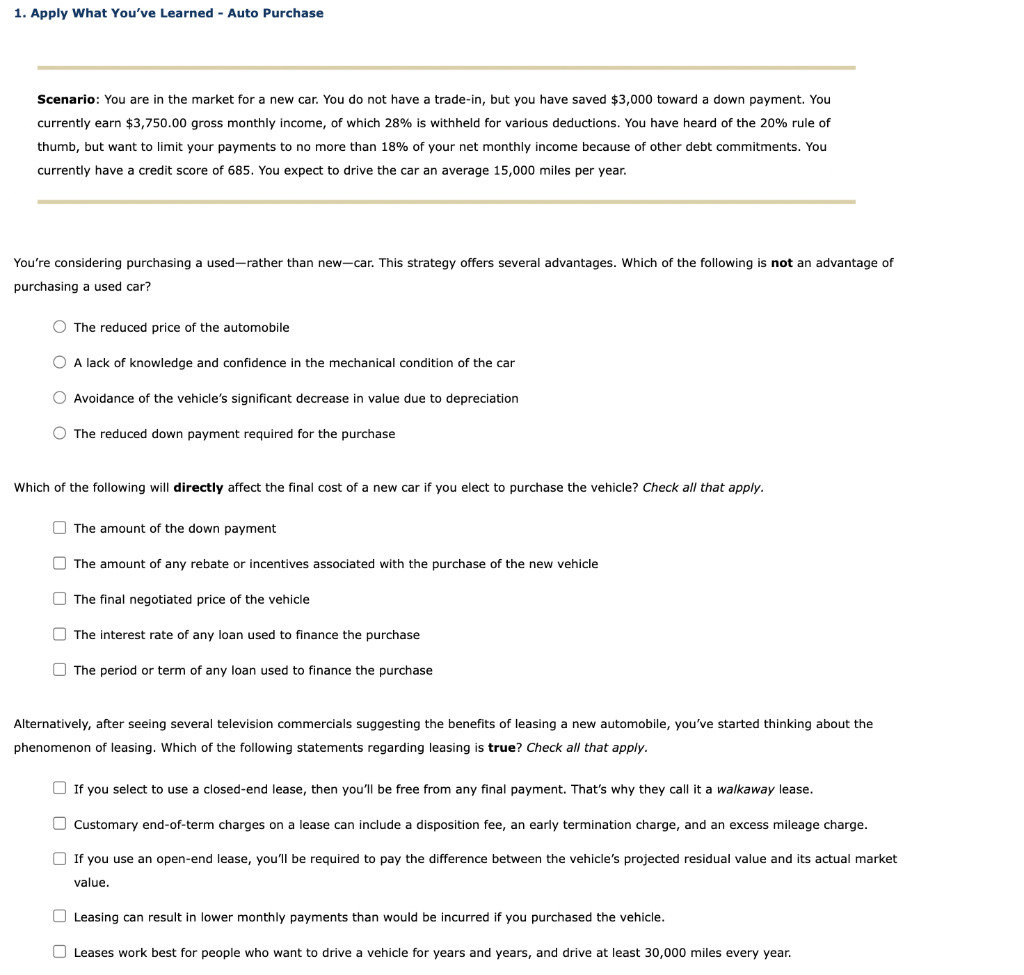

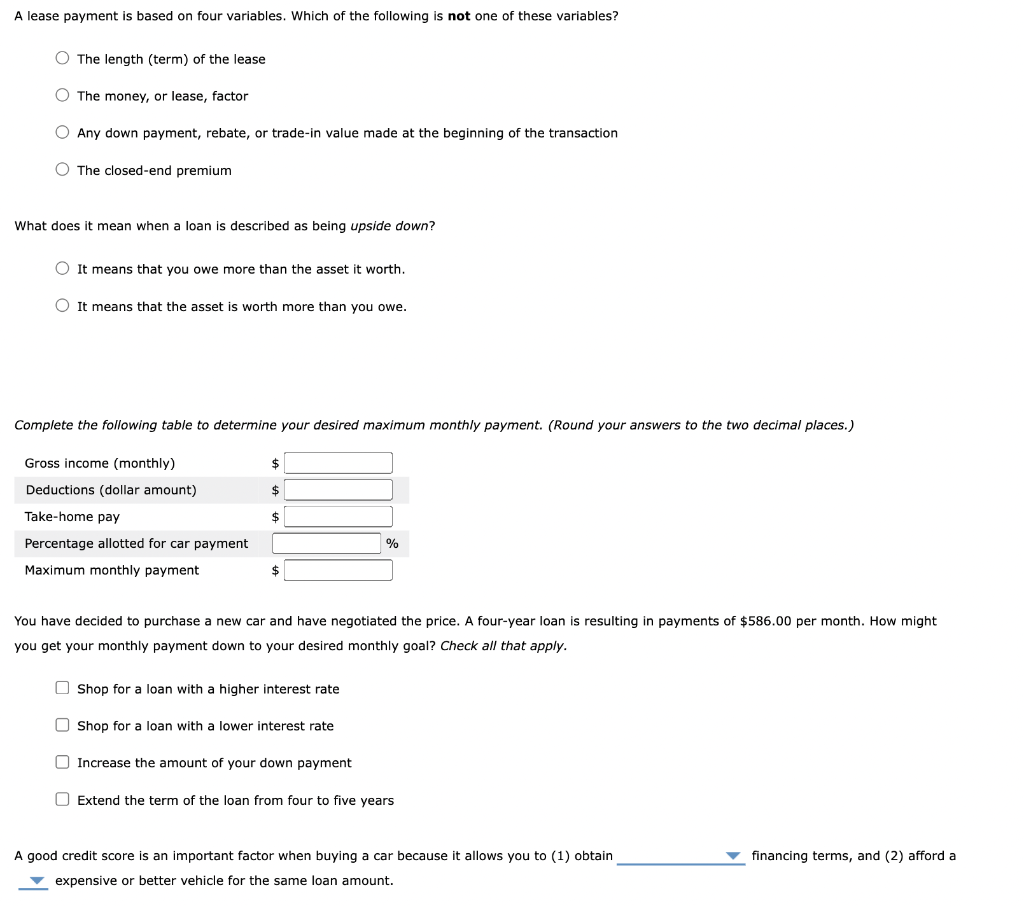

1. Apply What You've Learned - Auto Purchase Scenario: You are in the market for a new car. You do not have a trade-in, but you have saved $3,000 toward a down payment. You currently earn $3,750.00 gross monthly income, of which 28% is withheld for various deductions. You have heard of the 20% rule of thumb, but want to limit your payments to no more than 18% of your net monthly income because of other debt commitments. You currently have a credit score of 685. You expect to drive the car an average 15,000 miles per year. You're considering purchasing a used-rather than new-car. This strategy offers several advantages. Which of the following is not an advantage of purchasing a used car? The reduced price of the automobile O A lack of knowledge and confidence in the mechanical condition of the car Avoidance of the vehicle's significant decrease in value due to depreciation The reduced down payment required for the purchase Which of the following will directly affect the final cost of a new car if you elect to purchase the vehicle? Check all that apply. The amount of the down payment The amount of any rebate or incentives associated with the purchase of the new vehicle The final negotiated price of the vehicle The interest rate of any loan used to finance the purchase The period or term of any loan used to finance the purchase Alternatively, after seeing several television commercials suggesting the benefits of leasing a new automobile, you've started thinking about the phenomenon of leasing. Which of the following statements regarding leasing is true? Check all that apply. If you select to use a closed-end lease, then you'll be free from any final payment. That's why they call it a walkaway lease. Customary end-of-term charges on a lease can include a disposition fee, an early termination charge, and an excess mileage charge. If you use an open-end lease, you'll be required to pay the difference between the vehicle's projected residual value and its actual market value. Leasing can result in lower monthly payments than would be incurred if you purchased the vehicle. Leases work best for people who want to drive a vehicle for years and years, and drive at least 30,000 miles every year. A lease payment is based on four variables. Which of the following