Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Answer the following: (a) PREPARE a working capital estimate to finance an activity level of 52,000 units a year (52 weeks) based on

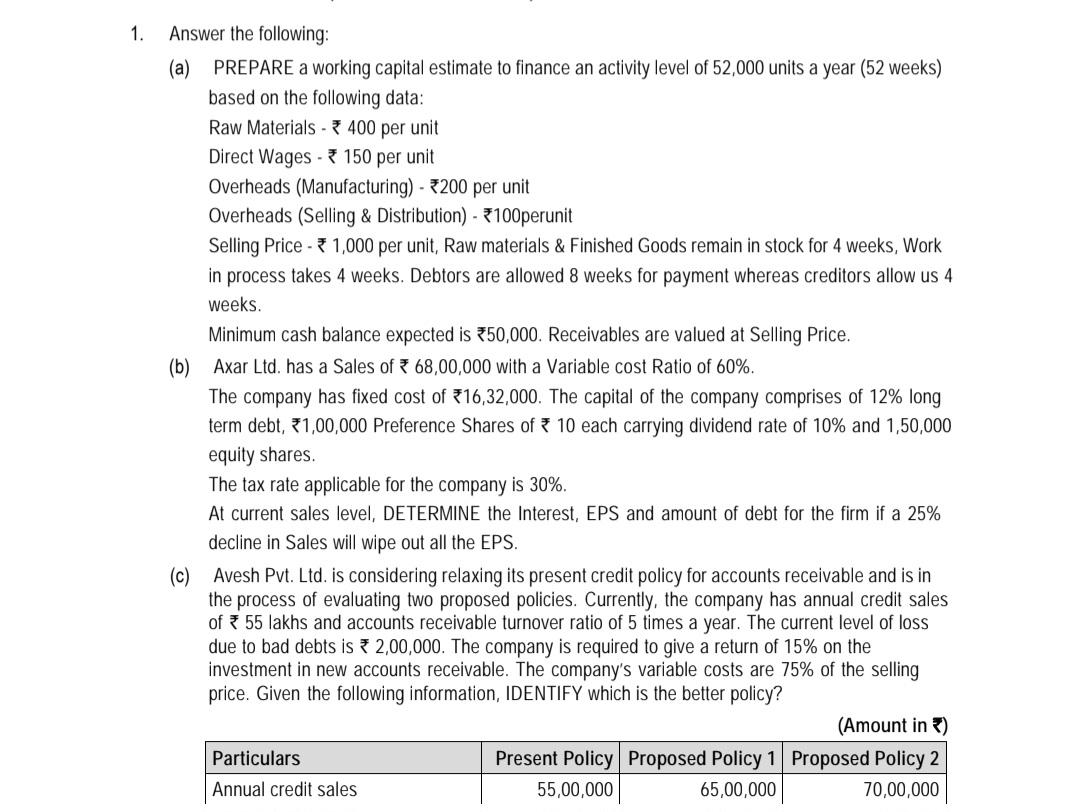

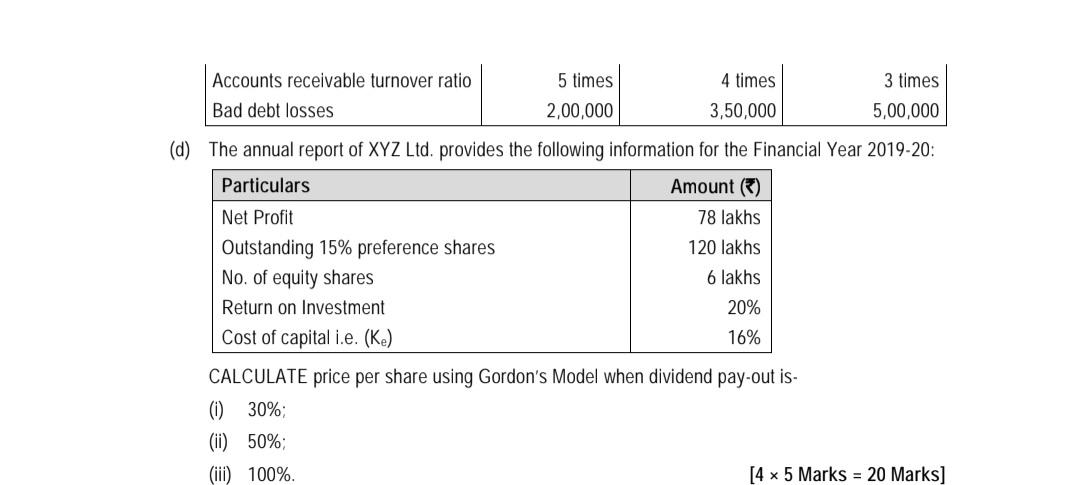

1. Answer the following: (a) PREPARE a working capital estimate to finance an activity level of 52,000 units a year (52 weeks) based on the following data: Raw Materials 400 per unit Direct Wages 150 per unit Overheads (Manufacturing) - 200 per unit Overheads (Selling & Distribution) - 100perunit Selling Price 1,000 per unit, Raw materials & Finished Goods remain in stock for 4 weeks, Work in process takes 4 weeks. Debtors are allowed 8 weeks for payment whereas creditors allow us 4 weeks. Minimum cash balance expected is 50,000. Receivables are valued at Selling Price. (b) Axar Ltd. has a Sales of 68,00,000 with a Variable cost Ratio of 60%. The company has fixed cost of 16,32,000. The capital of the company comprises of 12% long. term debt, 1,00,000 Preference Shares of 10 each carrying dividend rate of 10% and 1,50,000 equity shares. The tax rate applicable for the company is 30%. At current sales level, DETERMINE the Interest, EPS and amount of debt for the firm if a 25% decline in Sales will wipe out all the EPS. (c) Avesh Pvt. Ltd. is considering relaxing its present credit policy for accounts receivable and is in the process of evaluating two proposed policies. Currently, the company has annual credit sales of 55 lakhs and accounts receivable turnover ratio of 5 times a year. The current level of loss due to bad debts is 2,00,000. The company is required to give a return of 15% on the investment in new accounts receivable. The company's variable costs are 75% of the selling price. Given the following information, IDENTIFY which is the better policy? Particulars Annual credit sales (Amount in) Present Policy Proposed Policy 1 Proposed Policy 2 55,00,000 65,00,000 70,00,000 Accounts receivable turnover ratio Bad debt losses 5 times 2,00,000 4 times 3,50,000 3 times 5,00,000 (d) The annual report of XYZ Ltd. provides the following information for the Financial Year 2019-20: Particulars Amount (3) Net Profit 78 lakhs Outstanding 15% preference shares 120 lakhs No. of equity shares 6 lakhs Return on Investment 20% Cost of capital i.e. (Ke) 16% CALCULATE price per share using Gordon's Model when dividend pay-out is- (i) 30%; (ii) 50%; (iii) 100%. [4 x 5 Marks = 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started