Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. an old stock/a new stock 2. an old stock/a new stock 3. doesn't needeeds 11. Dividend reinvestment plans Dividend reinvestment plans (DRIPs) allow shareholders

1. an old stock/a new stock 2. an old stock/a new stock 3. doesn't needeeds

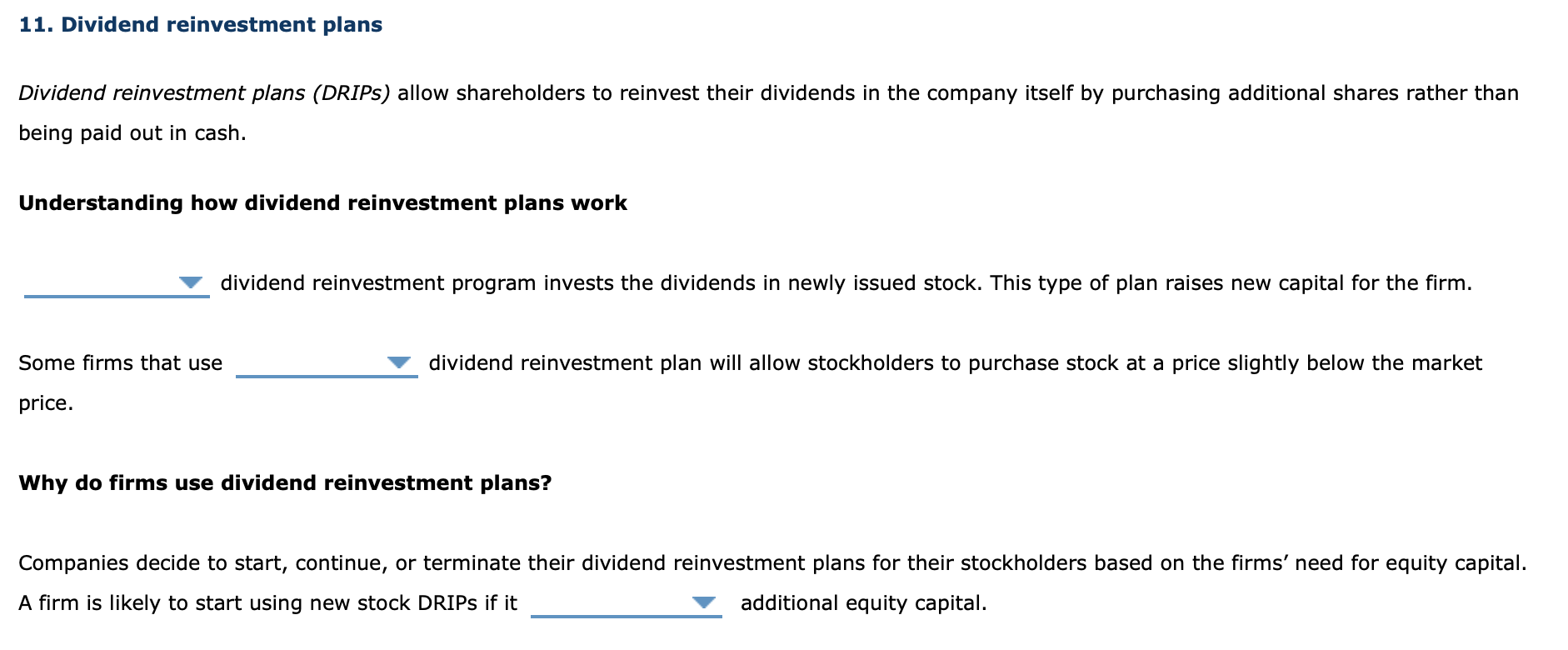

11. Dividend reinvestment plans Dividend reinvestment plans (DRIPs) allow shareholders to reinvest their dividends in the company itself by purchasing additional shares rather than being paid out in cash. Understanding how dividend reinvestment plans work dividend reinvestment program invests the dividends in newly issued stock. This type of plan raises new capital for the firm. Some firms that use dividend reinvestment plan will allow stockholders to purchase stock at a price slightly below the market price. Why do firms use dividend reinvestment plans? Companies decide to start, continue, or terminate their dividend reinvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it additional equity capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started