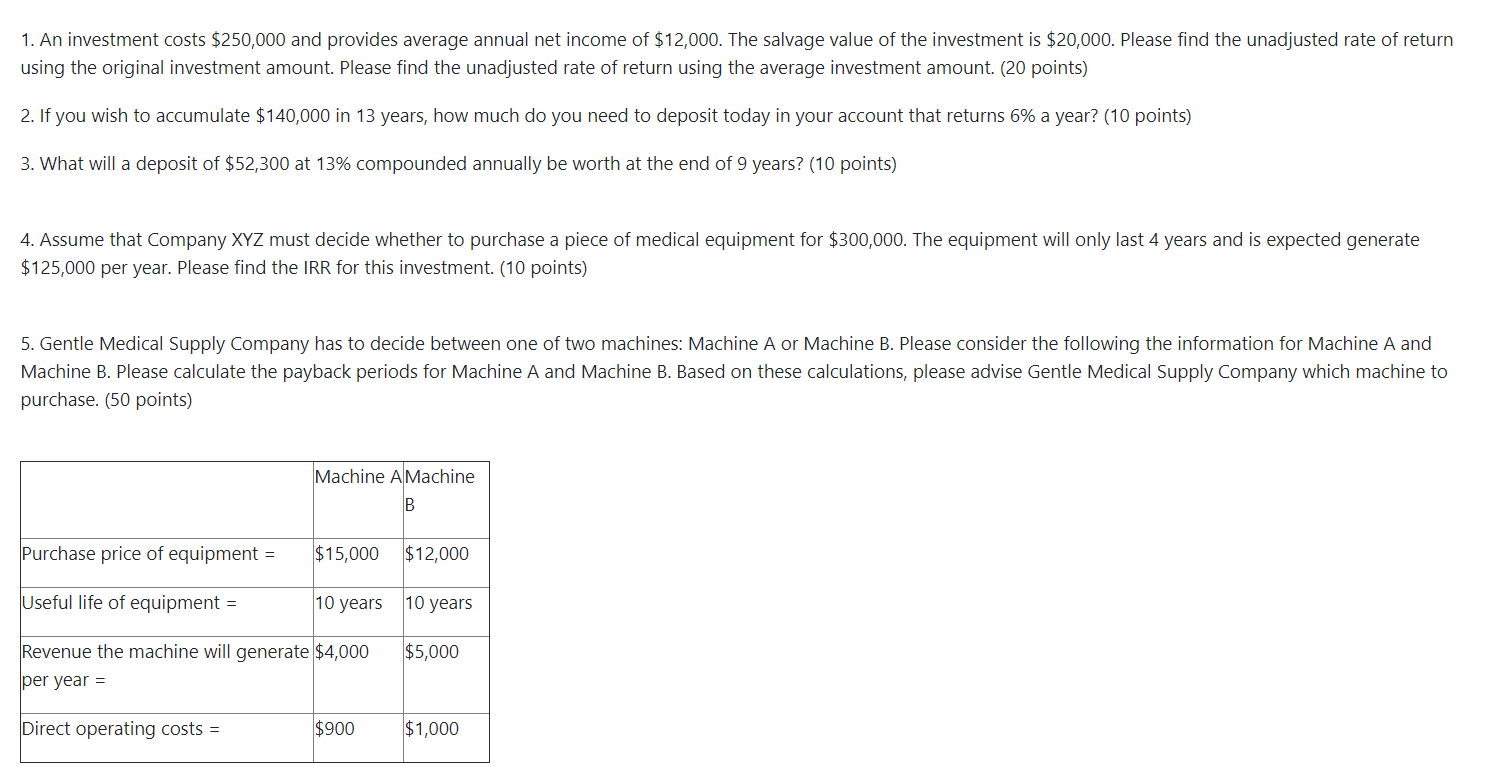

1. An investment costs $250,000 and provides average annual net income of $12,000. The salvage value of the investment is $20,000. Please find the unadjusted rate of return using the original investment amount. Please find the unadjusted rate of return using the average investment amount. (20 points) 2. If you wish to accumulate $140,000 in 13 years, how much do you need to deposit today in your account that returns 6% a year? (10 points) 3. What will a deposit of $52,300 at 13% compounded annually be worth at the end of 9 years? (10 points) 4. Assume that Company XYZ must decide whether to purchase a piece of medical equipment for $300,000. The equipment will only last 4 years and is expected generate $125,000 per year. Please find the IRR for this investment. (10 points) 5. Gentle Medical Supply Company has to decide between one of two machines: Machine A or Machine B. Please consider the following the information for Machine A and Machine B. Please calculate the payback periods for Machine A and Machine B. Based on these calculations, please advise Gentle Medical Supply Company which machine to purchase. (50 points) Machine A Machine B Purchase price of equipment = $15,000 $12,000 Useful life of equipment = 10 years 10 years $5,000 Revenue the machine will generate $4,000 per year = Direct operating costs = $900 $1,000 1. An investment costs $250,000 and provides average annual net income of $12,000. The salvage value of the investment is $20,000. Please find the unadjusted rate of return using the original investment amount. Please find the unadjusted rate of return using the average investment amount. (20 points) 2. If you wish to accumulate $140,000 in 13 years, how much do you need to deposit today in your account that returns 6% a year? (10 points) 3. What will a deposit of $52,300 at 13% compounded annually be worth at the end of 9 years? (10 points) 4. Assume that Company XYZ must decide whether to purchase a piece of medical equipment for $300,000. The equipment will only last 4 years and is expected generate $125,000 per year. Please find the IRR for this investment. (10 points) 5. Gentle Medical Supply Company has to decide between one of two machines: Machine A or Machine B. Please consider the following the information for Machine A and Machine B. Please calculate the payback periods for Machine A and Machine B. Based on these calculations, please advise Gentle Medical Supply Company which machine to purchase. (50 points) Machine A Machine B Purchase price of equipment = $15,000 $12,000 Useful life of equipment = 10 years 10 years $5,000 Revenue the machine will generate $4,000 per year = Direct operating costs = $900 $1,000