Answered step by step

Verified Expert Solution

Question

1 Approved Answer

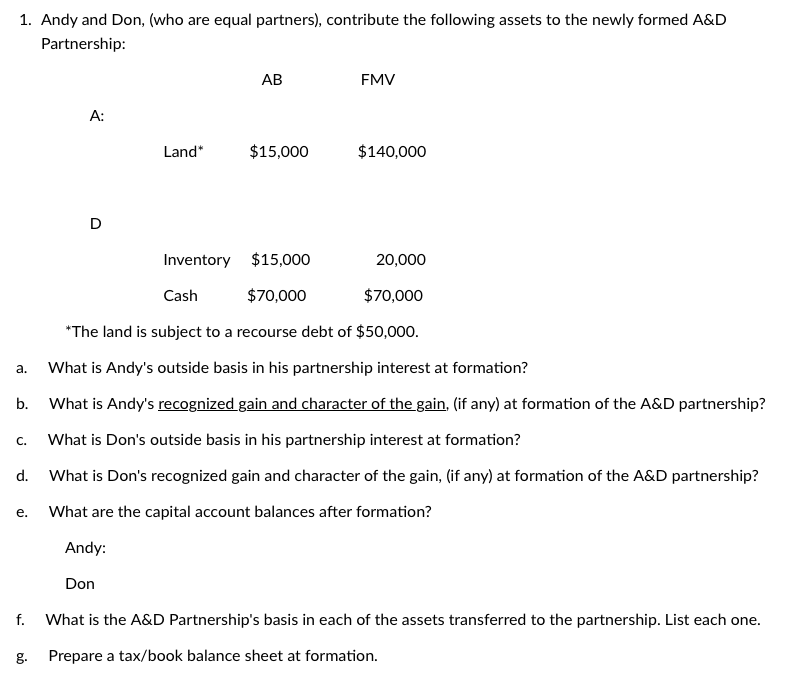

1. Andy and Don, (who are equal partners), contribute the following assets to the newly formed A&D Partnership: a. b. C. d. e. f.

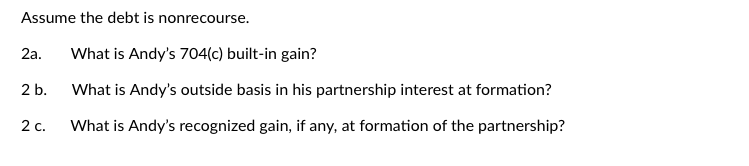

1. Andy and Don, (who are equal partners), contribute the following assets to the newly formed A&D Partnership: a. b. C. d. e. f. g. A: D Land* AB $15,000 Inventory $15,000 $70,000 FMV $140,000 20,000 Cash $70,000 *The land is subject to a recourse debt of $50,000. What is Andy's outside basis in his partnership interest at formation? What is Andy's recognized gain and character of the gain, (if any) at formation of the A&D partnership? What is Don's outside basis in his partnership interest at formation? What is Don's recognized gain and character of the gain, (if any) at formation of the A&D partnership? What are the capital account balances after formation? Andy: Don What is the A&D Partnership's basis in each of the assets transferred to the partnership. List each one. Prepare a tax/book balance sheet at formation. Assume the debt is nonrecourse. 2a. 2 b. 2 c. What is Andy's 704(c) built-in gain? What is Andy's outside basis in his partnership interest at formation? What is Andy's recognized gain, if any, at formation of the partnership? 1. Andy and Don, (who are equal partners), contribute the following assets to the newly formed A&D Partnership: a. b. C. d. e. f. g. A: D Land* AB $15,000 Inventory $15,000 $70,000 FMV $140,000 20,000 Cash $70,000 *The land is subject to a recourse debt of $50,000. What is Andy's outside basis in his partnership interest at formation? What is Andy's recognized gain and character of the gain, (if any) at formation of the A&D partnership? What is Don's outside basis in his partnership interest at formation? What is Don's recognized gain and character of the gain, (if any) at formation of the A&D partnership? What are the capital account balances after formation? Andy: Don What is the A&D Partnership's basis in each of the assets transferred to the partnership. List each one. Prepare a tax/book balance sheet at formation. Assume the debt is nonrecourse. 2a. 2 b. 2 c. What is Andy's 704(c) built-in gain? What is Andy's outside basis in his partnership interest at formation? What is Andy's recognized gain, if any, at formation of the partnership?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Andys Outside Basis at Formation Andys outside basis at formation is calculated based on the contributions he made to the partnership Land FMV 14000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started