Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Andrew purchased 500 shares of ABC, Inc. at $12 per share last year. Yesterday, ABC stock dropped to $8 per share and Andrew sold

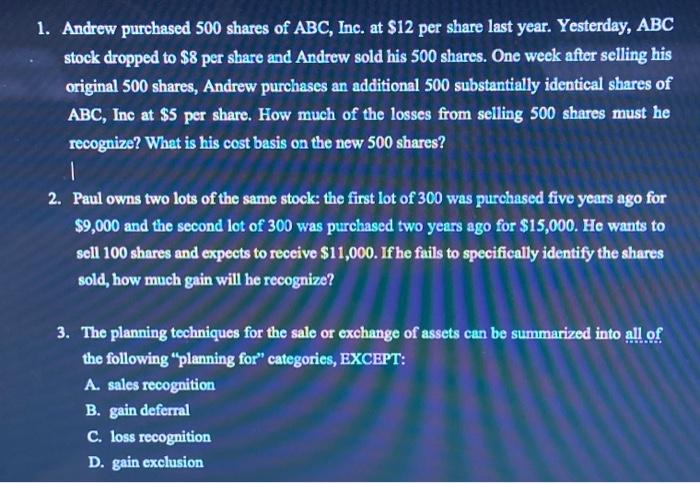

1. Andrew purchased 500 shares of ABC, Inc. at $12 per share last year. Yesterday, ABC stock dropped to $8 per share and Andrew sold his 500 shares. One week after selling his original 500 shares, Andrew purchases an additional 500 substantially identical shares of ABC, Inc at $5 per share. How much of the losses from selling 500 shares must he recognize? What is his cost basis on the new 500 shares? 1 2. Paul owns two lots of the same stock: the first lot of 300 was purchased five years ago for $9,000 and the second lot of 300 was purchased two years ago for $15,000. He wants to sell 100 shares and expects to receive $11,000. If he fails to specifically identify the shares sold, how much gain will he recognize? 3. The planning techniques for the sale or exchange of assets can be summarized into all of the following "planning for" categories, EXCEPT: A. sales recognition B. gain deferral C. loss recognition D. gain exclusion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started