1. An Overview of Panera Bread's current financial situation read Guide to Case Analysis as an overall guide. A. Analyze Current Financial Situation based complete a financial audit analysis of ratios within each of the four ratio categories, common size analysis, and comparison to industry specific averages Use all the data years in case for calculations of ratios, common size analysis and for the compounded annual growth rates.

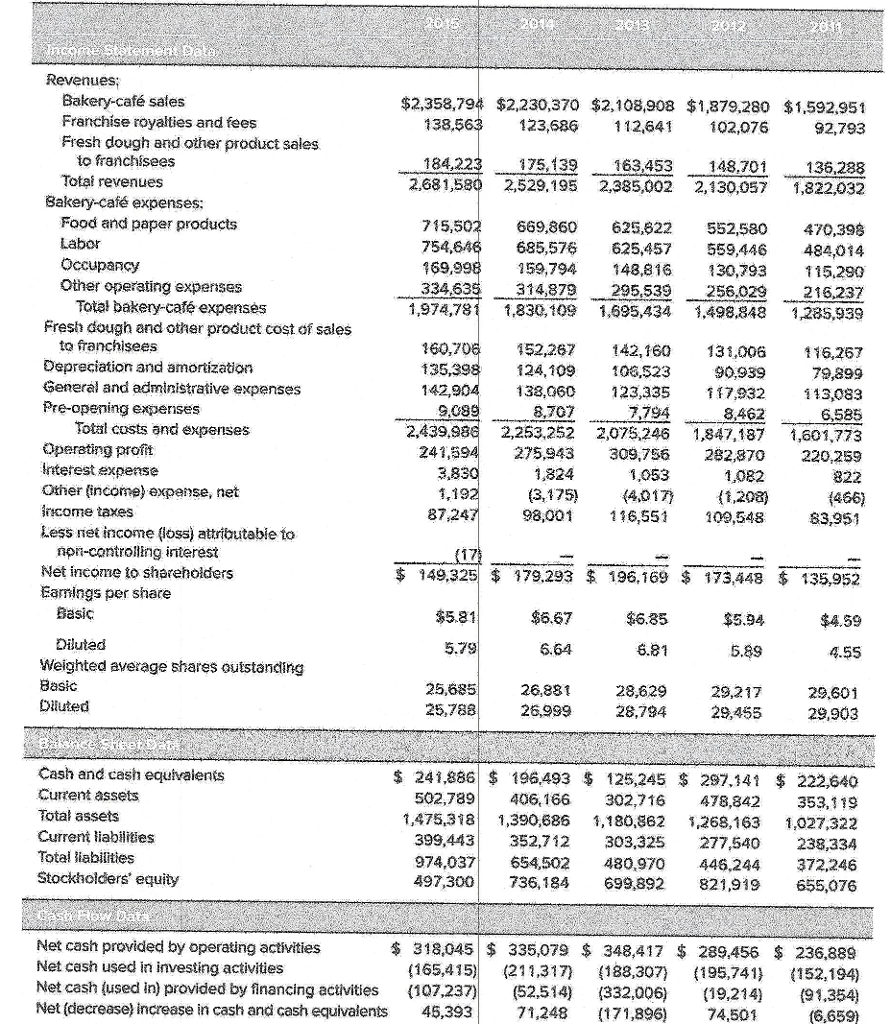

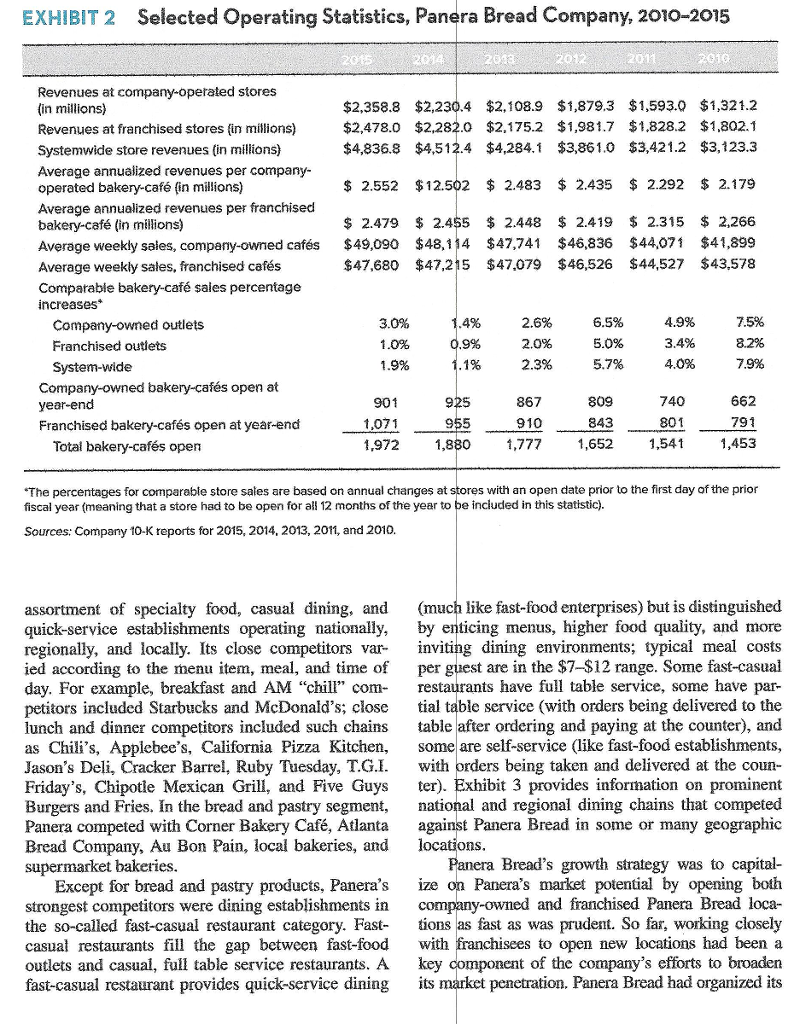

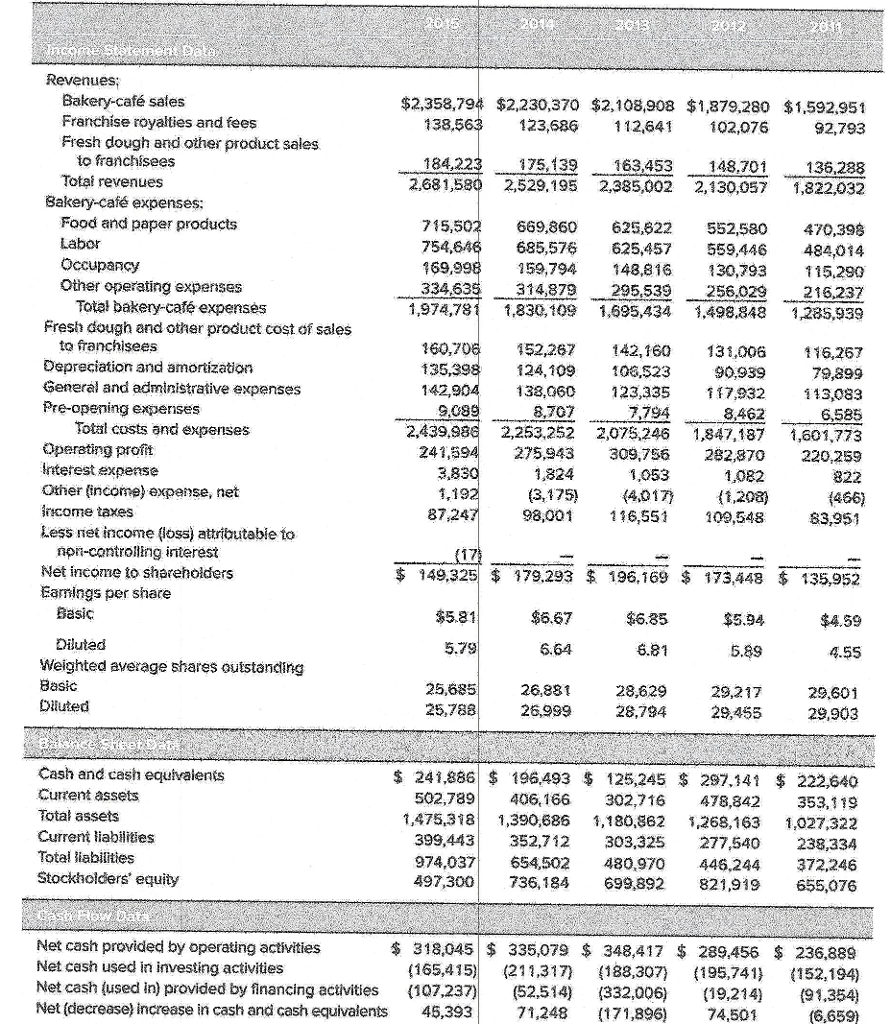

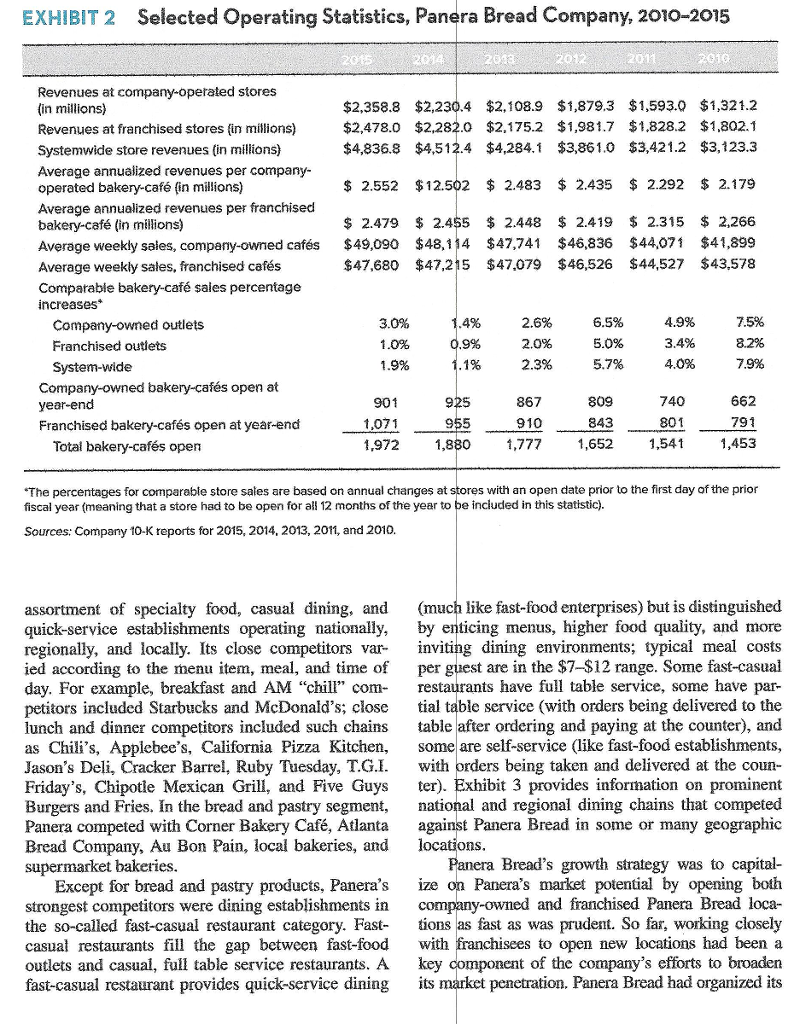

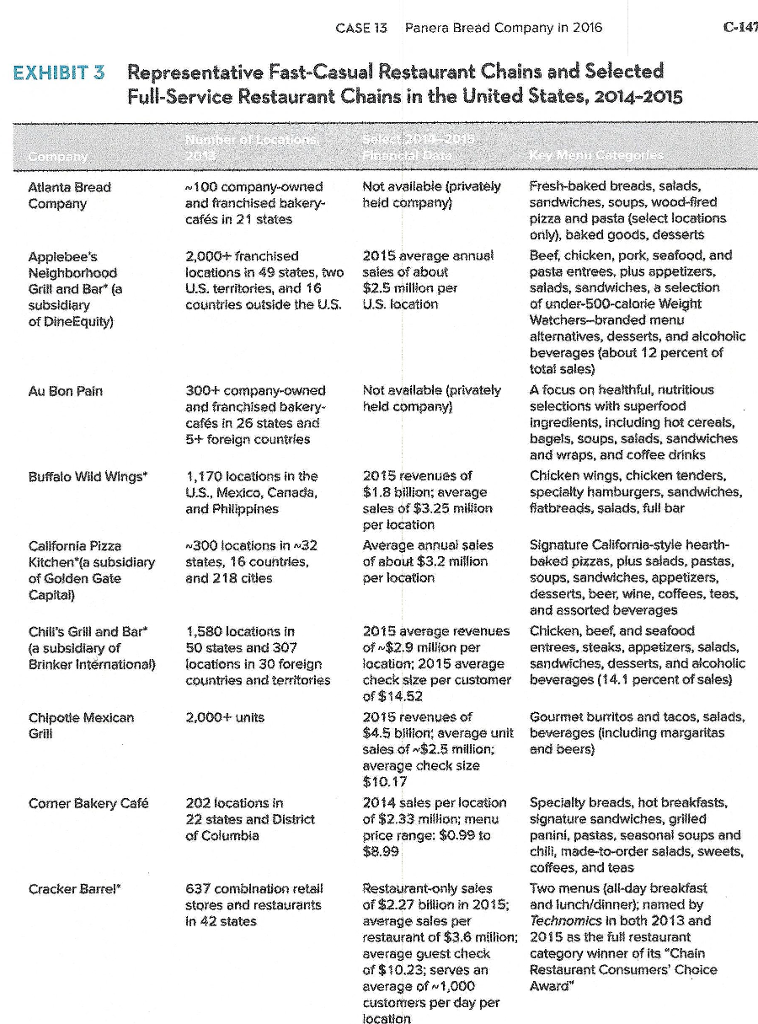

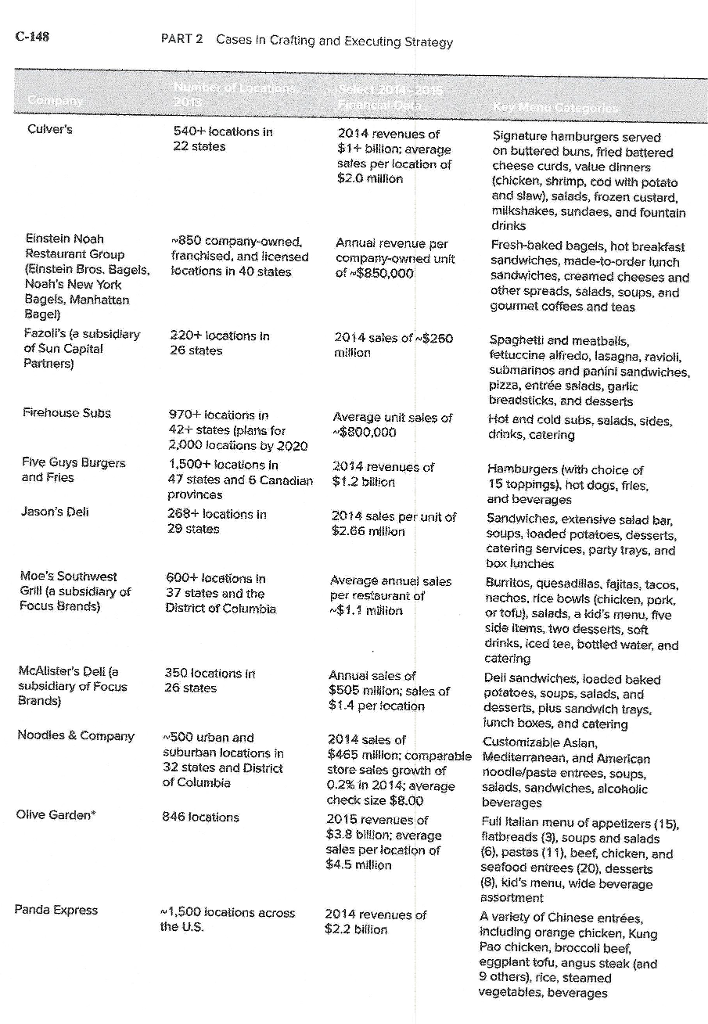

Revenues Bakery-caf safes Franchise royalties and fees Fresh dough and other product sales $2,358,79 $2,230,370 $2,108,908 $1,879,280$1,592,951 92,793 138,56 123,686 112,641 102,076 to franchlsees 184,22 175,139 163,453 148,701 136,288 2.681,580 2,529,195 2,385,002 2,130,057 1,822,032 Totai revenues Bakery-caf expenses: