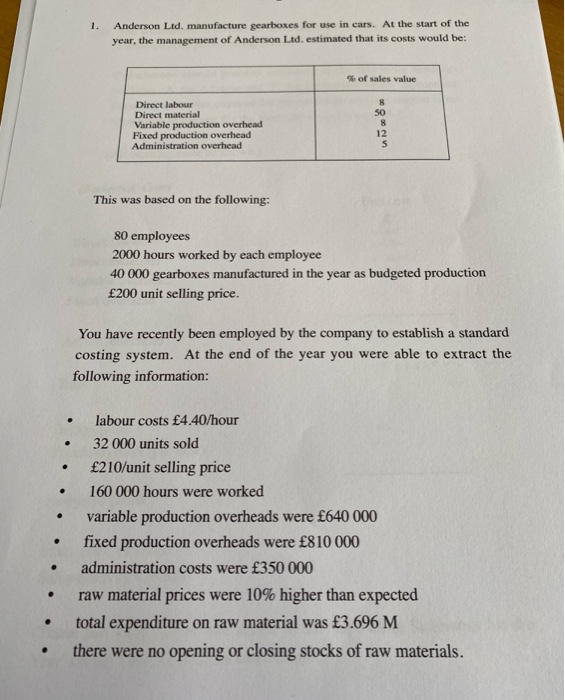

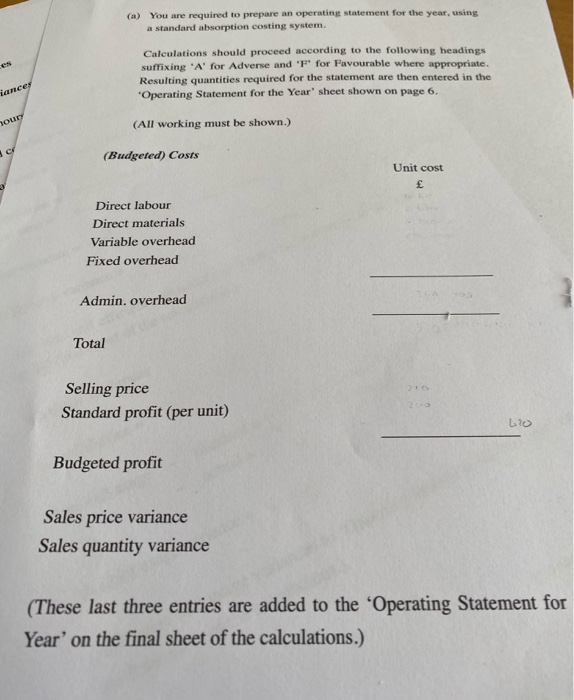

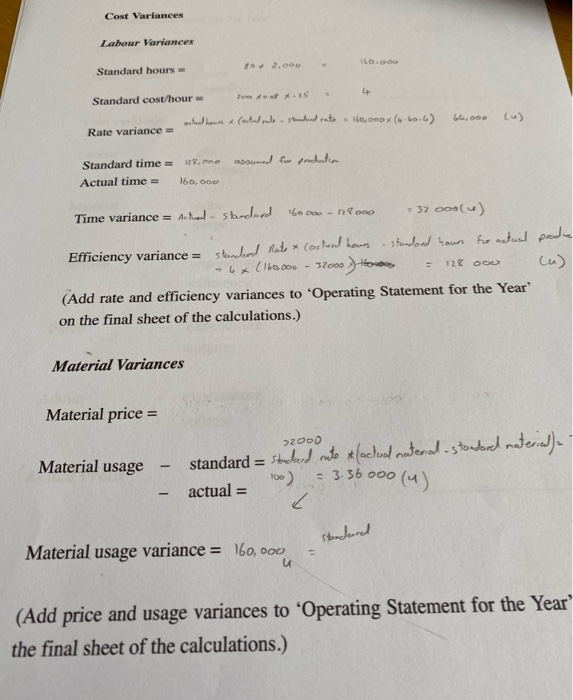

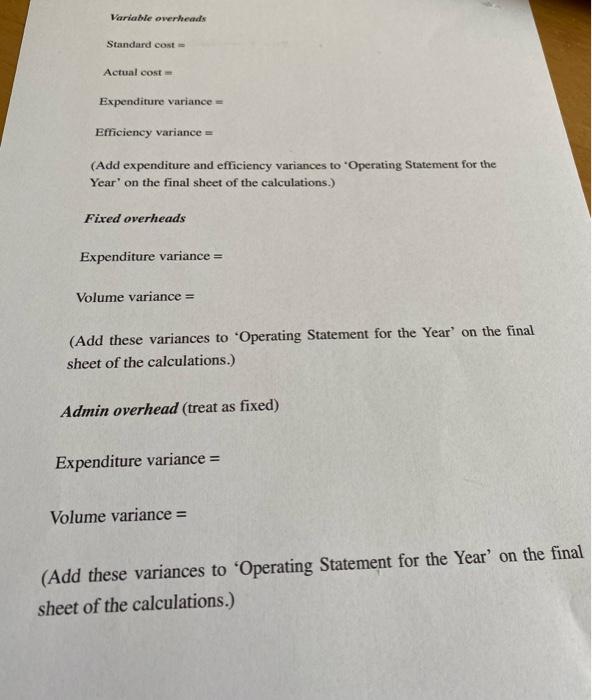

1. Anderson Ltd. manufacture gearboxes for use in cars. At the start of the year, the management of Anderson Ltd. estimated that its costs would be: % of sales value Direct labour Direct material Variable production overhead Fixed production overhead Administration overhead This was based on the following: 80 employees 2000 hours worked by each employee 40 000 gearboxes manufactured in the year as budgeted production 200 unit selling price. You have recently been employed by the company to establish a standard costing system. At the end of the year you were able to extract the following information: labour costs 4.40/hour 32 000 units sold 210/unit selling price 160 000 hours were worked variable production overheads were 640 000 fixed production overheads were 810 000 administration costs were 350 000 raw material prices were 10% higher than expected total expenditure on raw material was 3.696 M there were no opening or closing stocks of raw materials. (a) You are required to prepare an operating statement for the year, using a standard absorption costing system Calculations should proceed according to the following headings sumixing 'A' for Adverse and F for Favourable where appropriate Resulting quantities required for the statement are then entered in the 'Operating Statement for the Year' sheet shown on page 6. (All working must be shown.) (Budgeted) Costs Unit cost Direct