is not one of these variables? O The length (term) of the lease The money, or lease, factor O Any down payment, rebate, or trade-in value made at the beginning of the transaction The closed-end premium What does mean when a loan is described as being upside down? It means that you owe more than the asset it worth. It means that the asset is worth more than you owe. Complete the following table to determine your desired maximum monthly payment. (Round your answers to the two decimal places.) $ $ Gross income (monthly) Deductions (dollar amount) Take-home pay Percentage allotted for car payment Maximum monthly payment $ % $ You have decided to purchase a new car and have negotiated the price. A four-year loan is resulting in payments of $586.00 per month. How might you get your monthly payment down to your desired monthly goal? Check all that apply. Shop for a loan with a higher interest rate Shop for a loan with a lower interest rate Increase the amount of your down payment O Extend the term of the loan from four to five years financing terms, and (2) afford a A good credit score is an important factor when buying a car because it allows you to (1) obtain expensive or better vehicle for the same loan amount. 1. Apply What You've Learned - Auto Purchase Scenario: You are in the market for a new car. You do not have a trade-in, but you have saved $3,000 toward a down payment. You currently earn $3,750.00 gross monthly income, of which 28% is withheld for various deductions. You have heard of the 20% rule of thumb, but want to limit your payments to no more than 18% of your net monthly income because of other debt commitments. You currently have a credit score of 685. You expect to drive the car an average 15,000 miles per year. You're considering purchasing a used-rather than new-car. This strategy offers several advantages. Which of the following is not an advantage of purchasing a used car? The reduced price of the automobile O A lack of knowledge and confidence in the mechanical condition of the car Avoidance of the vehicle's significant decrease in value due to depreciation The reduced down payment required for the purchase Which of the following will directly affect the final cost of a new car if you elect to purchase the vehicle? Check all that apply. The amount of the down payment The amount of any rebate or incentives