Food and paper products Labor 715,502 669,860 625,622 552,580 470,398 685,576 625,457 559,446 484,014 159,794 148,816 130,793 115,290 314879295539256,02216.237 1,974,781 1,830,109 1,695,434 1,498848 1,285,939 754,64 169,99 33463 Other operating experses Total bakery-caf expenss Fresh dough and other product cost of sales to franchisees Depreciation and amortization General and administrative expenses Pre-opening experises 152,267 142,160 131,006 116,267 79,899 138,060 123,335 17,932 13,083 6,585 2439,986 2,253252 2,075246 1,847,187 1,601,773 241,594 275,943 309,7S6 282,870 220,259 822 160,70 135,39 142,90 124,109 103,S23 90939 8,707 7,794 8,462 Total costs and expenses Operating proft interest expense Other (income) expense, net irscome taxes Less net income (oss) attributable to 1,824 (3,175) 3,83 1,082 (1,208 (4,017) 87,24 98,001 116,551 10,548 83,951 npr-cantrolling interest Net income to shoreholders Eamings per share 17 $ 149,325 $ 179,293 $ 196, 169 $ 173,448 135,952 $6.57 $6.35 $3.94 Diluted Weighted average shares outstandiing Basic Dluted 5.73 4.55 25,685 25,788 26,881 26,999 28,629 28,794 29,217 29,455 29,601 29,903 Cash and cash equvalents Curtent assets Total assets Current liabilities Total liabllities Stockholders' equity $ 241.886$. 196.493125,245297,141 222,640 502,789406,166 302,716 A78,842 353,119 1,475,3181,390,686 1,180,862 1,268,163 1,027,322 399,443 352,712 303,325 277,540 238,334 974,037 654,502 480,970 446,244 372,246 497,300736,184 699,892 821,919 655,076 Net cash provided by operating activities Net cash used in investing activities Net cash (used in) provided by inancing acivities (107237)52514) (332,006 (19,214) 91354 Net (decrease) ncrease in cash and cash equivalents 45,393 71,248 171,896) 74,501 $ 318,045 $ 335,079 $ 348,417 289,456 $ 236,889 (165,415(211,317 (188,307) 195,741 152,194) (6,659 Revenues Bakery-caf safes Franchise royalties and fees Fresh dough and other product sales $2,358,79 $2,230,370 $2,108,908 $1,879,280$1,592,951 92,793 138,56 