labour Direct materials Variable overhead Fixed overhead Admin. overhead Total Selling price Standard profit (per unit) Budgeted profit Sales price variance Sales quantity variance (These last three entries are added to the 'Operating Statement for Year' on the final sheet of the calculations.) Cost Variances Labour Variances 2.000 - 10.00 Standard hours olulhous & Cartolombe - standard rate 160,000x (6.60.66) 66,000 (4) Rate variance = aboum fw procheta Standard time = Actual time = 128.000 160, ODD Time variance = Actual Studor 1600-1800 - 37 coolu) Efficiency variance = standard Rate (octua louns - standard hours for natured produce -ux libo, con - 32000 ) Homes = 128 cou cu) (Add rate and efficiency variances to 'Operating Statement for the Year on the final sheet of the calculations.) Material Variances Material price = 72000 Material usage - Standard = stdad rete lactual caterial-standard materia). 100) = 3.36000 (4) actual = Standard Material usage variance = 160,000,- (Add price and usage variances to 'Operating Statement for the Year the final sheet of the calculations.) Variable overheads Standard cost Actual cost Expenditure variance = Efficiency variance = (Add expenditure and efficiency variances to 'Operating Statement for the Year' on the final sheet of the calculations.) Fired overheads Expenditure variance = Volume variance = sheet of the calculations.) Admin overhead (treat as fixed) Expenditure variance = Volume variance = (Add these variances to 'Operating Statement for the Year on the final sheet of the calculations.)