Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#1 and #8 number one and number eight grows by 4% cach year, will guarantee the pension to continue indefinitely (325.000) REVIEW EXERCISES FOR CHAPTER

#1 and #8

number one and number eight

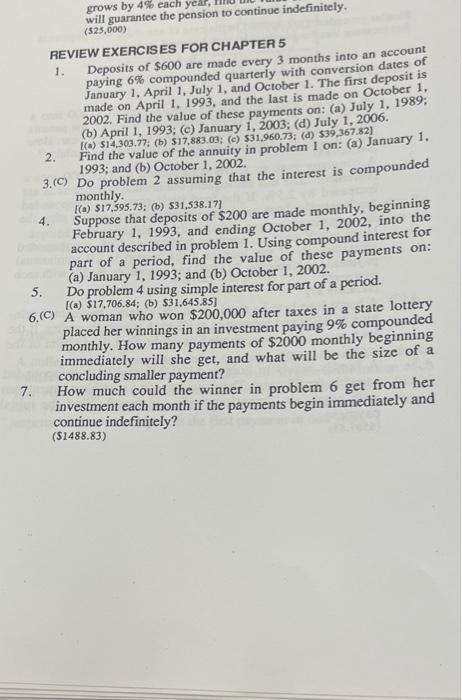

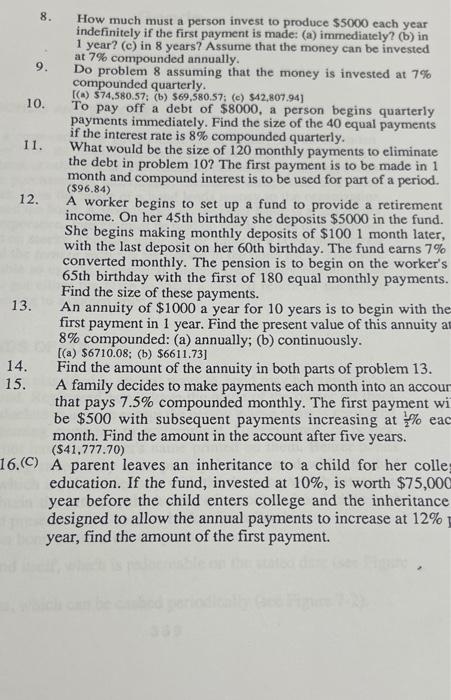

grows by 4% cach year, will guarantee the pension to continue indefinitely (325.000) REVIEW EXERCISES FOR CHAPTER 5 1. Deposits of $600 are made every 3 months into an account paying 6% compounded quarterly with conversion dates of January 1, April 1, July 1, and October 1. The first deposit is made on April 1, 1993, and the last is made on October 1, 2002. Find the value of these payments on: (a) July 1, 1989: (b) April 1, 1993: (c) January 1, 2003: (d) July 1, 2006. (a) 514,303.77; (b) $17,883.03; (e) $31.960.73; (d) $39,367.82) 2. Find the value of the annuity in problem 1 on: (a) January 1, 3.(C) Do problem 2 assuming that the interest is compounded monthly. (a) $17.595.73; (b) $31,538.17] 4. Suppose that deposits of $200 are made monthly, beginning February 1, 1993, and ending October 1, 2002, into the account described in problem 1. Using compound interest for part of a period, find the value of these payments on: (a) January 1, 1993; and (b) October 1, 2002. 5. Do problem 4 using simple interest for part of a period. [(a) $17,706.84; (b) $31,645.85] 6.(C) A woman who won $200,000 after taxes in a state lottery placed her winnings in an investment paying 9% compounded monthly. How many payments of $2000 monthly beginning immediately will she get, and what will be the size of a concluding smaller payment? 7. How much could the winner in problem 6 get from her investment each month if the payments begin immediately and continue indefinitely? (51488.83) 8. How much must a person invest to produce $5000 each year indefinitely if the first payment is made: (a) immediately? () in 1 year? (c) in 8 years? Assume that the money can be invested at 7% compounded annually. 9. Do problem 8 assuming that the money is invested at 7% compounded quarterly. (A) $74,580.57: (6) $69,580.57: (C) $42.807.94) 10. To pay off a debt of $8000, a person begins quarterly payments immediately. Find the size of the 40 equal payments if the interest rate is 8% compounded quarterly. 11. What would be the size of 120 monthly payments to eliminate the debt in problem 10? The first payment is to be made in 1 month and compound interest is to be used for part of a period. (596.84) . A worker begins to set up a fund to provide a retirement income. On her 45th birthday she deposits $5000 in the fund. She begins making monthly deposits of $100 1 month later, with the last deposit on her 60th birthday. The fund earns 7% converted monthly. The pension is to begin on the worker's 65th birthday with the first of 180 equal monthly payments. Find the size of these payments. 13. An annuity of $1000 a year for 10 years is to begin with the first payment in 1 year. Find the present value of this annuity a 8% compounded: (a) annually; (b) continuously. [(a) $6710.08; (b) $6611.73] Find the amount of the annuity in both parts of problem 13. 15. A family decides to make payments each month into an accoun that pays 7.5% compounded monthly. The first payment wi be $500 with subsequent payments increasing at % eac month. Find the amount in the account after five years. ($41,777.70) 16.) A parent leaves an inheritance to a child for her colle education. If the fund, invested at 10%, is worth $75,000 year before the child enters college and the inheritance designed to allow the annual payments to increase at 12% year, find the amount of the first payment. 14 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started