123,686 112,641 102,076 to franchlsees 184,22 175,139 163,453 148,701 136,288 2.681,580 2,529,195 2,385,002 2,130,057 1,822,032 Totai revenues Bakery-caf expenses: Food and paper products Labor 715,502 669,860 625,622 552,580 470,398 685,576 625,457 559,446 484,014 159,794 148,816 130,793 115,290 314879295539256,02216.237 1,974,781 1,830,109 1,695,434 1,498848 1,285,939 754,64 169,99 33463 Other operating experses Total bakery-caf expenss Fresh dough and other product cost of sales to franchisees Depreciation and amortization General and administrative expenses Pre-opening experises 152,267 142,160 131,006 116,267 79,899 138,060 123,335 17,932 13,083 6,585 2439,986 2,253252 2,075246 1,847,187 1,601,773 241,594 275,943 309,7S6 282,870 220,259 822 160,70 135,39 142,90 124,109 103,S23 90939 8,707 7,794 8,462 Total costs and expenses Operating proft interest expense Other (income) expense, net irscome taxes Less net income (oss) attributable to 1,824 (3,175) 3,83 1,082 (1,208 (4,017) 87,24 98,001 116,551 10,548 83,951 npr-cantrolling interest Net income to shoreholders Eamings per share 17 $ 149,325 $ 179,293 $ 196, 169 $ 173,448 135,952 $6.57 $6.35 $3.94 Diluted Weighted average shares outstandiing Basic Dluted 5.73 4.55 25,685 25,788 26,881 26,999 28,629 28,794 29,217 29,455 29,601 29,903 Cash and cash equvalents Curtent assets Total assets Current liabilities Total liabllities Stockholders' equity $ 241.886$. 196.493125,245297,141 222,640 502,789406,166 302,716 A78,842 353,119 1,475,3181,390,686 1,180,862 1,268,163 1,027,322 399,443 352,712 303,325 277,540 238,334 974,037 654,502 480,970 446,244 372,246 497,300736,184 699,892 821,919 655,076 Net cash provided by operating activities Net cash used in investing activities Net cash (used in) provided by inancing acivities (107237)52514) (332,006 (19,214) 91354 Net (decrease) ncrease in cash and cash equivalents 45,393 71,248 171,896) 74,501 $ 318,045 $ 335,079 $ 348,417 289,456 $ 236,889 (165,415(211,317 (188,307) 195,741 152,194) (6,659