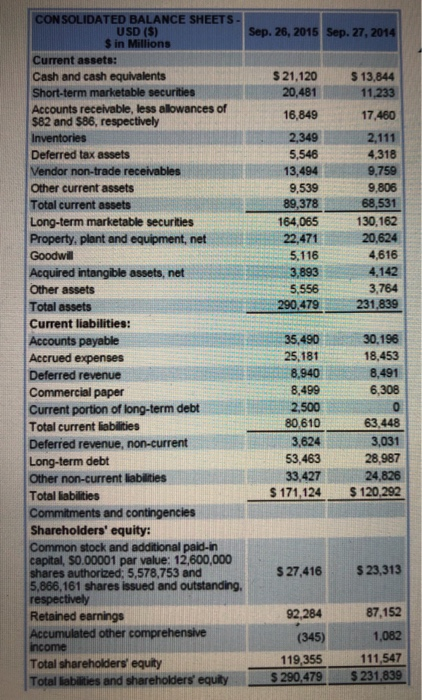

1. Analyze the following financial statement (2015). Market value of equity at the ending date of the fiscal year 2015 is 618 billion. (60 points) Show your calculation and analysis to get full points. CONSOLIDATED BALANCE SHEETS USD ($) Sep. 26, 2015 Sep. 27, 2014 $ in Millions Current assets: Cash and cash equivalents $ 21,120 $ 13,844 Short-term marketable securities 20,481 11,233 Accounts receivable, less allowances of $82 and $86, respectively 16,849 17,460 Inventories 2,349 2,111 Deferred tax assets 5,546 4,318 Vendor non-trade receivables 13,494 9,759 Other current assets 9,539 9,806 Total current assets 89,378 68,531 Long-term marketable securities 164,065 130,162 Property, plant and equipment, net 22,471 20,624 Goodwill 5.116 4,616 Acquired intangible assets, net 3,893 4.142 Other assets 5,556 3,764 Total assets 290,479 231.839 Current liabilities: Accounts payable 35,490 30.196 Accrued expenses 25, 181 18,453 Deferred revenue 8.940 8.491 Commercial paper 8,499 6,308 Current portion of long-term debt 2,500 0 Total current liabilities 80 610 63.448 Deferred revenue, non-current 3,624 3,031 Long-term debt 53,463 28,987 Other non-current liabilities 33,427 24,826 Total labilities $ 171,124 $ 120,292 Commitments and contingencies Shareholders' equity: Common stock and additional paid in capital, 80.00001 par value: 12,600,000 shares authorized: 5,578,753 and $ 27,416 $ 23,313 5,866,161 shares issued and outstanding, respectively Retained earnings 92,284 87,152 Accumulated other comprehensive (345) 1,082 Income Total shareholders' equity 119,355 111,547 Total liabilities and shareholders equity $ 290,479 $ 231.839 1. Analyze the following financial statement (2015). Market value of equity at the ending date of the fiscal year 2015 is 618 billion. (60 points) Show your calculation and analysis to get full points. CONSOLIDATED BALANCE SHEETS USD ($) Sep. 26, 2015 Sep. 27, 2014 $ in Millions Current assets: Cash and cash equivalents $ 21,120 $ 13,844 Short-term marketable securities 20,481 11,233 Accounts receivable, less allowances of $82 and $86, respectively 16,849 17,460 Inventories 2,349 2,111 Deferred tax assets 5,546 4,318 Vendor non-trade receivables 13,494 9,759 Other current assets 9,539 9,806 Total current assets 89,378 68,531 Long-term marketable securities 164,065 130,162 Property, plant and equipment, net 22,471 20,624 Goodwill 5.116 4,616 Acquired intangible assets, net 3,893 4.142 Other assets 5,556 3,764 Total assets 290,479 231.839 Current liabilities: Accounts payable 35,490 30.196 Accrued expenses 25, 181 18,453 Deferred revenue 8.940 8.491 Commercial paper 8,499 6,308 Current portion of long-term debt 2,500 0 Total current liabilities 80 610 63.448 Deferred revenue, non-current 3,624 3,031 Long-term debt 53,463 28,987 Other non-current liabilities 33,427 24,826 Total labilities $ 171,124 $ 120,292 Commitments and contingencies Shareholders' equity: Common stock and additional paid in capital, 80.00001 par value: 12,600,000 shares authorized: 5,578,753 and $ 27,416 $ 23,313 5,866,161 shares issued and outstanding, respectively Retained earnings 92,284 87,152 Accumulated other comprehensive (345) 1,082 Income Total shareholders' equity 119,355 111,547 Total liabilities and shareholders equity $ 290,479 $ 231.839