associated with the purchase of the new vehicle The final negotiated price of the vehicle The interest rate of any loan used to finance the purchase The period or term of any loan used to finance the purchase Alternatively, after seeing several television commercials suggesting the benefits of leasing a new automobile, you've started thinking about the phenomenon of leasing. Which of the following statements regarding leasing is true? Check all that apply. If you select to use a closed-end lease, then you'll be free from any final payment. That's why they call it a walkaway lease. Customary end-of-term charges on a lease can include a disposition fee, an early termination charge, and an excess mileage charge. If you use an open-end lease, you'll be required to pay the difference between the vehicle's projected residual value and its actual market value. Leasing can result in lower monthly payments than would be incurred if you purchased the vehicle. Leases work best for people who want to drive a vehicle for years and years, and drive at least 30,000 miles every year. A lease payment is based on four variables. Which of the following is not one of these variables? O The length (term) of the lease The money, or lease, factor O Any down payment, rebate, or trade-in value made at the beginning of the transaction The closed-end premium What does mean when a loan is described as being upside down? It means that you owe more than the asset it worth. It means that the asset is worth more than you owe. Complete the following table to determine your desired maximum monthly payment. (Round your answers to the two decimal places.) $ $ Gross income (monthly) Deductions (dollar amount) Take-home pay Percentage allotted for car payment Maximum monthly payment $ % $ You have decided to purchase a new car and have negotiated the price. A four-year loan is resulting in payments of $586.00 per month. How might you get your monthly payment down to your desired monthly goal? Check all that apply. Shop for a loan with a higher interest rate Shop for a loan with a lower interest rate Increase the amount of your down payment O Extend the term of the loan from four to five years financing terms, and (2) afford a A good credit score is an important factor when buying a car because it allows you to (1) obtain expensive or better vehicle for the same loan amount