Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An investor sets aside $10,000 when they are 18 years old. How much will the investor have accumulated at the end of 50

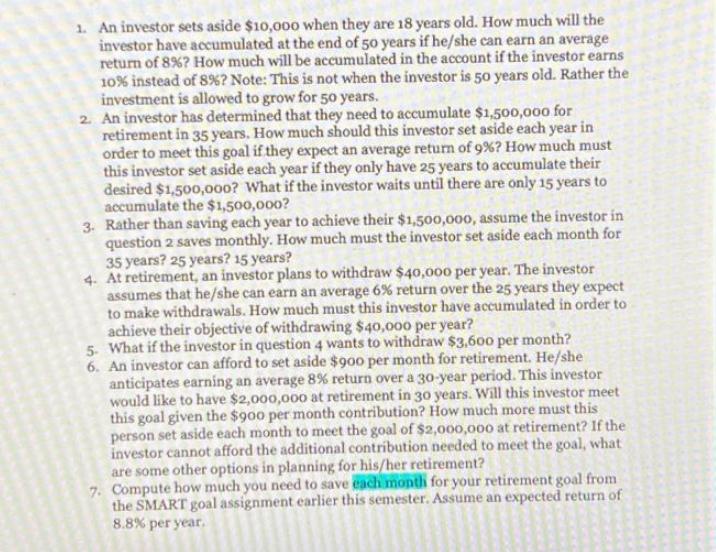

1. An investor sets aside $10,000 when they are 18 years old. How much will the investor have accumulated at the end of 50 years if he/she can earn an average return of 8% ? How much will be accumulated in the account if the investor earns 10% instead of 8% ? Note: This is not when the investor is 50 years old. Rather the investment is allowed to grow for 50 years. 2. An investor has determined that they need to accumulate $1,500,000 for retirement in 35 years. How much should this investor set aside each year in order to meet this goal if they expect an average return of 9% ? How much must this investor set aside each year if they only have 25 years to accumulate their desired $1,500,000? What if the investor waits until there are only 15 years to accumulate the $1,500,000? 3. Rather than saving each year to achieve their $1,500,000, assume the investor in question 2 saves monthly. How much must the investor set aside each month for 35 years? 25 years? 15 years? 4. At retirement, an investor plans to withdraw $40,000 per year. The investor assumes that he/she can earn an average 6% return over the 25 years they expect to make withdrawals. How much must this investor have accumulated in order to achieve their objective of withdrawing $40,000 per year? 5. What if the investor in question 4 wants to withdraw $3,600 per month? 6. An investor can afford to set aside $900 per month for retirement. He/she anticipates earning an average 8% return over a 30-year period. This investor would like to have $2,000,000 at retirement in 30 years. Will this investor meet this goal given the $900 per month contribution? How much more must this person set aside each month to meet the goal of $2,000,000 at retirement? If the investor cannot afford the additional contribution needed to meet the goal, what are some other options in planning for his/her retirement? 7. Compute how much you need to save each month for your retirement goal from the SMART goal assignment earlier this semester. Assume an expected return of 8.8% per year.

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Investor Accumulation After 50 Years Initial investment 10000 Average return 8 Formula for future value of a single sum FV PV 1 rn where FV is the fut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started