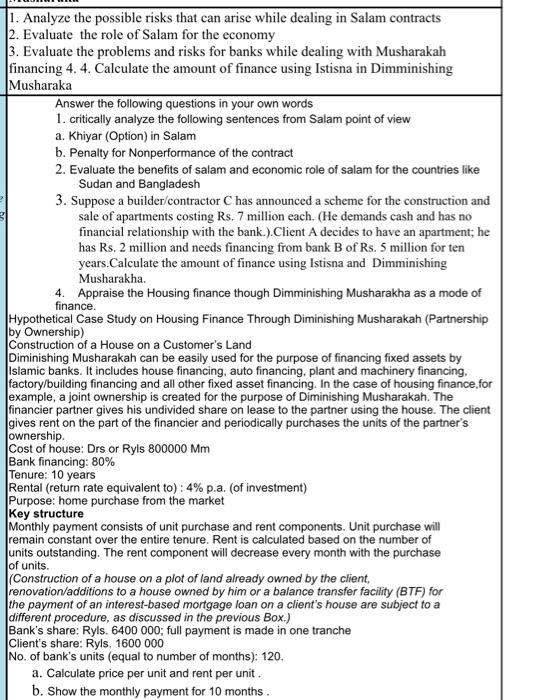

1. Analyze the possible risks that can arise while dealing in Salam contracts 2. Evaluate the role of Salam for the economy 3. Evaluate the problems and risks for banks while dealing with Musharakah financing 4. 4. Calculate the amount of finance using Istisna in Dimminishing Musharaka Answer the following questions in your own words 1. critically analyze the following sentences from Salam point of view a. Khiyar (Option) in Salam b. Penalty for Nonperformance of the contract 2. Evaluate the benefits of salam and economic role of salam for the countries like Sudan and Bangladesh 3. Suppose a builder/contractor C has announced a scheme for the construction and sale of apartments costing Rs. 7 million each. (He demands cash and has no financial relationship with the bank.).Client A decides to have an apartment; he has Rs. 2 million and needs financing from bank B of Rs. 5 million for ten years.Calculate the amount of finance using Istisna and Dimminishing Musharakha. 4. Appraise the Housing finance though Dimminishing Musharakha as a mode of finance. Hypothetical Case Study on Housing Finance Through Diminishing Musharakah (Partnership by Ownership) Construction of a House on a Customer's Land Diminishing Musharakah can be easily used for the purpose of financing fixed assets by Islamic banks. It includes house financing, auto financing, plant and machinery financing, factory/building financing and all other fixed asset financing. In the case of housing finance for example, a joint ownership is created for the purpose of Diminishing Musharakah. The financier partner gives his undivided share on lease to the partner using the house. The client gives rent on the part of the financier and periodically purchases the units of the partner's ownership Cost of house: Drs or Ryls 800000 MM Bank financing: 80% Tenure: 10 years Rental (return rate equivalent to): 4% p.a. (of investment) Purpose: home purchase from the market Key structure Monthly payment consists of unit purchase and rent components. Unit purchase will remain constant over the entire tenure. Rent is calculated based on the number of units outstanding. The rent component will decrease every month with the purchase of units. (Construction of a house on a plot of land already owned by the client, renovation/additions to a house owned by him or a balance transfer facility (BTF) for the payment of an interest-based mortgage loan on a client's house are subject to a different procedure, as discussed in the previous Box.) Bank's share: Ryls. 6400 000: full payment is made in one tranche Client's share: Ryls. 1600 000 No. of bank's units (equal to number of months): 120. a. Calculate price per unit and rent per unit. b. Show the monthly payment for 10 months